Introduction

Have you noticed how cashless vending machines are changing the game for property managers? They’re not just about convenience; they’re about security too. As more people embrace digital payments, these machines are stepping up to improve operational efficiency while meeting the needs of consumers who prefer contactless transactions.

But here’s the thing: How can property managers really tap into the benefits of cashless vending? It’s all about boosting revenue, enhancing tenant satisfaction, and staying ahead in a competitive market.

Let’s break it down. Exploring the many advantages of cashless vending machines can help modernize property management practices. It’s a way to connect with today’s tech-savvy clientele and meet their demands head-on. So, why not consider how these innovations can work for you?

Vending Village: Secure Transactions for Cashless Vending Machines

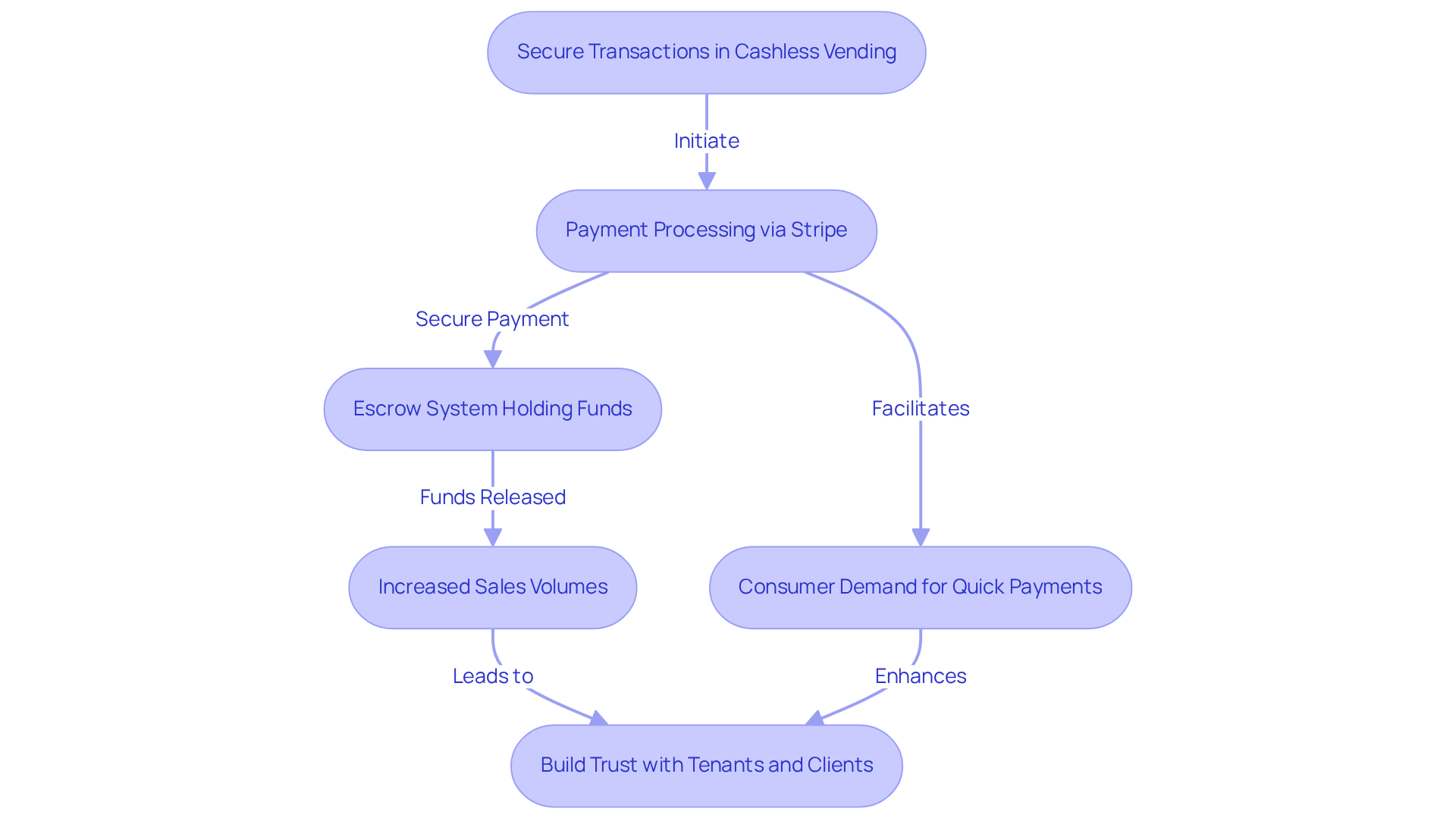

Have you ever thought about how important safe transactions are in today’s digital world? Vending Village gets it right by using Stripe for , which keeps both buyers and sellers protected. This kind of security is crucial for property managers who want to build trust with their tenants and clients.

