Overview

Have you ever thought about how cashless payment systems could change the game for your vending machines? Upgrading your vending equipment to handle digital transactions isn’t just a nice-to-have; it’s becoming essential.

These systems can really boost customer convenience and security. Plus, they often lead to increased sales and better operational efficiency. Just look at the companies that have already made the switch — they’ve reported significant sales growth!

So, here’s the thing: if you want to keep up and thrive, consider investing in these technologies. It’s a straightforward step that can pay off big time.

Introduction

Have you noticed how cashless payment systems are shaking things up in the vending industry? They’re making life a whole lot easier for folks who want to dodge the hassle of dealing with cash. In this guide, we’re going to explore the many perks of jumping on board with these modern payment options. From streamlining your operations to ramping up sales by engaging more customers, the benefits are pretty exciting.

But here’s the kicker: by 2025, it’s projected that a whopping 67% of vending transactions will be cashless. So, the big question is, how can you, as a vending machine owner, smoothly transition into this digital world? And how do you make sure your operations stay secure and compatible? Let’s break it down together.

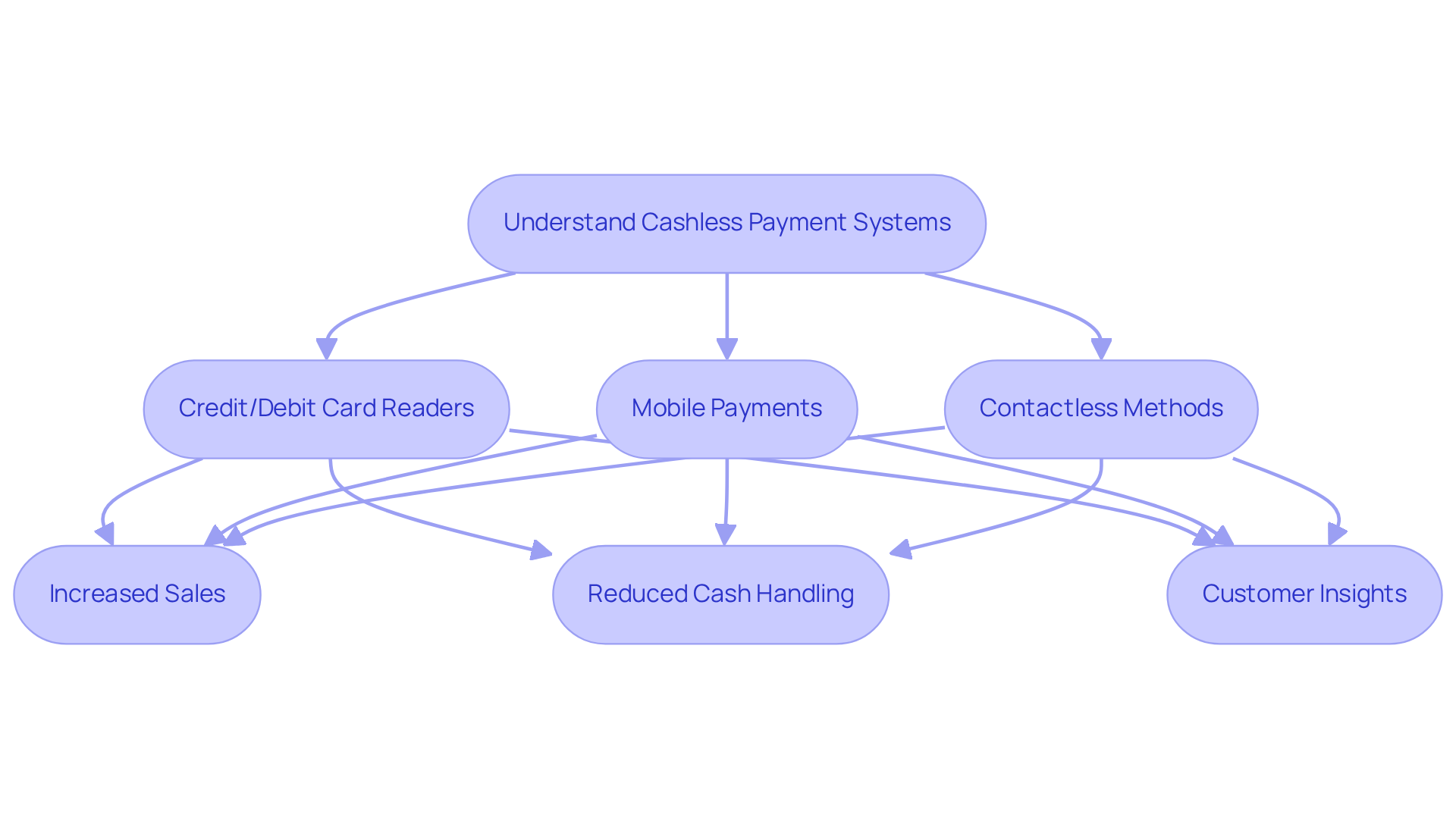

Understand Cashless Payment Systems in Vending

Have you noticed how cashless payment systems for vending machines are transforming the vending game? They make it super easy and convenient for folks to grab what they want without the hassle of cash. You’ll typically see features like credit and debit card readers, mobile payment options like Apple Pay and Google Wallet, and even contactless methods popping up everywhere.

Here’s the thing: there’s a real need for a secure marketplace for vending machine and location owners. That’s why Vending Village was created. We’re all about filling that gap. Our secure transaction platform makes sure that exchanges are safe. With our , funds are only released once both the buyer and seller confirm that the transaction is a go. It’s all about giving everyone peace of mind.

We team up with trusted transaction gateways like Stripe to keep your financial details locked down. Understanding cashless payment systems for vending machines means recognizing their perks. Think about it: you could see a boost in sales just because transactions are so straightforward. Plus, you won’t have to deal with cash handling as much, which means less risk of theft.

On top of that, digital payment methods can provide valuable insights into customer buying habits. This info can help you fine-tune your inventory and where you place your machines. So, getting familiar with cashless payment systems for vending machines is a solid first step toward modernizing your vending operations and ensuring secure purchases. Ready to dive in?

