Introduction

Have you noticed how mobile payment vending machines are popping up everywhere? This shift in the vending industry is all about what consumers want—convenience and security. For operators, this trend opens up a world of opportunities, from creating better customer experiences to boosting sales and streamlining operations.

But here’s the thing: as this landscape evolves, operators are left wondering how to make the most of these new technologies. How can you ensure secure transactions while keeping up with the high expectations of today’s tech-savvy consumers?

Let’s break it down. Mobile payment vending machines not only offer a chance for revenue growth but also come with their own set of challenges. To stay ahead in this competitive market, it’s crucial to explore both the benefits and the hurdles. So, what steps can you take to navigate this exciting yet complex terrain?

Vending Village: Secure Transactions for Mobile Payment Vending Machines

Have you ever considered how important safe transactions are when using mobile payment vending machines? Well, Vending Village gets it. They use advanced processing systems like Stripe, which means you can confidently accept cashless payments without worrying about fraud.

Their marketplace is designed with safety in mind. They offer pre-approved vending locations and only work with verified sellers. Each seller goes through a thorough identity verification process before their listings are approved. This dedication to verification builds trust and security, allowing operators to engage in risk-free exchanges. Plus, if a location doesn't match the description, you get a 100% money-back guarantee.

As more people embrace mobile transactions, the need for secure processing within mobile payment vending machines is more crucial than ever. Industry leaders agree that strong transaction solutions are vital for building consumer trust and boosting business growth. The way Stripe integrates into retail transactions shows how technology can make things easier while keeping safety a top priority. So, if you're looking for secure solutions, Vending Village is definitely leading the way.

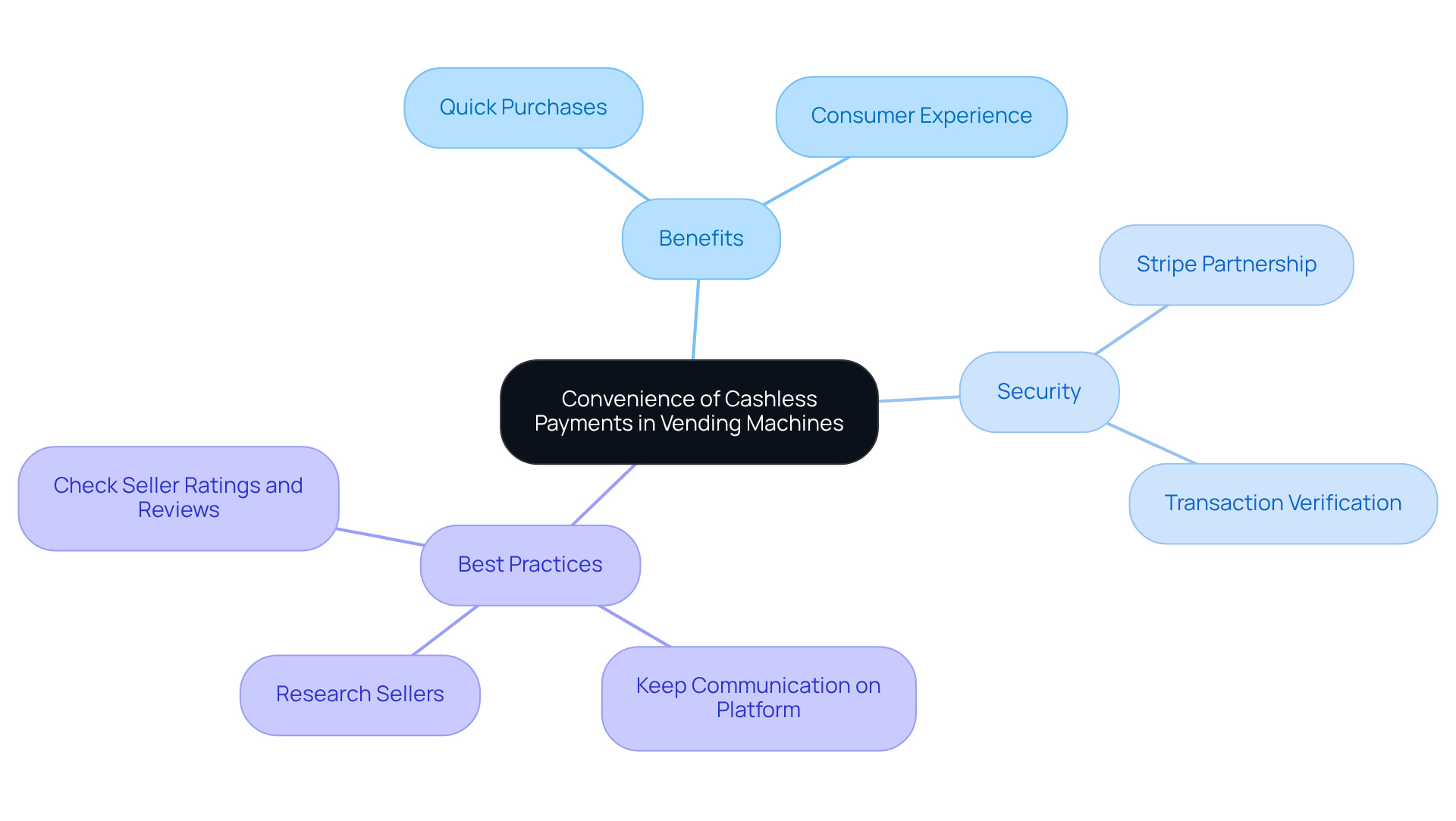

Convenience of Cashless Payments in Vending Machines

Cashless transactions are super convenient, right? You can make purchases quickly and easily without fumbling for coins or notes. This is especially handy in busy places where speed really matters. By adding mobile payment vending machines, machine operators can meet the needs of today’s consumers, making their experience even better.

At Vending Village, we care about your security. That’s why we’ve teamed up with Stripe to create a safe financial system. Funds are only released when both the buyer and seller have verified the transaction. This means your money is protected until everything is squared away, giving property managers peace of mind.

Now, here’s the thing: it’s smart to follow some best practices for safe online purchases:

- Always keep your communication on our platform.

- Do a little research on sellers.

- Before you finalize a deal, take a moment to check seller ratings and reviews.

By sticking to these tips, you can ensure positive experiences for your machine locations.