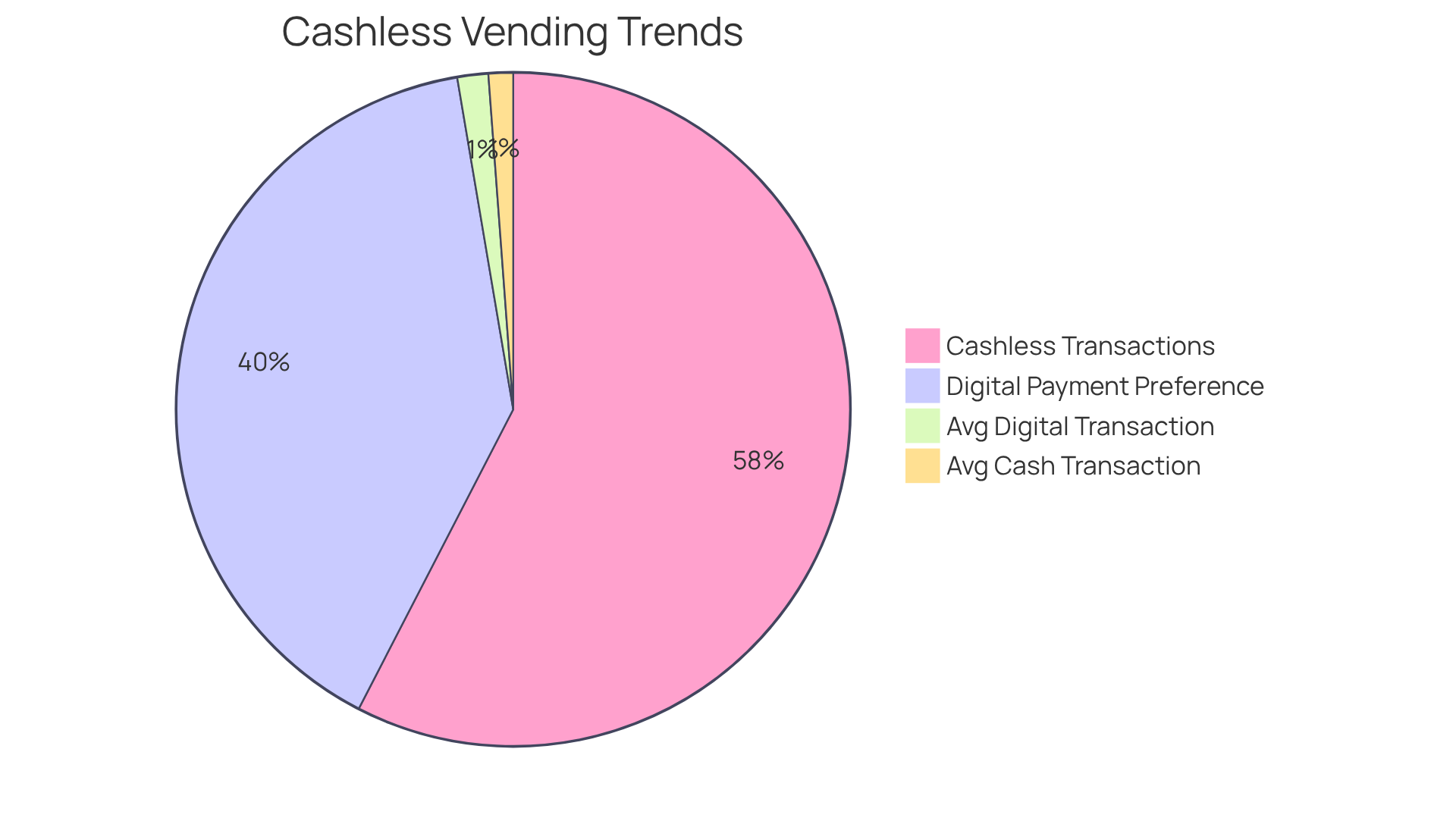

By choosing a payment system that prioritizes safety, property managers can roll out cashless vending machines without worrying about fraud or misrepresentation. The shift towards digital payments is more than just a trend; it’s a smart move. In fact, sales of cashless vending machines saw a huge boost in 2022, with electronic payments making up 67% of all machine sales. And guess what? This trend is projected to grow by another 6-8%!

Plus, the average value of electronic sales machines was $2.11, which is significantly higher than the $1.36 average for cash payments. This shift not only strengthens operational integrity but also meets consumer demands for quick and secure payment options, including cashless vending machines. Ultimately, this leads to increased sales volumes.

But here’s the kicker: Vending Village’s escrow system holds buyers' funds until they’re happy with their purchase. This reinforces their commitment to safety and trustworthiness in the marketplace. So, if you’re in the business, consider these insights to enhance your operations and customer satisfaction!

The Rise of Cashless Payments in Vending Machines

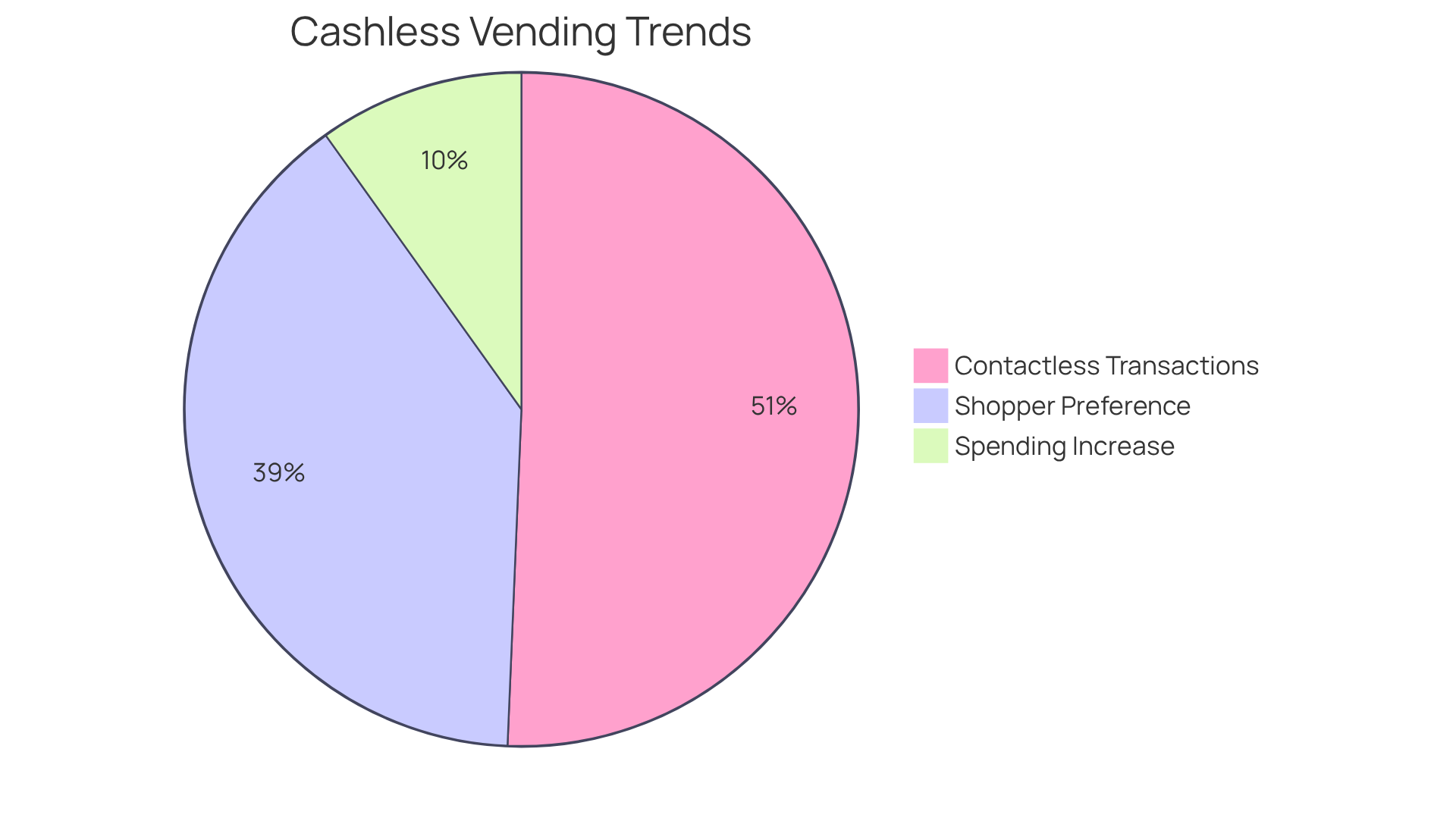

Have you noticed how cashless vending machines that utilize digital payments are really taking off? It’s all about convenience and speed these days. Recent stats show that 60% of shoppers now prefer using digital transactions at cashless vending machines. This isn’t just a passing trend; it’s a real shift in how we do things. In fact, cashless vending machines contributed to contactless payments, which made up a whopping 77% of all digital transactions in 2024, up from 65.5% the year before.

For real estate managers, embracing electronic payment solutions is essential to keep up with what consumers expect today. By offering cashless vending machines, property managers can make their locations more appealing, which helps them stay competitive. The impact is clear: in 2024, marking a 15% increase from the previous year. This growth shows just how important it is to adapt to what customers want. Digital transactions not only make buying easier but also attract a tech-savvy crowd to cashless vending machines.

Industry leaders are pointing out that this shift towards cashless vending machines and digital payments is transforming the game. Operators are encouraged to innovate and expand their services. As consumer preferences evolve, property managers who focus on cashless vending machines will be in a prime position to take advantage of this trend, leading to higher sales and happier customers.

So, what can you do? Consider integrating digital payment options into your offerings. It’s a simple step that could make a big difference in how you connect with your customers.

Enhanced Convenience with Cashless Vending Solutions

You know how hectic things can get, especially in busy places? Cashless vending machines really step in to save the day, allowing you to make purchases quickly without fumbling for cash. This is a game-changer for high-traffic areas where speed is key.