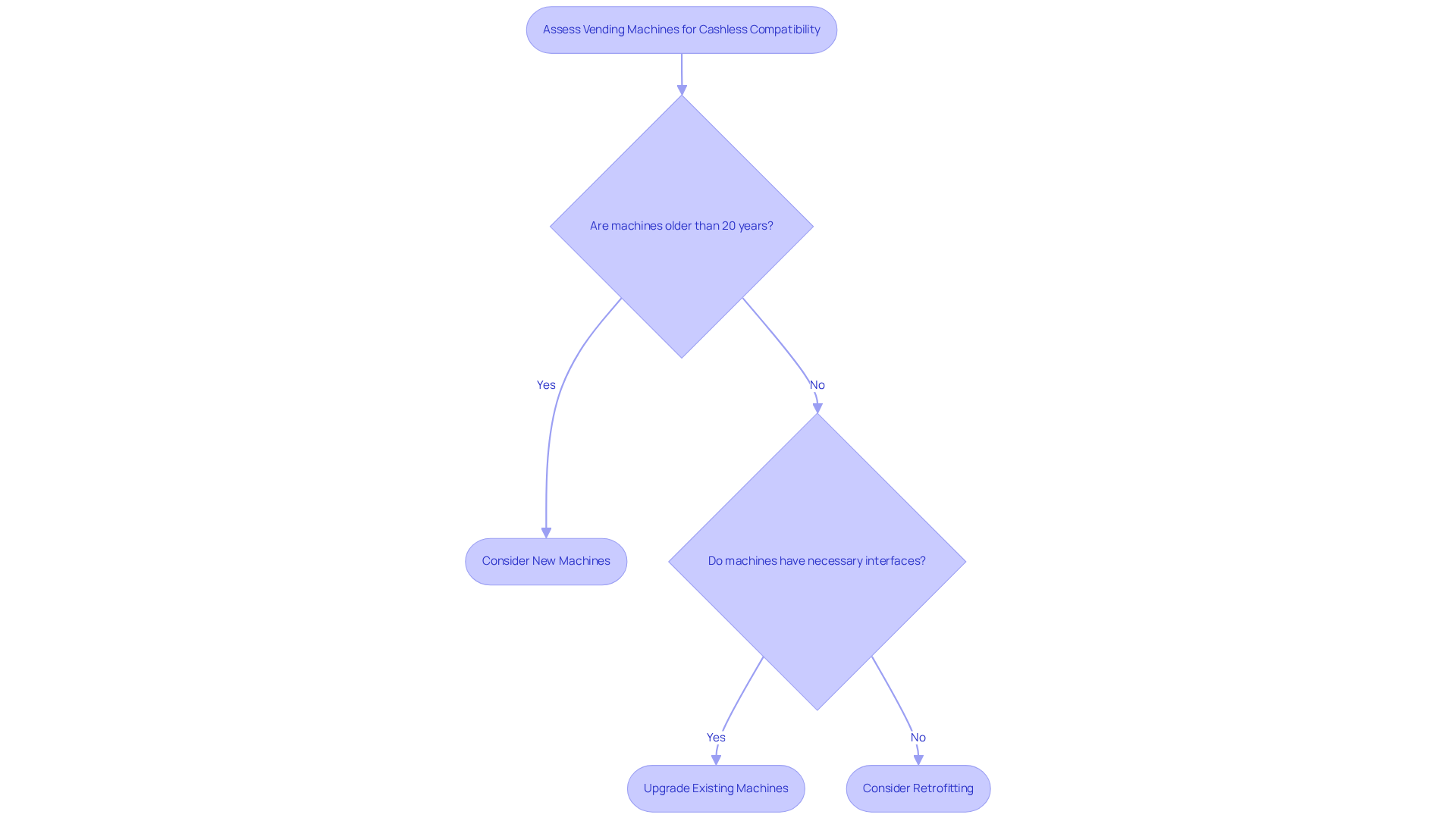

Assess Your Vending Machines for Cashless Compatibility

Before you dive into any upgrades for your vending units, it’s crucial to evaluate how suitable they are for cashless payment systems for vending machines. Start by checking the type and age of your devices. If they’re older than 20 years, they might not have the right interfaces for today’s transaction technologies.

Here’s the thing: by 2025, it’s expected that cashless payment systems for vending machines will account for 67% of vending transactions. That’s a clear sign that the industry is moving towards digital solutions.

Next, look for existing ports or interfaces that can support payment terminals, like MDB, EXE, or Pulse connections. If your equipment doesn’t match up, retrofitting could be an option. Many manufacturers, like DFY Vending, emphasize that upgrading your current devices can boost operational efficiency and enhance customer satisfaction. For instance, adding a card reader typically costs between $100 and $300. Considering the average cashless transaction is about $2.11, compared to $1.36 for cash, it’s a smart investment.

Don’t forget to check the manufacturer’s specifications or reach out to a technician for insights on retrofitting your equipment. This evaluation will help you decide whether to upgrade what you have or for vending machines. By aligning your vending operations with modern consumer preferences for speed and convenience, you can significantly boost profitability and customer engagement.

And here’s some good news: digital transactions in food and drink vending units are projected to rise by 6-8%. So, the importance of transitioning to electronic platforms is more significant than ever.