Increased Sales Potential with Mobile Payment Options

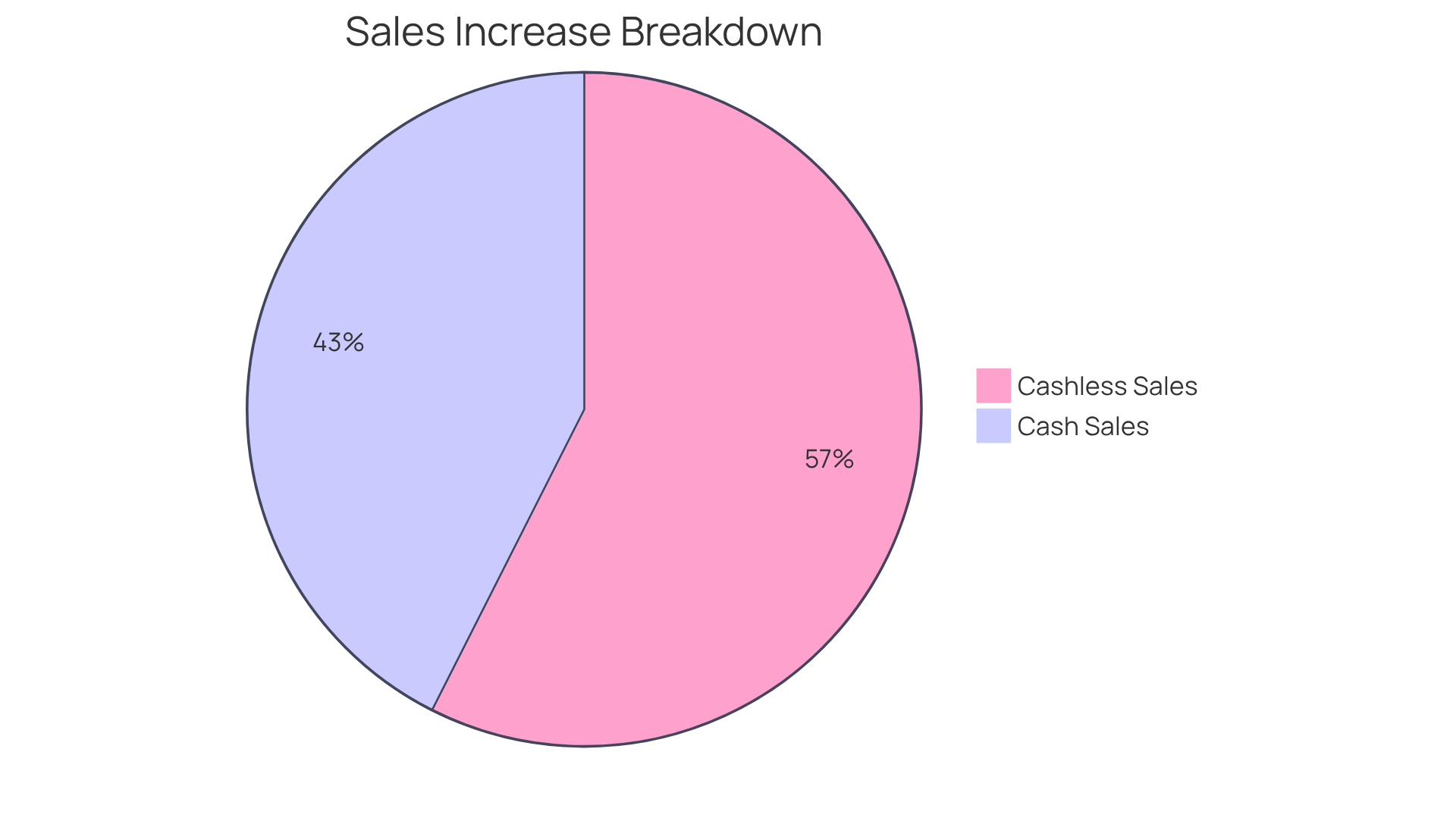

Have you ever thought about how mobile payment vending machines could really boost your vending sales? Well, here’s the scoop: mobile payment vending machines that utilize cashless processing systems often see a big jump in activity. Research shows that after implementing these systems, revenue can increase by an average of 35%.

But it gets even better. Low-performing machines have seen sales skyrocket by 110% within just 18 months of going cashless. This shift doesn’t just help with more sales; it also encourages impulse buying with mobile payment vending machines. Think about it—shoppers are way more likely to make a purchase when they can just whip out their smartphones and use mobile payment vending machines for easy payments. For example, cashless sales jumped by 131%, while cash sales increased by 97%. It’s clear that the convenience of mobile payment vending machines contributes to higher spending.

Plus, total transactions for automated machines rose by about 26% after cashless technology was introduced. If you’re considering this tech, you can expect a quicker return on your investment. It’s a smart move in today’s market.

As Jim Turner, a Senior Data Analyst at USA Technologies, puts it, "We believe that the results of this study underscore the real financial and operational value of adding cashless technology to every machine." So, why not explore how cashless options could work for you?