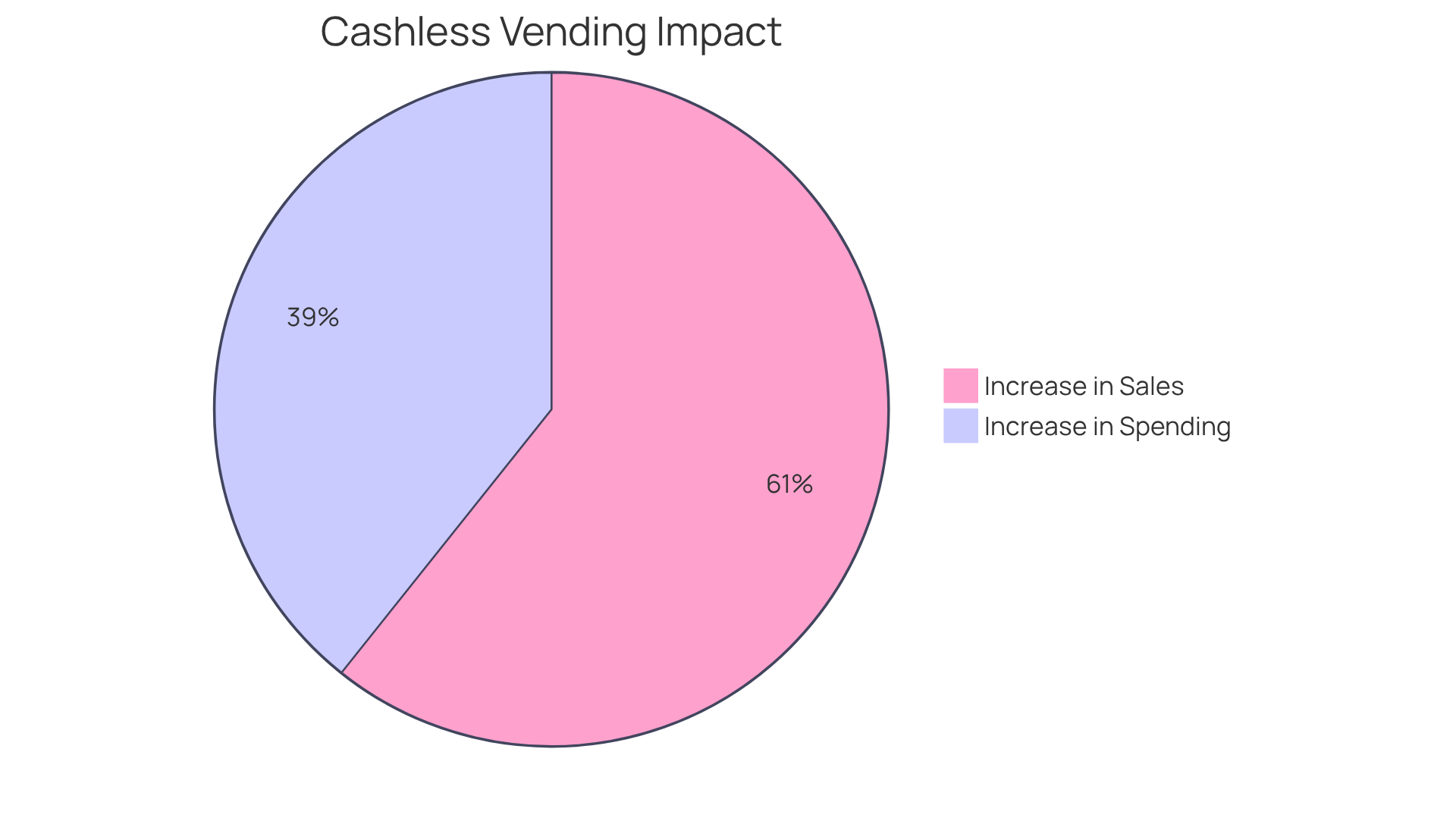

Now, if you're a property manager, think about how you can enhance your tenants' experience. Offering snack options that fit their fast-paced lifestyle can lead to happier residents and better retention rates. Did you know that people tend to spend up to 55% more per transaction when using digital payment systems? Plus, average monthly sales can jump by 85% after you implement these solutions.

But that’s not all. Electronic dispensing machines can really cut down on maintenance requests, streamlining operations for you. This shift to isn’t just about keeping up with technology; it’s about aligning with the behavior of today’s consumers. In the end, it creates a more satisfying and engaging environment for your tenants.

So, why not consider these options for cashless vending machines? They could make a real difference in your property management strategy.