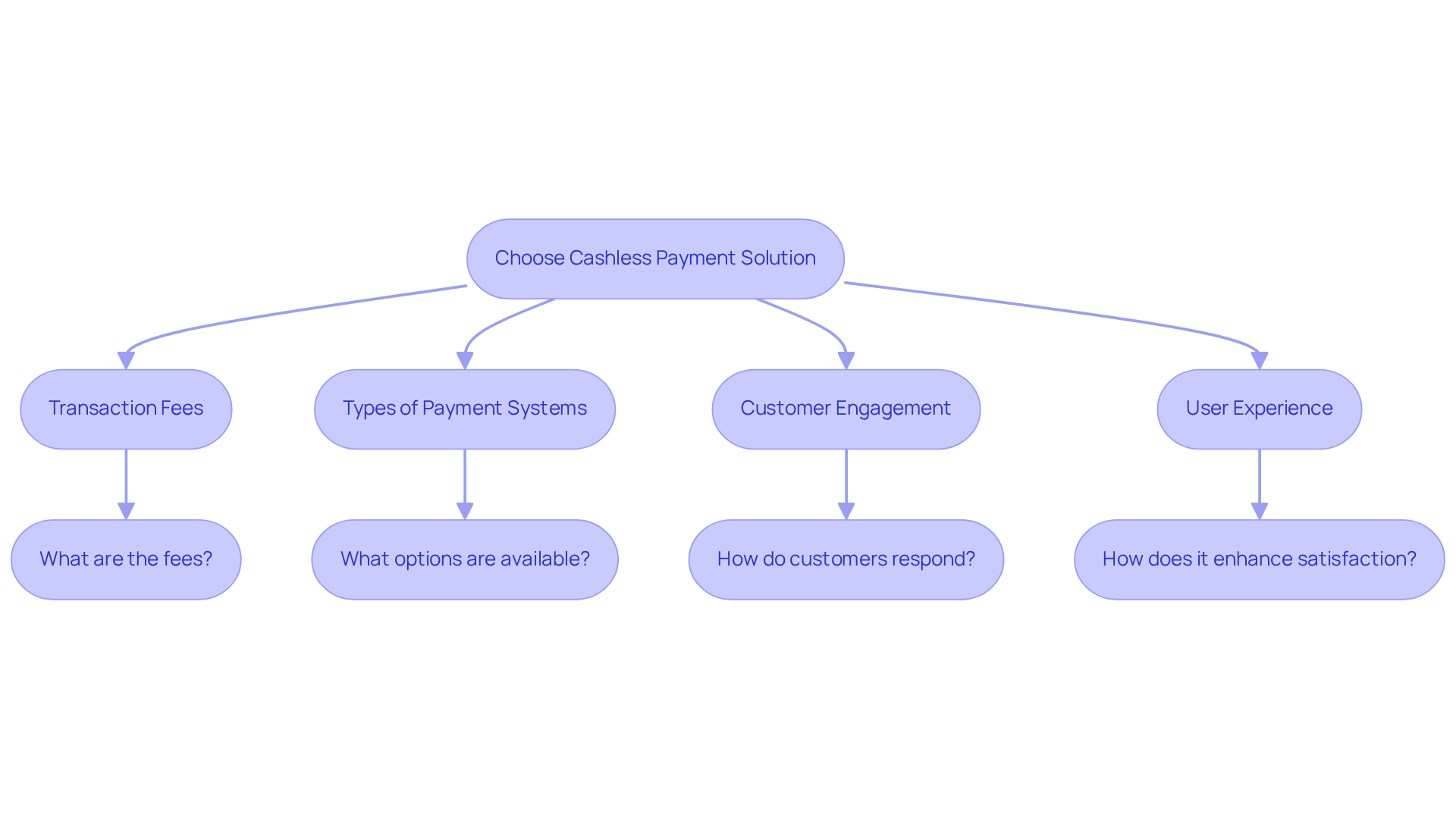

Choose the Right Cashless Payment Solution

Choosing the right cashless payment systems for vending machines isn’t just a quick decision; it requires careful consideration. First off, transaction fees are a big deal. Understanding how different providers charge can really affect your profits. You’ve got options ranging from traditional card readers to fancy mobile platforms and that support cashless payment systems for vending machines. Each of these comes with its own fee structure, so it’s super important to weigh these costs against the potential boost in sales that electronic payments can bring. After all, digital transactions often lead to higher spending, making this comparison crucial.