Enhanced Customer Experience with Mobile Payment Vending Machines

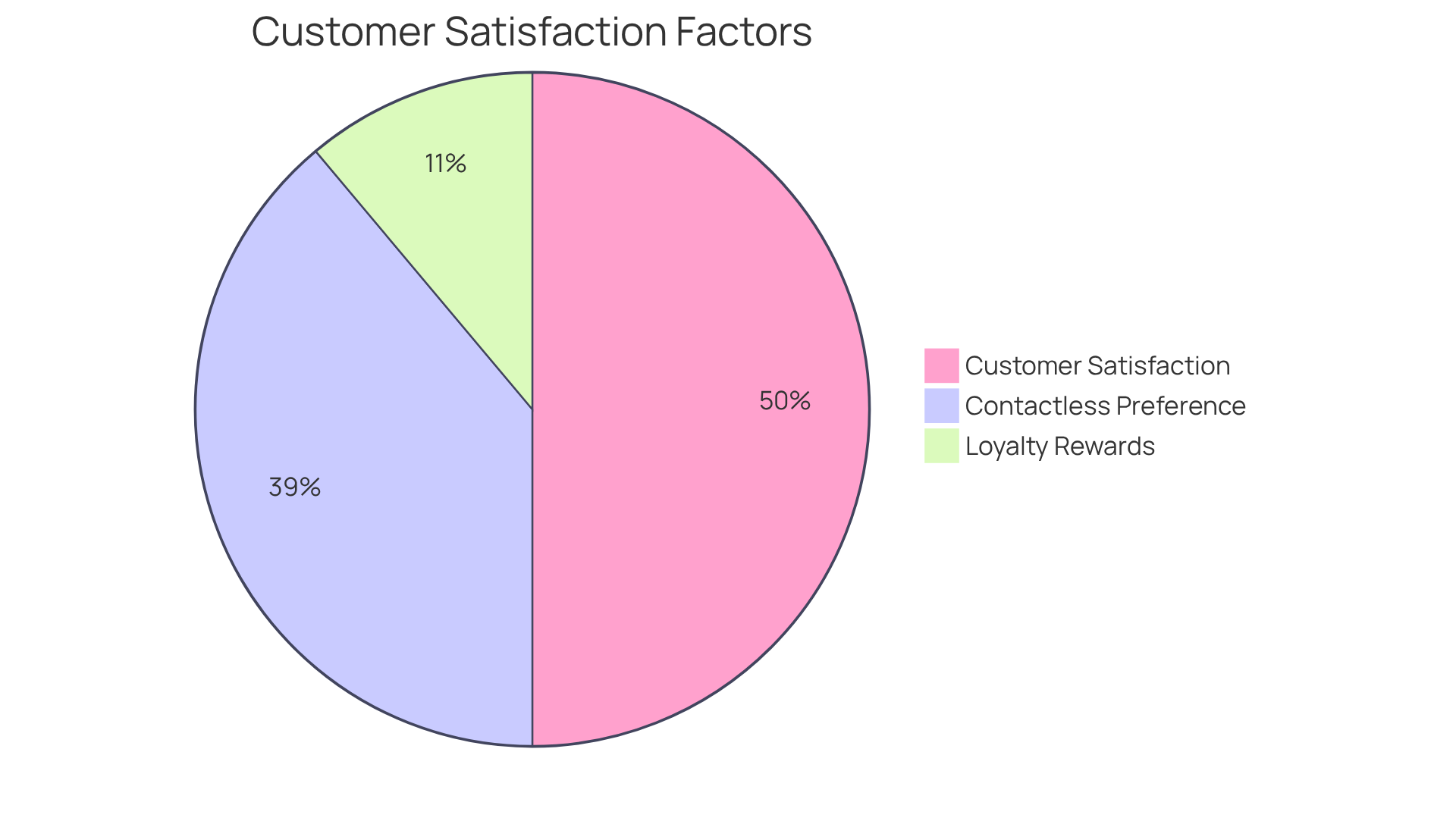

Have you ever used a vending machine and wished it was a bit quicker? Well, the introduction of mobile payment vending machines is here to change that! They really step up the customer experience by making the buying process a breeze. People love how fast and secure cashless payments are, and it's no surprise that satisfaction rates can hit over 90%.

Plus, features like digital receipts add a nice touch. They not only make things more convenient but also help keep everything organized, reducing the chances of any disputes over purchases. Here’s the thing: when customers feel secure and organized, they’re more likely to come back.

And let’s not forget about loyalty rewards programs. Integrating these into your vending machines can really pay off. Studies show that businesses offering such perks can see a 20% boost in repeat visits. That’s a pretty big deal!

As more and more consumers lean towards contactless payments—over 70% of users feel safer with these methods—vending providers have a golden opportunity to tap into the trend of mobile payment vending machines. By leveraging these technologies, you can create a service that’s not just efficient but also super appealing.

So, if you’re looking to enhance customer satisfaction and encourage repeat business, consider using mobile payment vending machines. They combine quick transactions, handy digital receipts, and enticing loyalty rewards to create a winning formula. Why not explore how you can implement this in your own business?

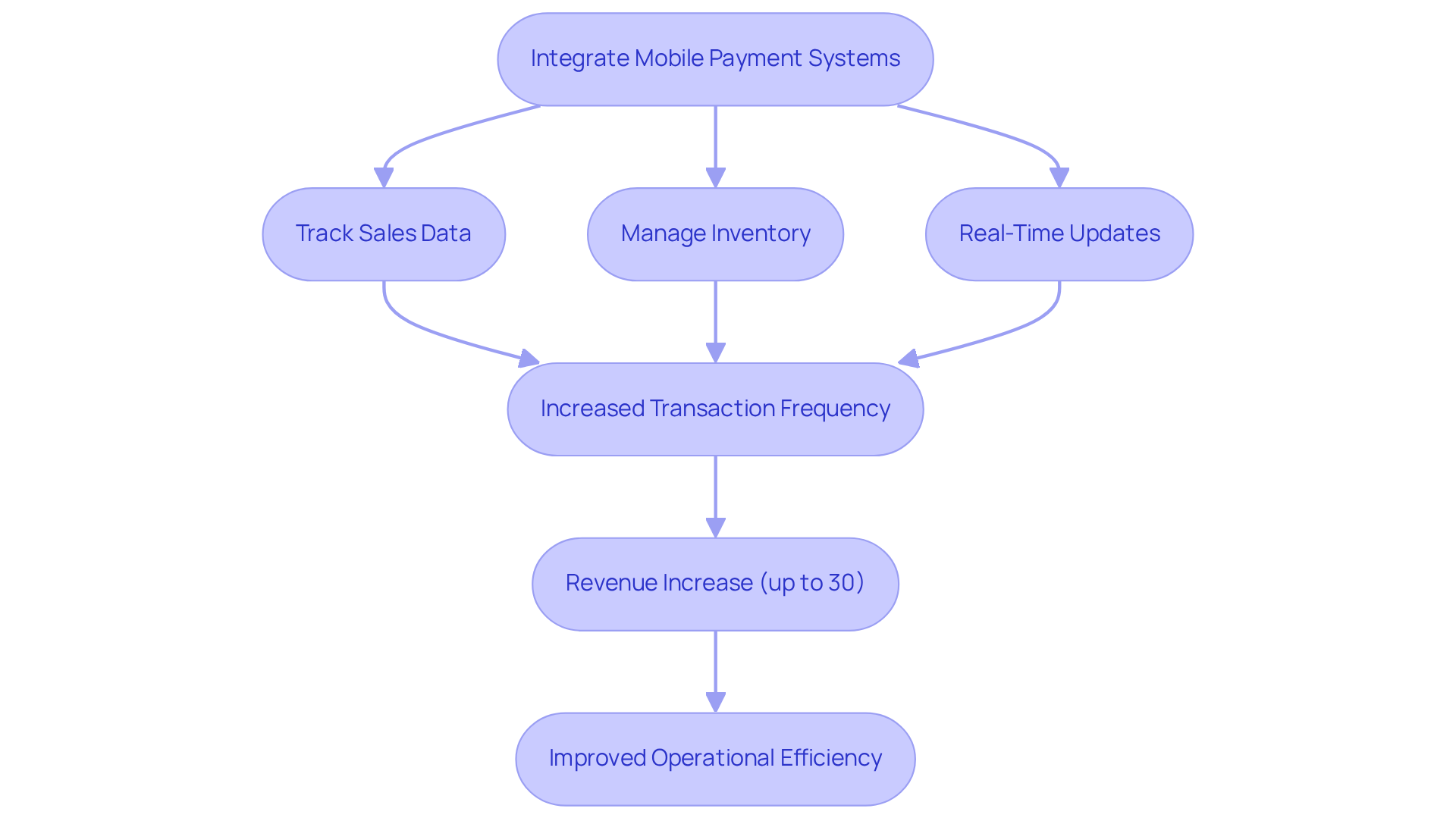

Operational Efficiency through Mobile Payment Integration

You know how managing vending machines can be a bit of a juggling act? Well, incorporating mobile payment vending machines can really streamline things for you. With these systems, you can easily track sales data, manage your inventory, and get real-time updates on how your machines are performing.

Here’s the thing: research shows that businesses utilizing mobile payment vending machines often see a significant boost in transaction frequency. We’re talking about a potential revenue increase of up to 30%! This data-driven approach not only helps you make better decisions but also optimizes how you allocate your resources, which can lead to improved profitability.

Industry leaders are on the same page — effective data management in vending operations is key to staying competitive in today’s fast-paced market. For instance, companies that have adopted mobile payment vending machines report much better inventory management. This means you can restock your machines in a timely manner and reduce downtime.

So, what does this mean for you? It means you can respond quickly to consumer demands and ensure that popular items are always available. This way, you’re maximizing your sales opportunities and keeping your customers happy. It’s all about making your operations smoother and more efficient!