Operational Efficiency Boost from Cashless Vending

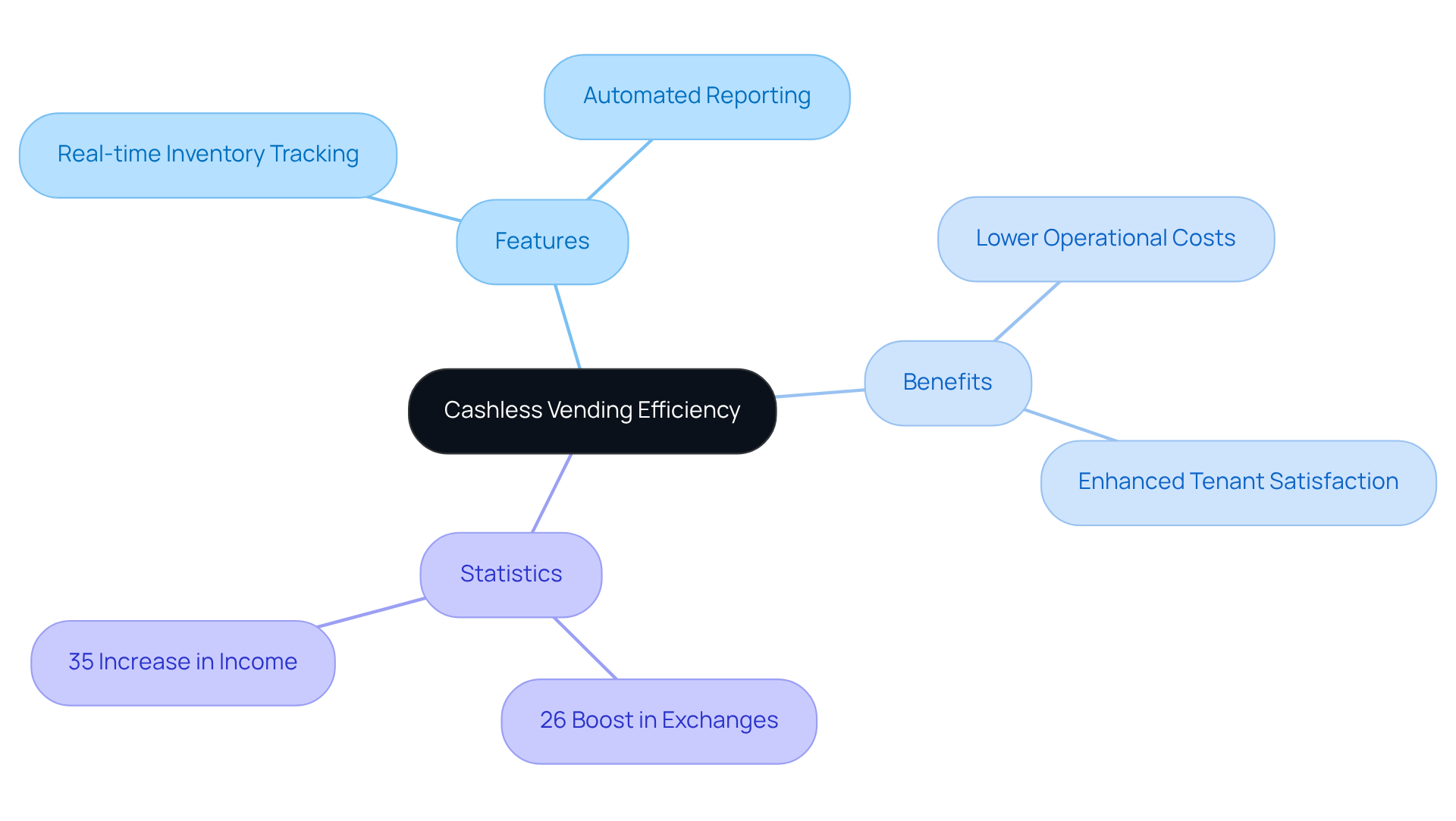

Have you ever thought about how cashless vending machines could change the game for your operations? These machines are not just high-tech gadgets; they come packed with features that let you track inventory in real-time and automate reporting. This means less time spent on those tedious manual checks and restocking—who wouldn't want that?

For real estate managers, this shift can lead to lower operational costs and more time to focus on what really matters: building better tenant relationships and maintaining properties. Plus, with digital payment systems, you get valuable insights into inventory levels and sales trends. This helps you make .

One property manager put it perfectly: 'The ability to monitor inventory in real-time has transformed how we manage our vending services, enabling us to respond quickly to demand and minimize downtime.' That’s a game-changer, right?

And here’s the kicker: digital payment technology has been shown to boost overall exchanges by 26% and increase average income by 35%. This isn’t just a passing trend; it’s a strategic move towards greater efficiency and happier tenants. As more consumers prefer digital payments, making this transition could really set you apart in the market.

So, why not consider implementing cashless vending machines? They can streamline your operations and enhance tenant satisfaction, making your job a whole lot easier.

Attracting Younger Consumers with Cashless Options

You know how younger folks are all about digital payments these days? It’s pretty clear they’re comfortable with electronic transactions in their daily lives. So, if you’re managing a site, introducing cashless vending machines could be a game-changer. It’s a great way to connect with this demographic and can lead to more foot traffic and sales at your location.

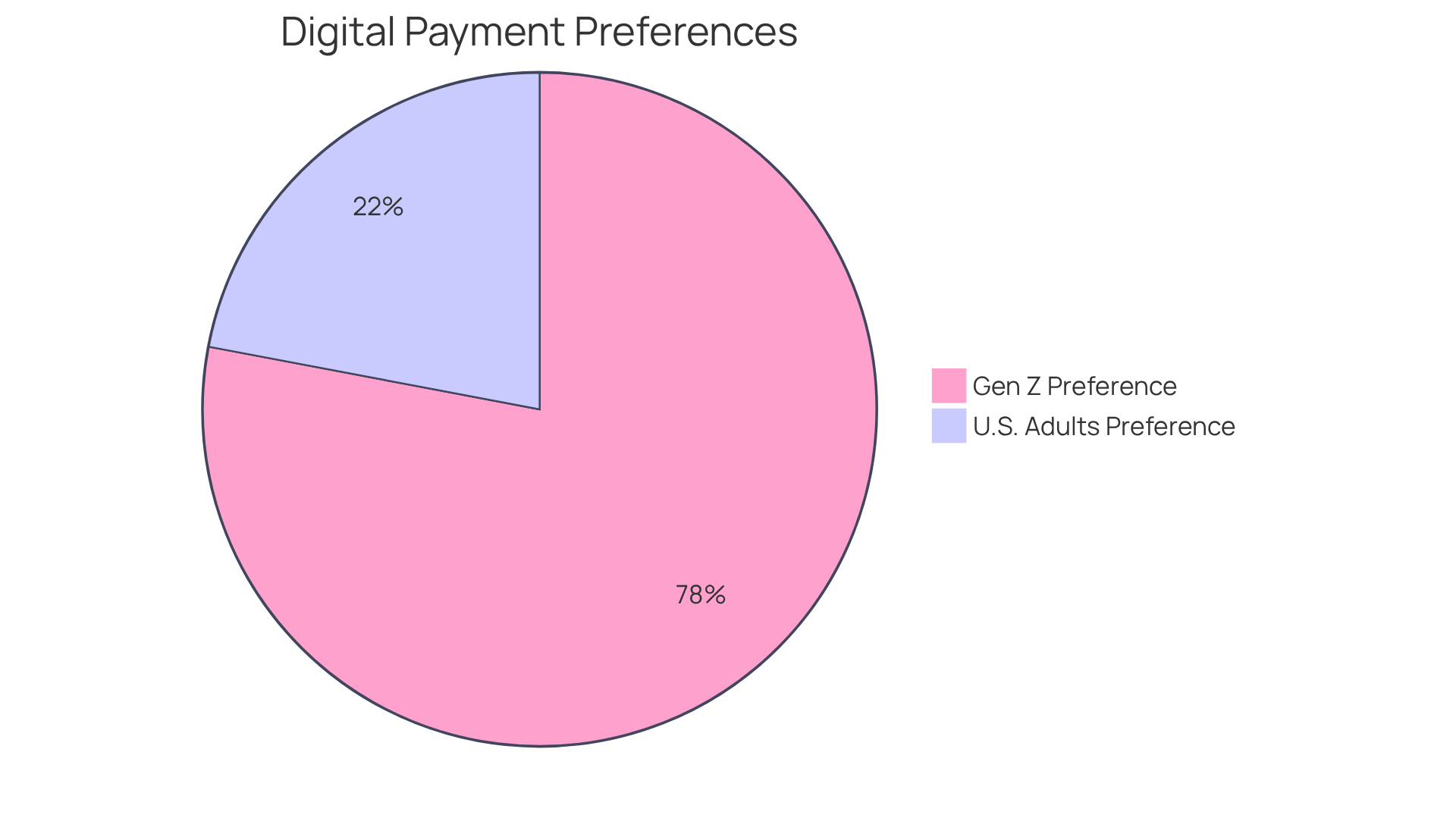

Here’s the thing: this shift towards cashless vending machines not only meets consumer preferences but also enhances your property's modern, tech-savvy image. Did you know that:

- 85% of Generation Z prefers digital payments over cash?

- 24% of U.S. adults are leaning towards digital options too?

That’s a big shift in how people are choosing to pay, regardless of age.

By adopting digital payment options, you’re likely to see a boost in customer engagement. Younger consumers really value , and these solutions hit the mark. But wait, there’s more! Incorporating loyalty programs that tie into digital payments can really enhance customer loyalty. In fact, 55% of Gen Z loves payment methods that offer cashback rewards.

So, if you’re looking to thrive in today’s competitive environment, embracing electronic sales is essential. It’s all about making things easier for your customers and keeping them coming back for more.