Now, let’s talk about the success stories. Many businesses that have adopted electronic transaction solutions have seen a real uptick in customer engagement and sales. Companies embracing these technologies often report a significant increase in transaction values, since folks using digital currency tend to spend more. This shift in how consumers view cashless payment systems for vending machines has evolved from being just a convenience to something they expect—especially after the pandemic. For instance, DFY Vending has seen a remarkable 63% increase in client sales thanks to their tech upgrades, proving that going digital can really pay off.

Don’t forget about customer satisfaction ratings for cashless systems. A smooth transaction experience doesn’t just make customers happy; it encourages them to come back. Doing some research on different providers and checking out user reviews can give you a good sense of their reliability and support. Plus, think about the user experience; a seamless process can significantly boost customer satisfaction. As DFY Vending puts it, "By integrating sophisticated electronic transaction methods, our clients have witnessed a significant 63% increase in sales."

Ultimately, you want to pick a solution that fits your budget and meets your customers’ expectations. By keeping these factors in mind, you can ensure your vending operations are equipped with cashless payment systems for vending machines that enhance efficiency and build customer loyalty. And don’t forget to stay updated on new trends in transaction technology, like mobile and wearable options, to help you adapt to the evolving landscape of cashless payment systems for vending machines.

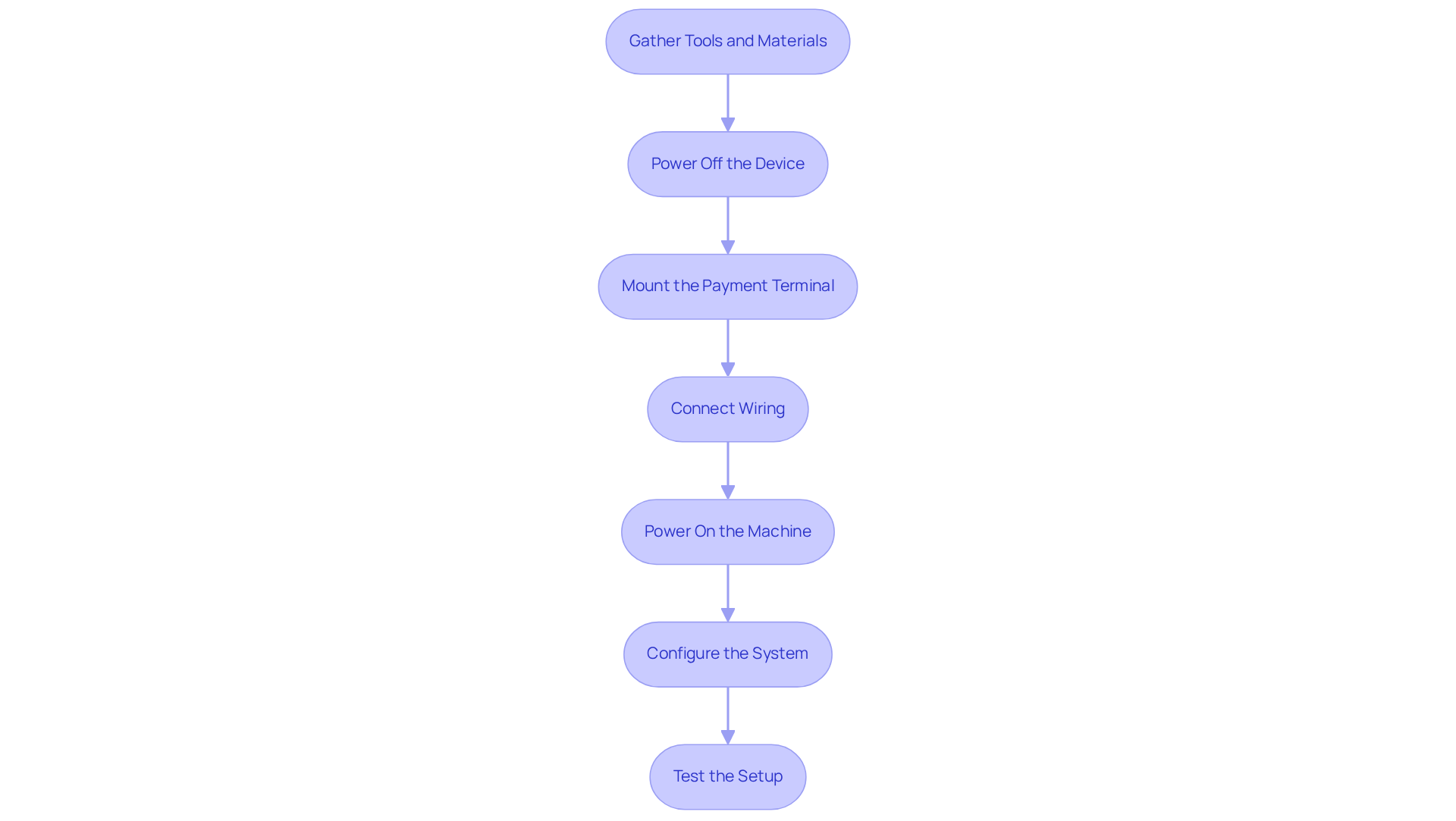

Install Cashless Payment Systems: A Step-by-Step Process