Rise of Contactless Payments in the Vending Industry

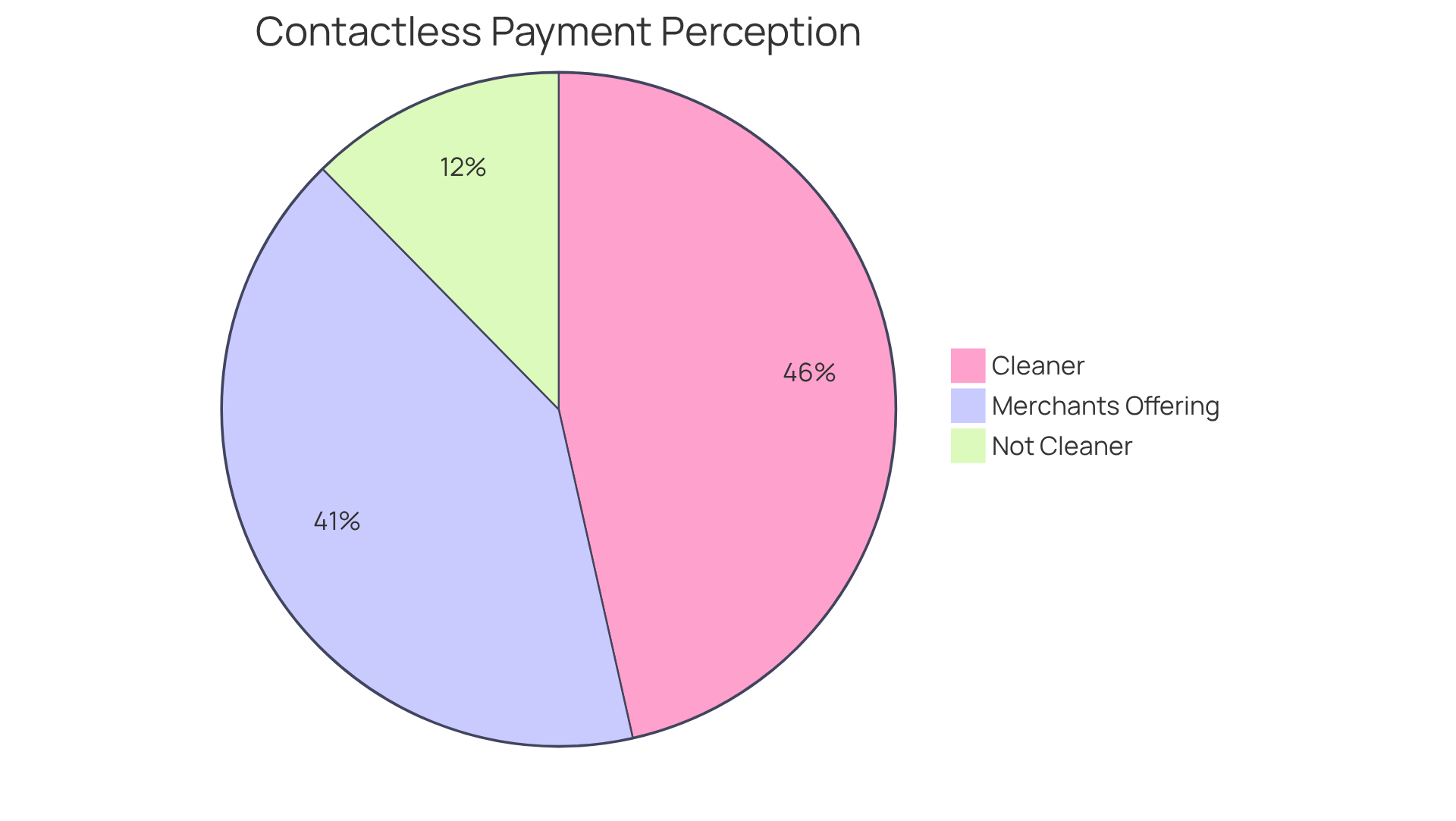

The vending sector is really changing, thanks to the rise of mobile payment vending machines. An increasing number of people are making purchases using their smartphones or contactless cards at mobile payment vending machines. This shift towards mobile payment vending machines isn’t just about convenience; it also addresses health and safety concerns that have become super important after the pandemic. Did you know that over 70% of U.S. merchants now offer contactless options? That’s a clear sign that consumer behavior is moving towards cashless transactions, including the use of mobile payment vending machines.

And here’s something interesting: consumers tend to stick with companies that provide contactless payment options. In fact, 79% of Americans see these methods as cleaner compared to traditional ones. This perception plays a big role in how people shop, making the experience better and boosting customer satisfaction and loyalty.

For machine operators, adopting mobile payment vending machines isn’t just about keeping up with trends; it’s a smart strategy to attract more customers. In 2022, EMV transactions at food and beverage vending machines hit over $500 million in sales, with a whopping 400% increase in total EMV transactions throughout the year. This growth really shows how important it is to offer mobile payment vending machines as modern payment methods to meet evolving consumer expectations.

As Judith McGuire, Senior Vice President at Global Products, Payment Services, put it, "The financial transaction landscape is swiftly changing, and alterations in how consumers settle their bills are anticipated." The good news is that operators who embrace these technologies will be in a great position to succeed in a competitive market. So, if you haven’t already, consider making the switch to contactless payments — it’s a move that could really pay off!