Increased Revenue Potential with Cashless Transactions

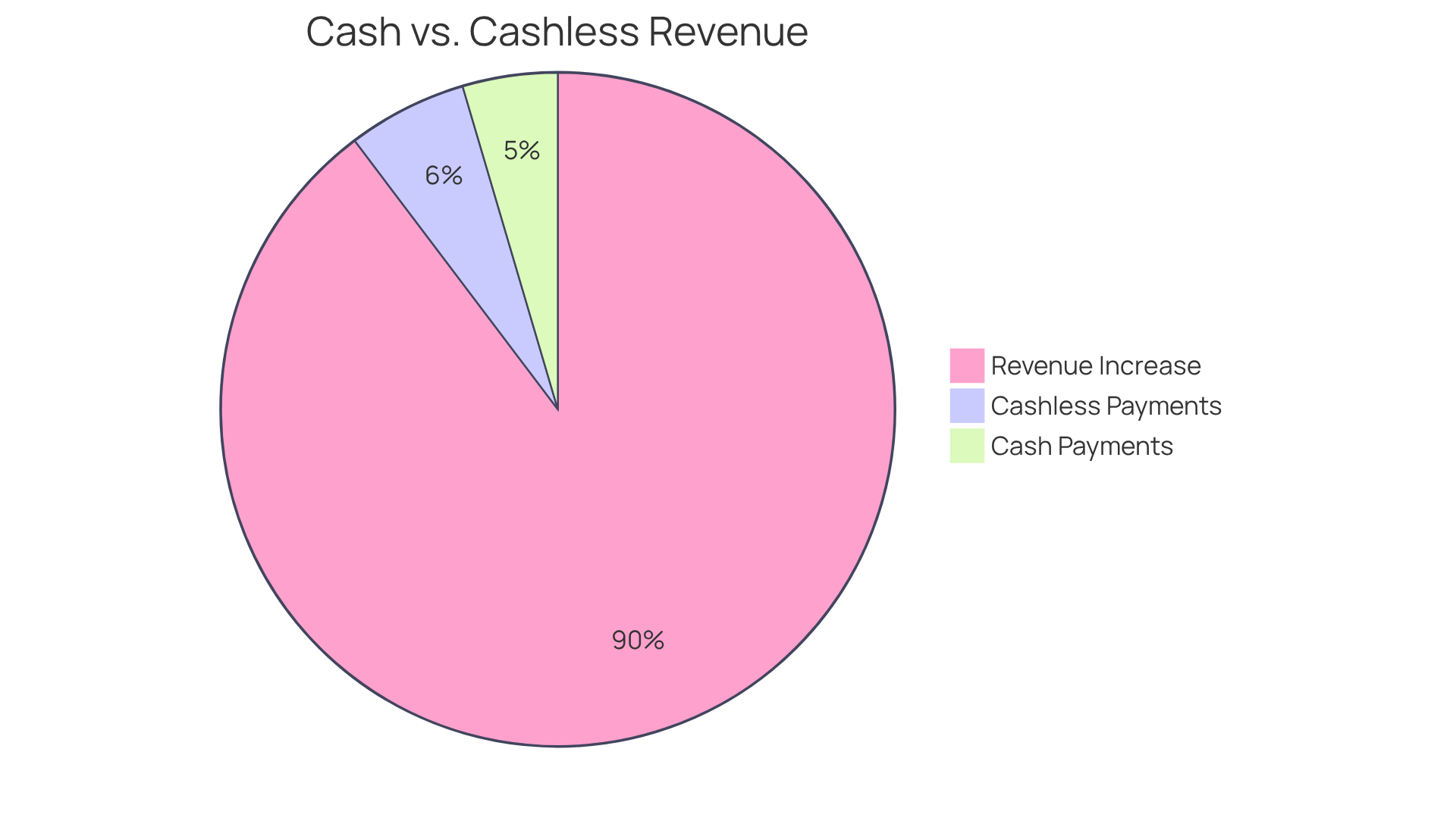

Cashless exchanges can really ramp up revenue for property managers. You know, studies have shown that dispensers with can see sales jumps of 20-30% compared to the old-school machines. Typically, an electronic purchase averages around $2.24, which is quite a bit higher than the $1.78 average for cash payments. This difference really shows how appealing digital payment systems are—they make transactions easier and encourage customers to spend a little more.

But here’s the kicker: some underperforming automated retail spots have reported sales boosts of up to 110% after switching to cashless vending machines. One manager even said, 'The incorporation of cashless vending machines has resulted in a significant increase in sales,' which really drives home the point that modern payment solutions are key to optimizing the operations of these machines.

The profitability of going digital is supported by the fact that cashless vending machines equipped with electronic payment options can see an average revenue increase of up to 35%. This trend highlights the economic perks of embracing digital payment technology, including cashless vending machines, making it a smart move for real estate managers looking to enhance their services. So, if you’re thinking about introducing digital payment solutions, it’s a good idea to take a close look at your current automated sales systems and explore the different electronic payment options out there.

And with Vending Village’s impressive 4.9/5 average review score, you can feel confident that making the switch to electronic systems will boost your operations.