Setting up a digital transaction system in your vending units? It’s not as daunting as it sounds! Here’s a straightforward process to get you started:

- Gather Tools and Materials: Grab your screwdrivers, a drill, and the cashless transaction terminal. You’ll need these essentials.

- Power Off the Device: Safety first! Unplug the vending machine before diving into the installation.

- Mount the Payment Terminal: Securely attach the payment terminal to the device. Just follow the manufacturer’s guidelines for the best placement.

- Connect Wiring: Carefully connect the terminal to the internal wiring of the device. Make sure all connections are tight to avoid any hiccups later on.

- Power On the Machine: Once everything’s connected, plug the machine back in and turn it on.

- Configure the System: Follow the setup instructions from your transaction solution provider to configure the terminal and link it to your account.

- Test the Setup: Give it a spin with a to ensure everything’s working smoothly. If something’s off, don’t hesitate to consult the troubleshooting guide from your provider.

Successful installations really show how important it is to use the right tools and stick to best practices. A good tip? Always double-check your connections and configurations to steer clear of common pitfalls. As one technician put it, "Thoroughness in checking connections can prevent many operational issues down the line."

By following these steps, you can ensure a smooth transition to cashless payment systems for vending machines, which will make things easier for your customers and boost your operational efficiency. Plus, going digital can help cut down on administrative errors and save time for your business — definitely a smart investment!

And remember, if you hit any bumps during installation, customer and technical support are just a call away to help you out.