Technological Advancements in Mobile Payment Vending Machines

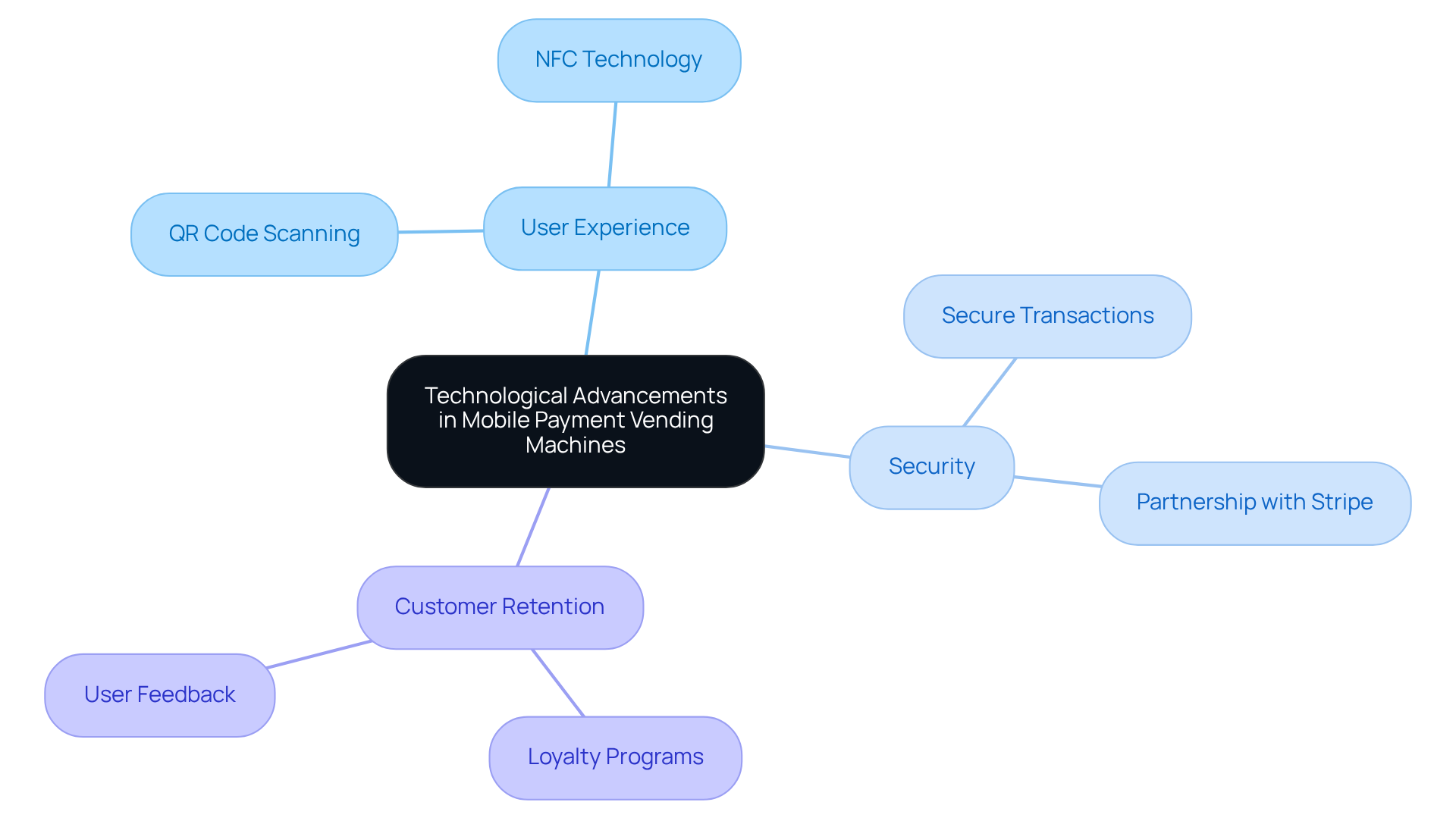

Have you noticed how much easier mobile payment vending machines have become? Recent tech advancements have really upped the user-friendliness and efficiency of these machines. With features like QR code scanning and NFC (Near Field Communication) now standard, making a purchase is simpler than ever for consumers.

Here’s the thing: according to Gartner Research, 78% of successful tech deployments focus on user experience right from the planning stages. This highlights just how crucial these innovations are. Not only do these technologies speed up transactions, but they also help operators gather valuable data. This means they can enhance their product offerings by integrating mobile payment vending machines to boost customer satisfaction.

For example, think about mobile payment vending machines equipped with NFC technology. They let you use your smartphone or smartwatch to pay, which is super convenient. Plus, Vending Village has a secure payment system that ensures your money isn’t released until both the buyer and seller confirm the deal. This way, your funds are safe until everything is verified.

And it gets better — we partner with Stripe to handle transactions securely, keeping your financial information protected. Integrated loyalty programs are also on the rise. Companies that actively seek and use user feedback see customer retention rates 10-15% higher.

As the automated retail sector evolves, integrating these technologies along with strong security measures is essential. It’s all about staying competitive and meeting the changing tastes of customers. So, why not explore how these advancements can work for you?

Utilizing Data Analytics for Vending Machine Optimization

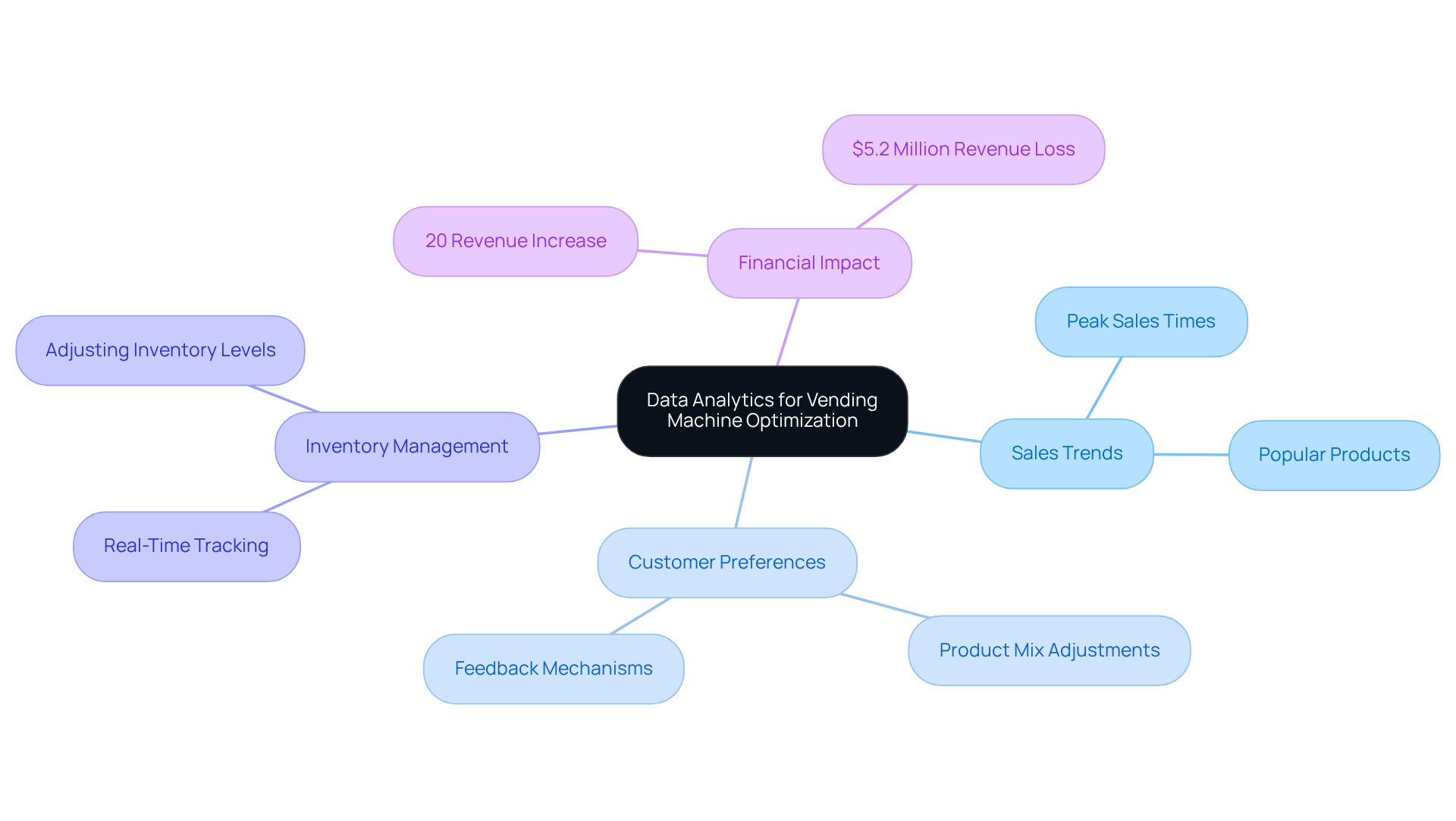

Data analytics is super important for making vending machine operations better. It helps managers tap into sales trends, customer preferences, and inventory levels to make smart decisions. By digging into sales data, teams can spot trends that guide what products to offer and where to place machines. This means more sales and less waste. For instance, looking at peak sales times and popular products can help adjust inventory, making sure high-demand items are always on hand.