Leveraging Data Analytics in Cashless Vending

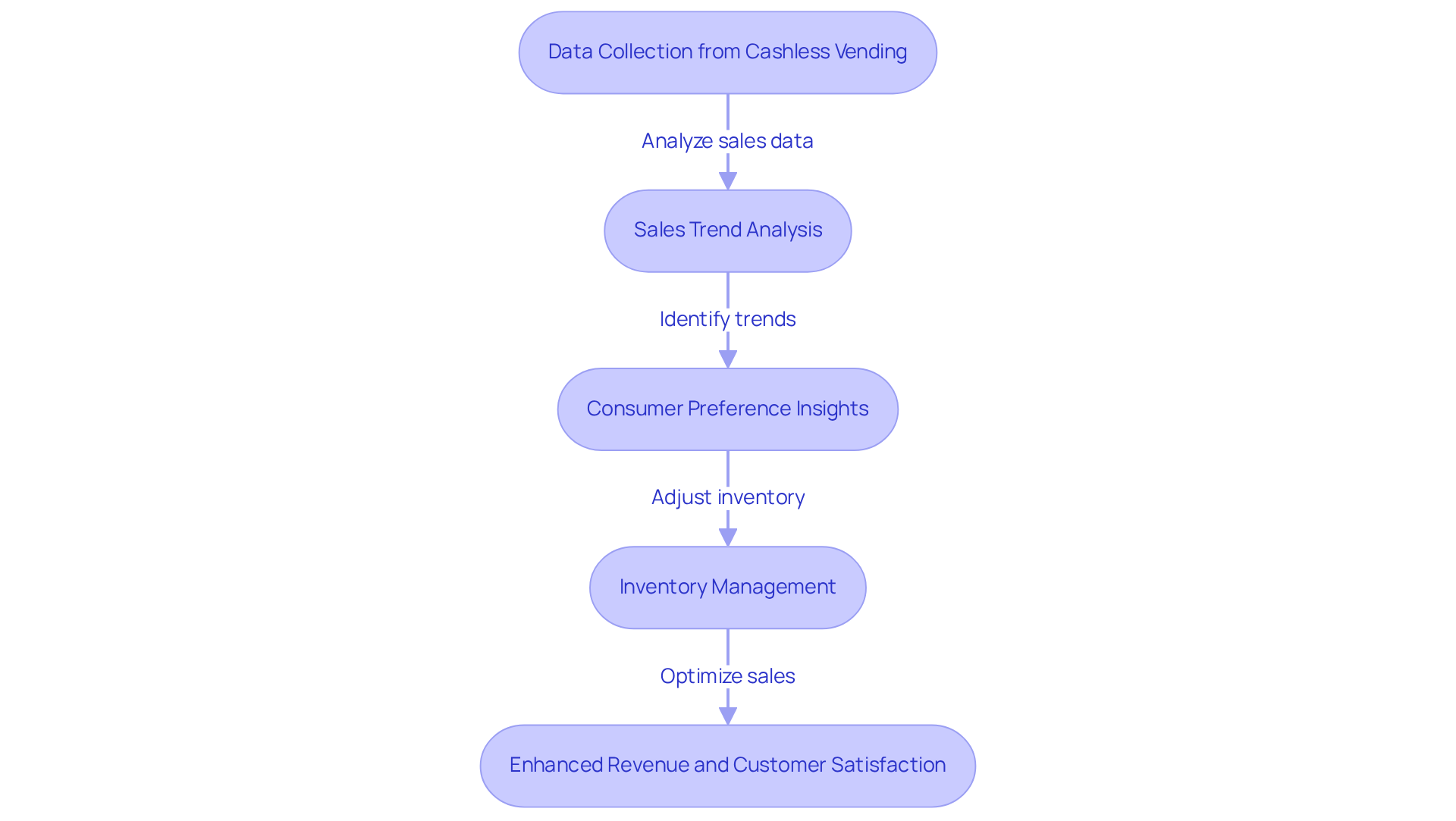

You know how cashless vending machines are popping up everywhere? They’re not just for show anymore; they’re getting some serious upgrades with data analytics features. This means managers can keep an eye on , consumer preferences, and inventory levels in real time.

Here’s a fun fact: in 2022, a whopping 67% of all automated machine transactions were non-cash. That’s a big shift towards digital payment solutions! By tapping into this data, property managers can make smart choices about what products to offer, how to price them, and when to restock.

For example, when managers track sales data, they can spot which items are flying off the shelves. This way, they can keep popular products in stock while cutting down on waste from items that just aren’t moving. And get this—sales from cashless vending machines saw an 11% increase in automated retail and electronic payment trends in 2022. That really shows how important it is to adapt to these changes.

So, what’s the takeaway? This data-driven approach not only boosts operational efficiency but also enhances overall performance. Property managers who embrace these analytics-driven strategies are seeing real improvements in revenue and customer satisfaction. It’s clear that using data in operations can be a game changer.

Health and Safety Benefits of Cashless Vending Machines

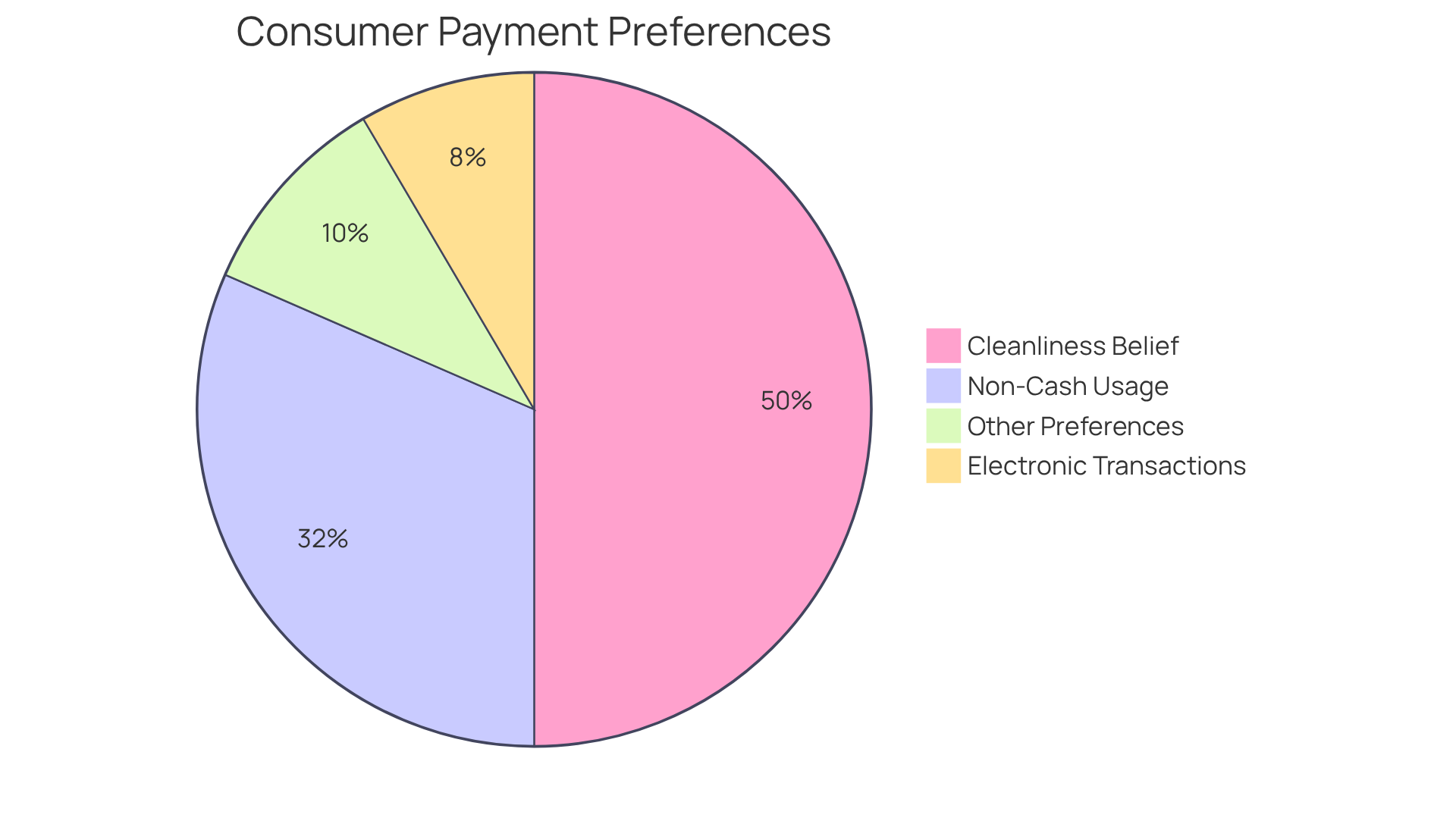

Cashless vending machines are essential for enhancing health and safety by greatly minimizing physical contact during transactions. After the pandemic, many consumers became more concerned about cleanliness, leading to a preference for digital payment methods over cash. Did you know that 65% of people believe contactless payments are cleaner than traditional methods? This highlights a growing trend toward hygienic payment options. Plus, the use of electronic transactions jumped from 51% in 2020 to 62% in 2021, showing that more folks are opting for digital solutions. By adopting these payment systems, managers can create a safer environment, enhancing the overall health of both residents and visitors.

Now, think about this: digital transactions not only cut down on the risk of germs but also eliminate the need for physical cash, which can harbor bacteria. This shift addresses while catering to the increasing desire for convenience and efficiency in how we shop today. Properties with cashless vending machines can foster a sense of safety and well-being among users, ultimately enhancing their experience in shared spaces. And with 41% of Americans not using cash for transactions in 2022, the reliance on cash is clearly fading, further supporting the case for cashless solutions.