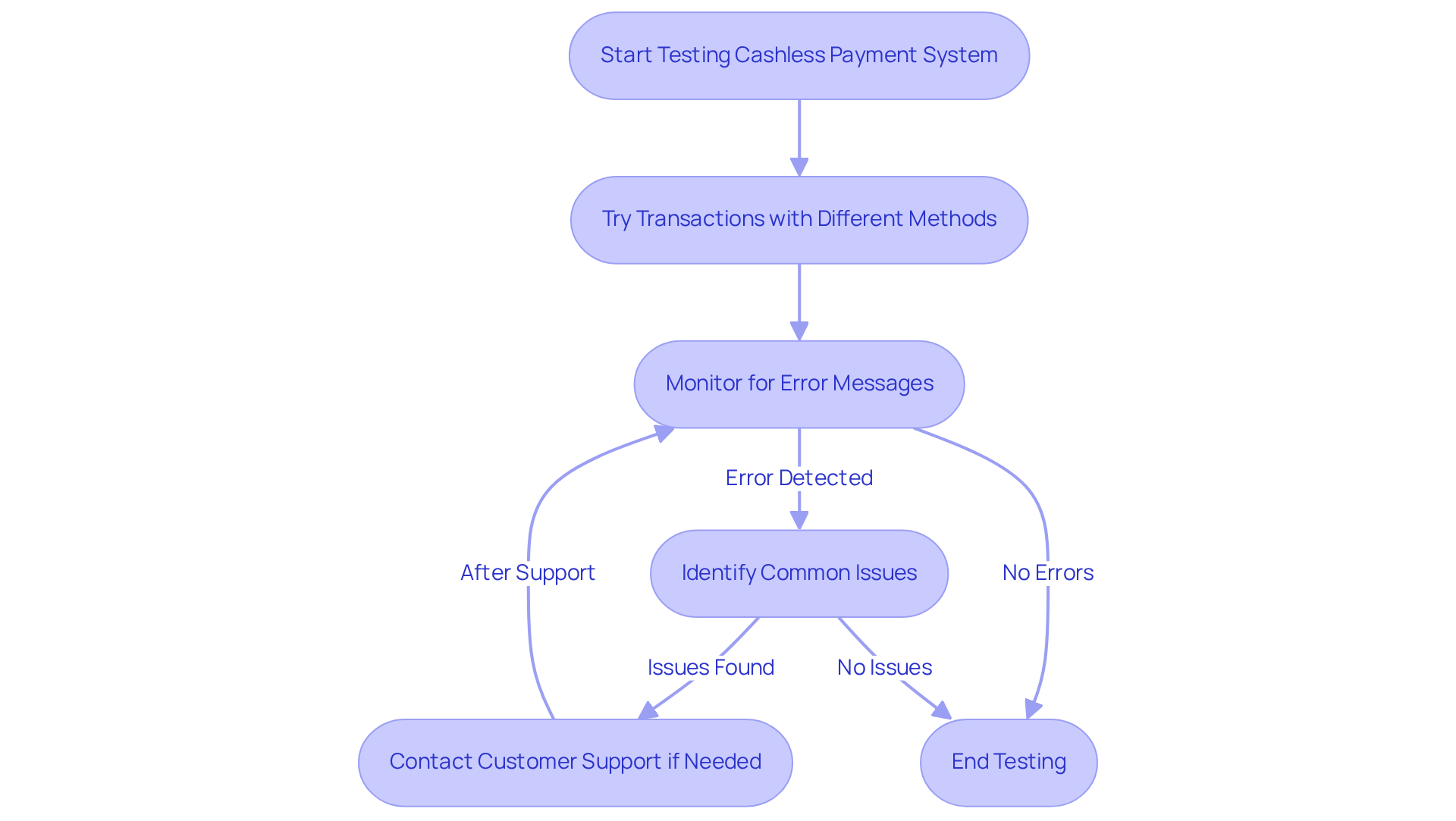

Test and Troubleshoot Your Cashless Payment System

After you install your cashless payment systems for vending machines, it’s super important to give it a good test run. Start by trying out a few transactions using different methods to make sure everything's working as it should. Vending Village has some solid in place, like collecting fees upfront, which means charges are secured before any transactions get confirmed. This way, you’re only dealing with serious buyers who are committed.

Keep an eye out for any error messages or transaction hiccups. If something goes wrong, don’t hesitate to check out the troubleshooting section of your payment provider's manual. Common issues can pop up, like:

- Connectivity problems

- Wiring errors

- Software glitches

Remember, payments won’t go through until both the buyer and seller confirm that the transaction is a success. This ensures that you only get rewarded when all the agreed conditions are met.

If you’re stuck and can’t figure it out, just reach out to the provider's customer support for help. Regular testing of your system is key to keeping it reliable and ensuring that your customers have a great experience with cashless payment systems for vending machines.

Conclusion

Switching to cashless payment systems for vending machines is a game changer in our industry. It’s not just about making transactions easier for customers; it’s also a great way for vending operators to ramp up sales and streamline how they do business. Nowadays, customers are leaning more towards digital transactions instead of cash, and businesses need to keep up with that shift.

In this guide, we’ve shared some key insights on:

- How to check if your vending machines can handle cashless systems

- How to pick the right payment solution

- Tips for installing and troubleshooting these technologies

The growth of cashless transactions is on the rise, and it’s crucial for operators to adapt. Projections show that by 2025, cashless systems will make up a large chunk of vending transactions. Plus, the ability to collect data on customer buying habits through digital payments opens up fantastic opportunities for optimizing inventory and boosting customer engagement.