Industry experts are really emphasizing how data can change the game for vending operations. One expert even said, 'Data is the new oil,' showing just how valuable it is for making informed business choices. By analyzing sales patterns, managers can boost profits and keep customers happy by providing the products they want.

Recent updates in vending technology make this data-driven approach even easier. Now, advanced analytics tools let users track real-time sales data, so they can quickly tweak inventory and pricing strategies. This kind of proactive management can seriously boost profits since managers can respond fast to what customers want.

In real life, successful operators are already using data analytics to sharpen their strategies. For example, one case study showed a machine company upped its revenue by 20% after analyzing sales patterns and fine-tuning its product mix based on customer preferences. This shows just how powerful data analytics can be in the automated retail world, proving that smart decision-making can lead to big financial wins.

It’s also worth noting that companies lose around $5.2 million in revenue because they don’t use their data effectively. That’s a big hit! As Eric McGee pointed out, 'In the next two to three years, consumer data will be the most important differentiator,' which really highlights the need to get on board with data analytics. Plus, the demand for data professionals is expected to grow by 36%, showing just how crucial data analytics skills are becoming in the industry.

Competitive Advantage of Mobile Payment Adoption in Vending

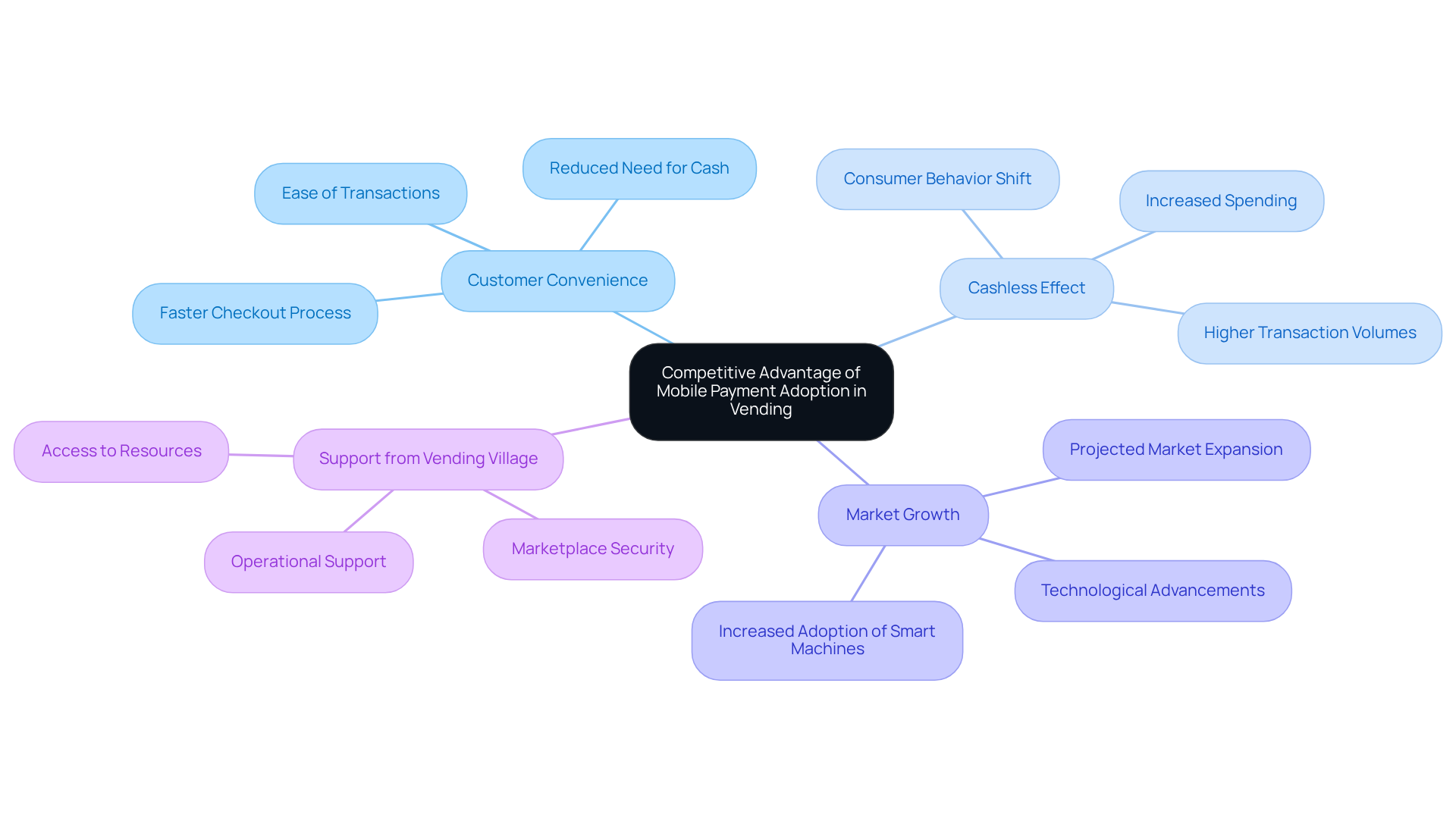

Imagine this: more and more people are choosing to go cashless these days. So, if you’re running a vending operation, incorporating mobile payment vending machines can really set you apart from the competition. It’s not just about keeping up; it’s about making life easier for your customers and building their loyalty. After all, who doesn’t appreciate the simplicity of cashless transactions?

Here’s the thing: data shows that when people can pay without cash, they tend to spend more. This phenomenon is often called the ‘cashless effect,’ and it’s clear that mobile payment vending machines are becoming a significant part of the automated retail market, with forecasts suggesting that this trend will continue to grow.

So, what does this mean for you? By adopting mobile payment vending machines, you can tap into this expanding market. It’s a straightforward way to boost your market share and strengthen your position in a competitive landscape.

But the good news is, you don’t have to navigate this transition alone. Vending Village is here to help. They provide a secure marketplace that supports machine and location owners in thriving within this increasingly cashless environment. Ready to take the leap?