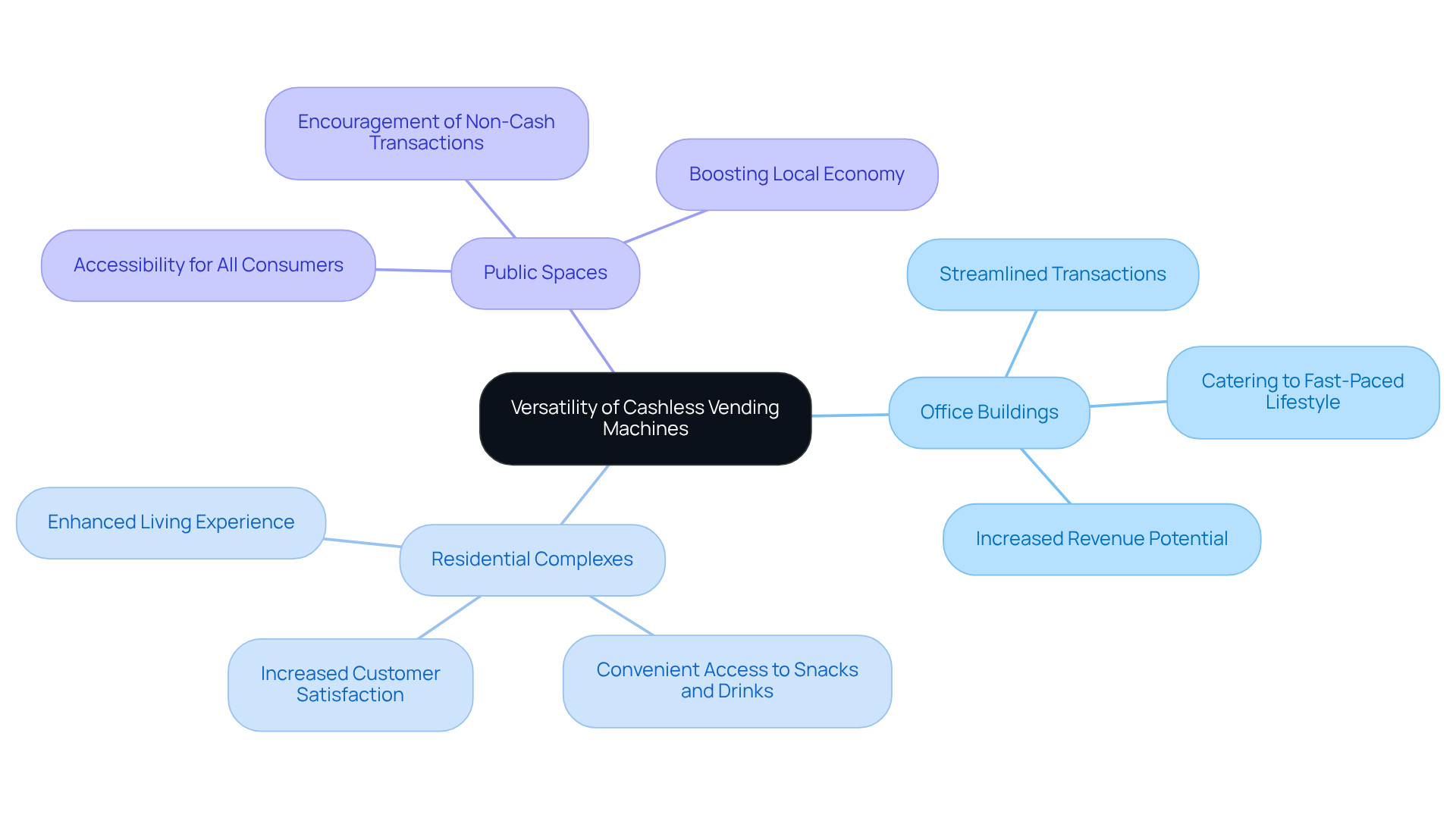

Versatility of Cashless Vending Machines Across Locations

Cashless vending machines are super versatile, making them a great fit for all sorts of places—think office buildings, residential complexes, and even public spaces. This flexibility helps property managers meet diverse consumer needs and preferences, keeping offerings relevant and appealing no matter where they are. For instance, in workplaces, digital payment systems can streamline transactions, catering to the fast-paced lifestyle of staff who want quick and easy purchasing options. And in residential complexes, these machines can give residents easy access to snacks and drinks, really enhancing their living experience.

Here’s the thing: data shows that more and more consumers are leaning towards non-cash transactions. Electronic sales are averaging $2.11, which is significantly higher than the $1.36 average for cash transactions. This trend really highlights the potential for in places where cashless vending machines are offered. Plus, facility managers who jump on board with electronic sales solutions can expect an average monthly revenue increase of 85% after they implement them. That’s a clear sign that consumers are looking for smooth and effective buying experiences.

But the good news is, real estate managers have shared that adding cashless vending machines as digital payment solutions not only increases customer satisfaction but also positions their properties as modern and innovative. By leveraging the flexibility of electronic dispensing machines, property managers can make their operations more efficient, ultimately increasing profitability and engaging tenants more effectively. So, why not consider integrating these solutions into your property management strategy?

The Future of Cashless Vending: Trends and Innovations

The future of cashless sales looks bright, thanks to quick advancements in technology and payment systems. Think about it: mobile wallets, contactless payments, and easy-to-use interfaces are changing how we shop. By 2025, mobile payments are set to take the lead in vending, with a big boost from digital wallets like Apple Pay, Google Pay, and Samsung Pay. In fact, 60% of shoppers now prefer digital payments. They not only make things easier but also boost customer satisfaction.

Now, here’s the thing: industry leaders are saying that electronic payments are becoming the norm. A whopping 86.9% of U.S. point-of-sale transactions are now digital. You can really see this shift in automated retail, where operators are jumping on the bandwagon with to cater to consumers who want quick and secure payment options. Plus, the average digital transaction is now $2.24, compared to just $1.78 for cash. That’s a clear sign that people are leaning towards electronic payments.

But it’s not just a trend; incorporating mobile wallets into cashless vending machines is essential for operators aiming to stay competitive. As cash usage drops, those who embrace these innovations can cut down on maintenance costs and reduce the risks tied to cash handling. And let’s not forget about subscription services—they’re really helping to build customer loyalty and giving operators a steady stream of revenue.

So, in a nutshell, property managers should really focus on adopting cashless vending machines for sales solutions. It’s all about aligning with what consumers want and boosting operational efficiency. By keeping up with these trends, you can make sure your vending operations thrive in this increasingly digital marketplace.

Conclusion

You know, cashless vending machines are really changing the game for property managers. They not only boost operational efficiency but also make customers happier. By jumping on board with these digital payment options, you’re aligning with what today’s tech-savvy shoppers want—convenience and a modern shopping experience.

Here’s the thing: cashless vending doesn’t just speed up transactions and cut down on maintenance costs. It can also lead to a significant increase in sales and revenue. In fact, studies show that electronic transactions often bring in higher average sales compared to cash payments. Plus, in our post-pandemic world, focusing on health and safety means we need solutions that reduce physical contact and keep things clean.

So, what should property managers take away from all this? Embracing cashless vending machines is key to meeting the needs of today’s consumers and improving your operational strategies. It’s not just about boosting revenue; it’s also about creating a safer, more inviting environment for everyone—tenants and visitors alike. The future is cashless, and it’s time to grab this opportunity to innovate and adapt to the changing landscape.

Frequently Asked Questions

What payment processing system does Vending Village use for cashless vending machines?

Vending Village uses Stripe for payment processing, ensuring secure transactions for both buyers and sellers.

Why is secure payment processing important for property managers?

Secure payment processing helps property managers build trust with their tenants and clients, allowing them to roll out cashless vending machines without concerns about fraud or misrepresentation.

How much did sales of cashless vending machines increase in 2022?

Sales of cashless vending machines increased significantly in 2022, with electronic payments accounting for 67% of all machine sales.

What is the projected growth rate for cashless vending machine sales?