But here’s the thing: moving to cashless payment systems isn’t just a trend; it’s essential for the vending industry’s evolution. By embracing digital transactions, operators can enhance profitability, improve customer satisfaction, and stay competitive in a fast-changing market. So, let’s not wait—investing in cashless payment solutions now will not only future-proof your vending operations but also create a smooth and satisfying experience for your customers.

Frequently Asked Questions

What are cashless payment systems in vending machines?

Cashless payment systems in vending machines allow customers to make purchases using credit and debit cards, mobile payment options like Apple Pay and Google Wallet, and contactless methods, providing a convenient alternative to cash transactions.

Why is there a need for a secure marketplace for vending transactions?

There is a need for a secure marketplace for vending transactions to ensure safe exchanges between vending machine owners and customers. Platforms like Vending Village provide secure transaction features, including withholding funds until both parties confirm the transaction.

How do cashless payment systems benefit vending machine owners?

Cashless payment systems can boost sales due to the ease of transactions, reduce cash handling and the associated risks of theft, and provide valuable insights into customer buying habits to help optimize inventory and machine placement.

How can I assess my vending machines for cashless compatibility?

To assess vending machines for cashless compatibility, check the type and age of the machines, look for existing ports or interfaces that support payment terminals (like MDB, EXE, or Pulse), and consider retrofitting if necessary.

What is the expected trend for cashless transactions in vending by 2025?

By 2025, it is expected that cashless payment systems will account for 67% of vending transactions, indicating a significant shift towards digital solutions in the industry.

What are the costs associated with upgrading vending machines for cashless payments?

Adding a card reader to a vending machine typically costs between $100 and $300. This investment is justified as the average cashless transaction amount is higher than cash transactions.

Why is it important to transition to cashless payment systems for vending machines?

Transitioning to cashless payment systems is important because it aligns vending operations with modern consumer preferences for speed and convenience, potentially boosting profitability and customer engagement. Additionally, digital transactions in food and drink vending units are projected to rise by 6-8%.

List of Sources

- Assess Your Vending Machines for Cashless Compatibility

- Latest news and insights from Aurency (https://aurency.com/post/how-to-switch-your-vending-machines-to-cashless-payments-a-step-by-step-guide)

- The Future of Cashless, Electronic Payments in Vending (https://vending.com/blog/go-cashless-go-smart-a-peak-into-the-future-of-cashless-vending)

- Cashless Payment Revolution: How DFY Vending's Technology Upgrade Increased Client Sales by 63% (https://dfyvending.com/cashless-payment-vending-sales)

- Vending Machine Rental: Key Strategies for Success and Profitability (https://blog.vendingvillage.com/vending-machine-rental-key-strategies-for-success-and-profitability)

- Nayax (https://allcloud.io/case_studies/nayax)

- Choose the Right Cashless Payment Solution

- Cashless Payment Revolution: How DFY Vending's Technology Upgrade Increased Client Sales by 63% (https://dfyvending.com/cashless-payment-vending-sales)

- Install Cashless Payment Systems: A Step-by-Step Process

- Payment Terminal - Installation and Support Guide (https://hello.easytransac.com/en/help/help-categories/payment-terminal)

- RFID for the Supply Chain and Operations Professional, [Second ed.] 9781631574634, 1631574639 - DOKUMEN.PUB (https://dokumen.pub/rfid-for-the-supply-chain-and-operations-professional-secondnbsped-9781631574634-1631574639.html)

- Test and Troubleshoot Your Cashless Payment System

- 25+ Global Payment Statistics To Inform Your Testing Strategy (https://testlio.com/blog/payment-testing-statistics)

- 22 Quotes on the Future of Money: What Experts Are Saying (https://fintechly.com/cryptocurrencies/22-quotes-on-the-future-of-money-what-experts-are-saying)