Future Potential of Mobile Payment Vending Machines

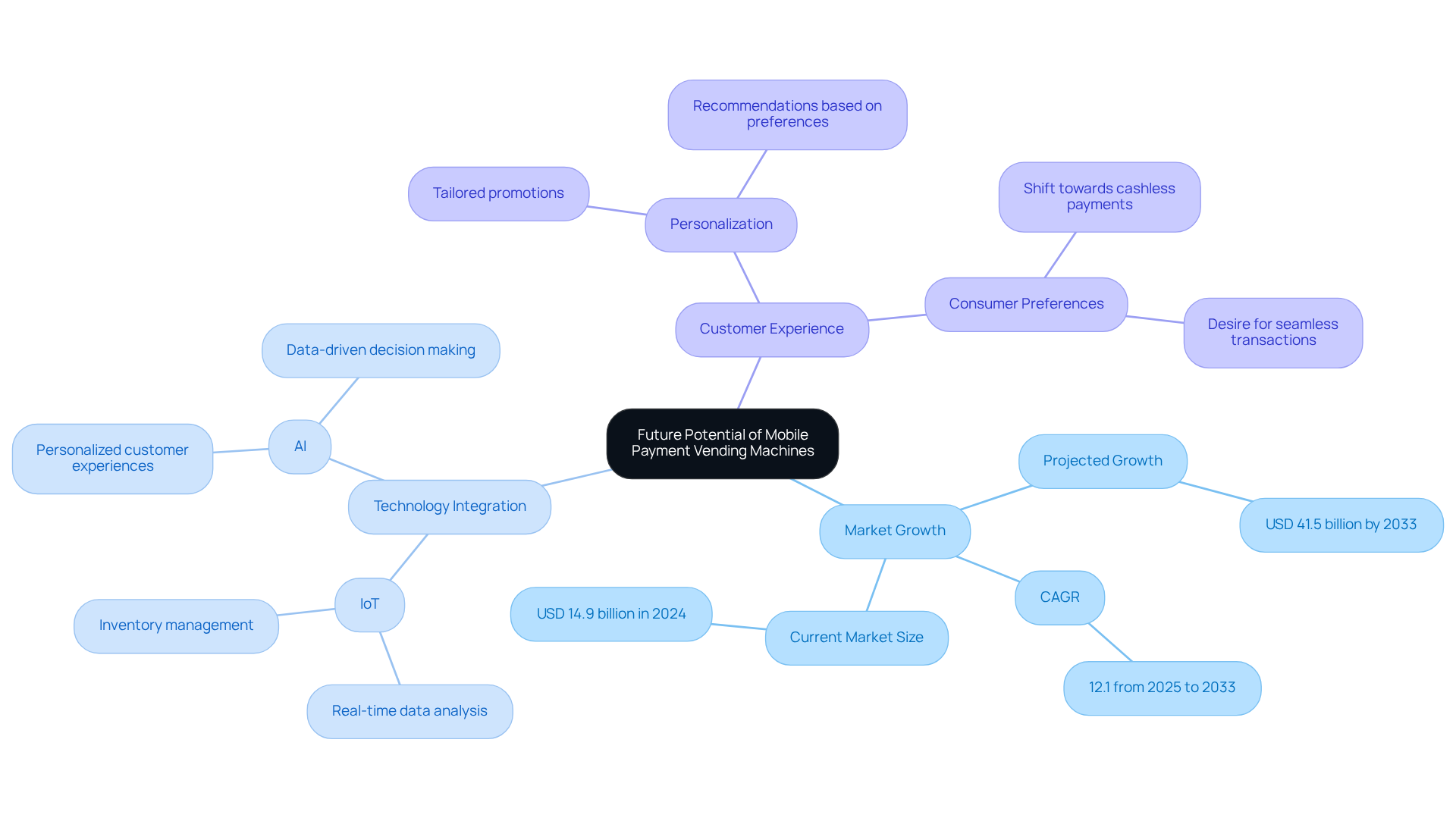

You know how we’re all moving towards cashless transactions these days? Well, the future for mobile payment vending machines looks really bright! With technology evolving and more folks favoring cashless payments, the global cashless retail market is set to grow from USD 14.9 billion in 2024 to a whopping USD 41.5 billion by 2033. That’s a compound annual growth rate (CAGR) of 12.1% from 2025 to 2033! This growth is mainly driven by the increasing demand for mobile payment vending machines and the digital shift in dispensing infrastructure.

Now, here’s the thing: as mobile transaction systems get more integrated with cool tech like the Internet of Things (IoT) and artificial intelligence (AI), we can expect better efficiencies and a more engaging experience for customers. For instance, IoT-enabled vending machines can analyze data in real-time, allowing managers to keep an eye on inventory and machine performance from afar. This not only makes operations smoother but also helps in making smarter decisions about restocking and maintenance.

Plus, with AI stepping in, we can personalize the customer experience by digging into purchasing patterns and preferences. This means tailored promotions and recommendations that really resonate with tech-savvy consumers who want seamless transactions.

Looking ahead, experts believe that cashless vending will keep evolving, with mobile payment vending machines and contactless payments becoming the norm. Did you know that only 18% of in-person purchases are currently made in cash? That’s a big sign of the shift towards digital payments! So, if operators jump on these trends, they’ll not only boost their efficiency but also stand out in a competitive market.

Conclusion

Mobile payment vending machines are shaking things up in the vending world. They’re not just about convenience; they’re a smart way for operators to boost security, increase sales, and keep customers happy. By going cashless, businesses can meet the growing demand for quick and easy transactions, which is essential in today’s fast-paced market.

Let’s face it, the numbers speak for themselves. Some research shows that low-performing machines can see sales jump by as much as 110% after switching to cashless options. Plus, with tools like data analytics and secure payment systems—think Vending Village—you can fine-tune your inventory and run your operations more smoothly. And don’t forget about the customer experience! Features like digital receipts and loyalty programs make mobile payments even more appealing.

As cashless payments gain traction, it’s time for operators to hop on board with these innovative solutions. The future looks bright for mobile payment vending machines, thanks to ongoing tech advancements that promise even greater efficiencies and personalized customer interactions. By embracing this shift, you’re not just keeping up with what today’s consumers want; you’re also setting your business up for long-term success in a cashless economy.

Frequently Asked Questions

What is Vending Village and what do they offer?

Vending Village is a platform that facilitates secure transactions for mobile payment vending machines. They use advanced processing systems like Stripe to enable cashless payments while ensuring safety and fraud protection.

How does Vending Village ensure safe transactions?

Vending Village ensures safe transactions by using pre-approved vending locations and working only with verified sellers. Each seller undergoes a thorough identity verification process, and if a location does not match the description, there is a 100% money-back guarantee.

Why are secure processing systems important for mobile payment vending machines?

Secure processing systems are vital for building consumer trust and boosting business growth. As mobile transactions become more popular, ensuring safety in these transactions is crucial for both operators and consumers.

What are the benefits of cashless payments in vending machines?

Cashless payments offer convenience, allowing quick and easy purchases without the need for coins or notes. This is especially beneficial in busy locations, enhancing the consumer experience.

How does Vending Village protect funds during transactions?

Vending Village protects funds by releasing them only when both the buyer and seller have verified the transaction, ensuring that money is safeguarded until the deal is finalized.

What best practices should users follow for safe online purchases on Vending Village?

Users should keep communication on the platform, research sellers, and check seller ratings and reviews before finalizing a deal to ensure positive experiences.

How can mobile payment vending machines increase sales?

Mobile payment vending machines can significantly boost sales, with research showing an average revenue increase of 35% after implementing cashless systems. Low-performing machines have even seen sales rise by 110% within 18 months of going cashless.

What impact does mobile payment convenience have on consumer behavior?

The convenience of mobile payments encourages impulse buying, as shoppers are more likely to make purchases when they can easily use their smartphones for payment. Cashless sales have increased by 131%, while cash sales have risen by 97%.

What overall improvements can be expected from implementing cashless technology in vending machines?

Implementing cashless technology can lead to a 26% increase in total transactions for automated machines and a quicker return on investment, making it a smart choice for machine operators.