The trend in cashless vending machine sales is projected to grow by another 6-8%.

What is the average value of electronic sales compared to cash payments in vending machines?

The average value of electronic sales machines was $2.11, compared to $1.36 for cash payments.

How does Vending Village's escrow system enhance transaction safety?

Vending Village's escrow system holds buyers' funds until they are satisfied with their purchase, reinforcing safety and trustworthiness in the marketplace.

What percentage of shoppers prefer digital transactions at cashless vending machines?

60% of shoppers now prefer using digital transactions at cashless vending machines.

What was the contribution of cashless vending machines to contactless payments in 2024?

Cashless vending machines contributed to contactless payments, which made up 77% of all digital transactions in 2024.

How much did consumer spending at automated machines increase in 2024?

Consumer spending at automated machines increased by $500 million in 2024, marking a 15% increase from the previous year.

What benefits do cashless vending machines provide to property managers?

Cashless vending machines enhance tenant experiences, lead to higher spending per transaction, and can increase monthly sales by up to 85%, while also reducing maintenance requests.

Why is it important for property managers to integrate digital payment options?

Integrating digital payment options is essential for property managers to meet consumer expectations, stay competitive, and create a more satisfying environment for tenants.

List of Sources

- Vending Village: Secure Transactions for Cashless Vending Machines

- convenience.org (https://convenience.org/Media/Daily/2023/June/19/EMV-Payments-Vending-Machines-Rise_Payments)

- ecspayments.com (https://ecspayments.com/vending-machine-card-reader)

- vending.com (https://vending.com/blog/go-cashless-go-smart-a-peak-into-the-future-of-cashless-vending)

- Stripe Stats for 2025: The Most Accurate Stripe Statistics Online (https://chargeflow.io/blog/stripe-statistics)

- coinlaw.io (https://coinlaw.io/contactless-payment-statistics)

- The Rise of Cashless Payments in Vending Machines

- amsvendors.com (https://amsvendors.com/beyond-chips-unlocking-the-future-of-vending-machines-in-2025)

- evending.com (https://evending.com/blogs/news/vending-convenience-the-rise-of-cashless-payments?srsltid=AfmBOooGVbQTrabeL2I6wAKCGVz49X9XUDafuPou4odDVeeqI8qgBlNl)

- Micropayment Trends Report 2025 | Cantaloupe (https://cantaloupe.com/resource-center/micropayment-trends-report-2025)

- grandviewresearch.com (https://grandviewresearch.com/horizon/statistics/retail-vending-machine-market/payment-mode/cashless/global)

- Enhanced Convenience with Cashless Vending Solutions

- dfyvending.com (https://dfyvending.com/cashless-vending-payments)

- Retail Vending Machine Market Size | Industry Report, 2033 (https://grandviewresearch.com/industry-analysis/global-vending-machine-market)

- dfyvending.com (https://dfyvending.com/cashless-vending-machines-investment)

- Vending Machines Market Size, Share & Growth Report, 2033 (https://marketdataforecast.com/market-reports/vending-machines-market)

- Operational Efficiency Boost from Cashless Vending

- cutimes.com (https://cutimes.com/2019/05/20/cashless-tech-boosting-vending-maching-revenue-study-finds)

- dfyvending.com (https://dfyvending.com/cashless-vending-payments)

- nayax.com (https://nayax.com/he/blog/how-profitable-are-vending-machines)

- dfyvending.com (https://dfyvending.com/cashless-vending-machines-investment)

- U.S. Retail Vending Machine Market | Industry Report, 2033 (https://grandviewresearch.com/industry-analysis/us-retail-vending-machine-market-report)

- Attracting Younger Consumers with Cashless Options

- pymnts.com (https://pymnts.com/digital-payments/2024/85percent-of-gen-z-prefers-digital-payments-to-cash)

- frbservices.org (https://frbservices.org/news/research/2024-findings-from-the-diary-of-consumer-payment-choice)

- swipesum.com (https://swipesum.com/insights/gen-z-and-the-future-of-payments-cards-cash-and-the-shift-to-digital)

- news.gallup.com (https://news.gallup.com/poll/397718/americans-using-cash-less-often-foresee-cashless-society.aspx)

- primax.us (https://primax.us/blog/gen-z-and-millennial-preferences-and-behaviors-drive-popularity-of-payments)

- Increased Revenue Potential with Cashless Transactions

- paymentsjournal.com (https://paymentsjournal.com/cashless-payments-are-a-boon-for-vending-machines)

- Vending is Dead: Why Digital Payments Just Made Machines More Profitable Than Ever (https://dfyvending.com/digital-payments-vending-profitability)

- U.S. Retail Vending Machine Market | Industry Report, 2033 (https://grandviewresearch.com/industry-analysis/us-retail-vending-machine-market-report)

- grandviewresearch.com (https://grandviewresearch.com/horizon/statistics/retail-vending-machine-market/payment-mode/cashless/global)

- mssvending.com (https://mssvending.com/blog/how-cashless-vending-machines-boost-sales-morris-county-businesses-07072025)

- Leveraging Data Analytics in Cashless Vending

- dfyvending.com (https://dfyvending.com/data-analytics-vending-performance)

- vending.com (https://vending.com/blog/go-cashless-go-smart-a-peak-into-the-future-of-cashless-vending)

- dfyvending.com (https://dfyvending.com/dfy-vending-data-analytics)

- godreamcast.com (https://godreamcast.com/blog/cashless/cashless-payment-analytics-for-vendor-growth)

- datahorizzonresearch.com (https://datahorizzonresearch.com/cashless-vending-machine-market-22211)

- Health and Safety Benefits of Cashless Vending Machines

- ecspayments.com (https://ecspayments.com/vending-machine-card-reader)

- westernsydney.edu.au (https://westernsydney.edu.au/ics/news/in_the_conversation/cashless_payment_is_booming,_thanks_to_coronavirus._so_is_financial_surveillance)

- Retail Vending Machine Market Size | Industry Report, 2033 (https://grandviewresearch.com/industry-analysis/global-vending-machine-market)

- nextmsc.com (https://nextmsc.com/report/vending-machine-market)

- Versatility of Cashless Vending Machines Across Locations

- dfyvending.com (https://dfyvending.com/cashless-vending-machines-investment)

- growthmarketreports.com (https://growthmarketreports.com/report/cashless-vending-market)

- Retail Vending Machine Market Size | Industry Report, 2033 (https://grandviewresearch.com/industry-analysis/global-vending-machine-market)

- evending.com (https://evending.com/blogs/news/vending-convenience-the-rise-of-cashless-payments?srsltid=AfmBOoorUsIGxXGgwtYjujDBa34zpiRLlfdcXjf51nhiJZ3_h_tjKXs2)

- vendingmarketwatch.com (https://vendingmarketwatch.com/home/article/53066302/2023-technology-update-self-service-trends-for-vending-and-micro-markets)

- The Future of Cashless Vending: Trends and Innovations

- datahorizzonresearch.com (https://datahorizzonresearch.com/cashless-vending-machine-market-22211)

- vending-machines.ie (https://vending-machines.ie/what-payment-trends-are-shaping-the-vending-industry-in-2025)

- amsvendors.com (https://amsvendors.com/beyond-chips-unlocking-the-future-of-vending-machines-in-2025)

- vendingmarketwatch.com (https://vendingmarketwatch.com/technology/article/55285749/cantaloupe-inc-10-takeaways-from-cantaloupes-report-on-micropayments)