List of Sources

- Vending Village: Secure Transactions for Mobile Payment Vending Machines

- cranepi.com (https://cranepi.com/en/resource-center/news/crane-payment-innovations-and-verifone-announce-strategic-patnership)

- statista.com (https://statista.com/topics/4872/mobile-payments-worldwide?srsltid=AfmBOorap5cAx_BHLk_OLNeKwZPrQMQZj8OUnC8Jzd5_wIpoGDwN0Xo9)

- investors.jabil.com (https://investors.jabil.com/news/news-details/2024/Jabil-Teams-with-Fintech-Leader-Revolut-to-Scale-Development-and-Production-of-Innovative-Mobile-Payment-mPOS-Solution/default.aspx)

- verifone.com (https://verifone.com/en/za/vending-ticketing)

- cranepi.com (https://cranepi.com/en/resource-center/news/everi-and-crane-payment-innovations-announce-strategic-agreement-revolutionize)

- Convenience of Cashless Payments in Vending Machines

- sciencedaily.com (https://sciencedaily.com/releases/2024/06/240611130332.htm)

- apgsolutions.com (https://apgsolutions.com/cashless-payments-spending-behavior?srsltid=AfmBOoohgyokmo9iHzXdz9oWfayBebbNXIQHWVSmksYF2XE8DI7YitRw)

- papers.ssrn.com (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4668928)

- appdirect.com (https://appdirect.com/blog/cashless-payment-advantages-and-disadvantages-should-your-business-go-cashless)

- ecb.europa.eu (https://ecb.europa.eu/stats/ecb_surveys/space/html/ecb.space2024~19d46f0f17.en.html)

- Increased Sales Potential with Mobile Payment Options

- Smart vending machines fuel 65% sales boost, transforming convenience (https://digitalmediavending.com/smart-vending-machines-fuel-65-sales-boost-transforming-convenience)

- convenience.org (https://convenience.org/Media/Daily/2023/June/19/EMV-Payments-Vending-Machines-Rise_Payments)

- Study finds cashless vending machines outperform cash-only counterparts - CampusIDNews (https://campusidnews.com/study-finds-cashless-vending-machines-outperform-cash-only-counterparts)

- paymentsjournal.com (https://paymentsjournal.com/cashless-payments-are-a-boon-for-vending-machines)

- cutimes.com (https://cutimes.com/2019/05/20/cashless-tech-boosting-vending-maching-revenue-study-finds)

- Enhanced Customer Experience with Mobile Payment Vending Machines

- Retail Vending Machine Market Size | Industry Report, 2033 (https://grandviewresearch.com/industry-analysis/global-vending-machine-market)

- persistencemarketresearch.com (https://persistencemarketresearch.com/market-research/smart-vending-machines-market.asp)

- coinlaw.io (https://coinlaw.io/contactless-payment-statistics)

- electroiq.com (https://electroiq.com/stats/nfc-payment-statistics)

- Top 100 Inspirational Fintech Quotes [2025] (https://digitaldefynd.com/IQ/inspirational-fintech-quotes)

- Operational Efficiency through Mobile Payment Integration

- Vending Machine Statistics and Facts (2025) (https://news.market.us/vending-machine-statistics)

- Retail Vending Machine Market Size & Growth 2025 to 2035 (https://futuremarketinsights.com/reports/retail-vending-machine-market)

- Vending Machines Market Size, Share & Growth Report, 2033 (https://marketdataforecast.com/market-reports/vending-machines-market)

- imarcgroup.com (https://imarcgroup.com/intelligent-vending-machines-market)

- dfyvending.com (https://dfyvending.com/digital-payment-vending-profits)

- Rise of Contactless Payments in the Vending Industry

- convenience.org (https://convenience.org/Media/Daily/2023/June/19/EMV-Payments-Vending-Machines-Rise_Payments)

- paycron.com (https://paycron.com/blog/u-s-merchants-see-surge-in-contactless-payments)

- thefinancialbrand.com (https://thefinancialbrand.com/news/payments-trends/payment-contactless-card-mobile-wallet-digital-coronavirus-covid-19-pandemic-trend-101415)

- cantaloupeinc.gcs-web.com (https://cantaloupeinc.gcs-web.com/news-releases/news-release-details/cantaloupe-notes-rapid-growth-emv-enabled-vending-creditdebit)

- Technological Advancements in Mobile Payment Vending Machines

- frontu.com (https://frontu.com/blog/vending-machine-trends)

- velocity-smart.com (https://velocity-smart.com/velocity-hub/blog/8-smart-vending-best-practices-for-enhanced-efficiency)

- cscsw.com (https://cscsw.com/press-release/usa-technologies-and-csc-serviceworks-announce-supply-agreement)

- selecta.com (https://selecta.com/int/en/selecta-group/newsroom/selecta-presents-first-crypto-compatible-smart-fridges-at-solana-breakpoint2023)

- Why Smart Vending Machines Are the Future of Retail (https://prestigeservicesinc.com/blog/smart-vending-machines-the-future-of-retail)

- Utilizing Data Analytics for Vending Machine Optimization

- careerfoundry.com (https://careerfoundry.com/en/blog/data-analytics/inspirational-data-quotes)

- digitaldefynd.com (https://digitaldefynd.com/IQ/inspirational-quotes-about-data-and-analytics)

- 20 Data Science Quotes by Industry Experts (https://coresignal.com/blog/data-science-quotes)

- 9 Must-read Inspirational Quotes on Data Analytics From the Experts (https://nisum.com/nisum-knows/must-read-inspirational-quotes-data-analytics-experts)

- mitsloan.mit.edu (https://mitsloan.mit.edu/ideas-made-to-matter/15-quotes-and-stats-to-help-boost-your-data-and-analytics-savvy)

- Competitive Advantage of Mobile Payment Adoption in Vending

- cantaloupe.com (https://cantaloupe.com/articles/five-reasons-your-vending-business-should-accept-cashless-payments)

- Vending Machine Statistics and Facts (2025) (https://news.market.us/vending-machine-statistics)

- Retail Vending Machine Market Size | Industry Report, 2033 (https://grandviewresearch.com/industry-analysis/global-vending-machine-market)

- Apple Pay Statistics (2025): Users, Market Share & Growth Rate (https://capitaloneshopping.com/research/apple-pay-statistics)

- Future Potential of Mobile Payment Vending Machines

- cranepi.com (https://cranepi.com/en/resource-center/news/whats-next-cashless-payments-in-casinos)

- growthmarketreports.com (https://growthmarketreports.com/report/cashless-vending-market)

- openpr.com (https://openpr.com/news/4235580/cashless-vending-machine-market-to-expand-at-a-cagr-of-12-2)

- Vending Machine Market Report 2025: Automation Trends & Forecasts 2024-2033 - Ready-to-Eat Demand, Cashless Payments, and AI-Powered Technologies Propel Global Growth - ResearchAndMarkets.com (https://businesswire.com/news/home/20250918424691/en/Vending-Machine-Market-Report-2025-Automation-Trends-Forecasts-2024-2033---Ready-to-Eat-Demand-Cashless-Payments-and-AI-Powered-Technologies-Propel-Global-Growth---ResearchAndMarkets.com)

- digitalmonk.biz (https://digitalmonk.biz/case-study-smart-vending-machine-for-budkoin)