Overview

Have you ever thought about how much easier life could be with cashless vending systems? They’re not just a trend; they can really boost efficiency in property management. Imagine your tenants enjoying the convenience of cashless payments while you see an uptick in revenue. It’s a win-win!

Here’s the thing: adopting these technologies doesn’t just make transactions smoother. It also means less hassle for you when it comes to handling cash. We all know that cash can be a headache, right? By going cashless, you reduce the operational risks that come with it. Plus, data shows that cashless solutions lead to higher transaction values and significant market growth.

So, if you’re looking to enhance your property management game, consider making the switch to cashless vending. It’s a simple step that can lead to greater tenant satisfaction and increased spending. Let’s embrace the future together!

Introduction

Have you noticed how cashless transactions are changing the game in property management? It’s pretty fascinating! This shift offers a smooth solution that really hits home with what today’s consumers want. By jumping on the cashless vending trend, property managers can not only streamline their operations but also see a nice boost in revenue and tenant satisfaction.

But here’s the thing: as we move away from traditional cash systems, there are definitely some challenges and considerations to think about. What do you need to keep in mind to make these modern solutions work for you? Let’s dive into that and explore how you can navigate this exciting change.

Define Cashless Vending and Its Mechanisms

Cashless machines are pretty handy, right? They let you make purchases without fumbling for cash. Instead, these devices are designed for cashless vending, accepting all sorts of electronic payment methods—think credit and debit cards, mobile wallets like Apple Pay and Google Pay, and even QR codes. The tech behind these digital sales is advanced, using secure processing terminals that often rely on Near Field Communication (NFC) for those quick, contactless transfers. This not only makes life easier for users but also helps property managers by cutting down on cash handling and the risks that come with it.

So, here’s the deal: electronic dispensing machines are equipped with technology that connects with financial processors, making transactions quick and safe. By 2025, it’s expected that about 75% of automated dispensers will be equipped for cashless vending by accepting electronic payments. This is a clear sign that consumer habits are shifting towards digital transactions. The shift from cash to digital, exemplified by cashless vending, is driven by changing preferences and the pressing need for efficiency in property management. Plus, the market for cashless vending machines is set to grow at a CAGR of 12.2% from 2025 to 2033—pretty significant, right?

Successful cashless vending in property management has shown that it boosts customer satisfaction and cuts operational costs. This makes them an attractive option for modern facilities. Did you know the average digital transaction value is $2.24 compared to just $1.78 for cash transactions? That’s a financial win for embracing digital systems! With 60% of consumers leaning towards in automated retail, property managers can truly capitalize on this trend to enhance their services.

To maximize profitability, it’s crucial to strategically position automated retail machines in high-traffic areas and offer a variety of products. It’s all about making the most of this cashless movement!

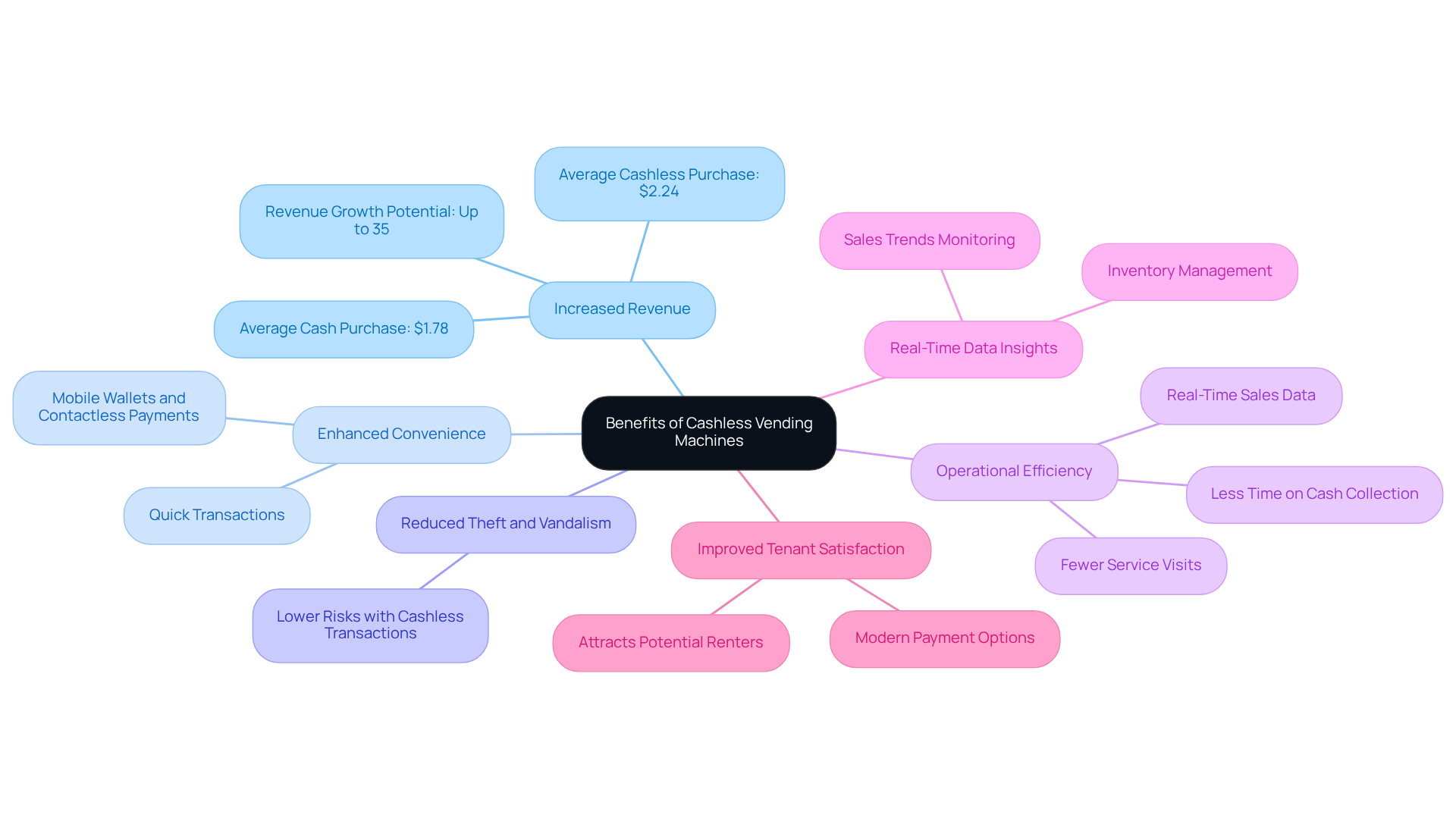

Explore the Benefits of Cashless Vending Machines

Cashless vending machines offer numerous benefits for property managers. Let’s dive into some of them:

Increased Revenue: You know how it goes—when cash isn't in the picture, people tend to spend more. Studies show cash purchases at vending machines average around $1.78, while electronic payments jump to $2.24. That's a clear boost in spending! Additionally, the implementation of cashless vending can result in revenue growth of up to 35% when compared to traditional cash-operated machines.

Enhanced Convenience: These systems make buying stuff super easy for tenants. They love quick and hassle-free transactions, and really hit the mark on user satisfaction.

Reduced Theft and Vandalism: By implementing cashless vending, property managers can cut down on theft and vandalism risks that come with handling cash. It’s a win-win!

Operational Efficiency: Cashless vending results in less time spent on collecting and counting cash. This frees up property managers to focus on other important tasks. Plus, with real-time sales data, managing inventory and planning operations becomes a breeze. And swapping out bill acceptors for card transactions means fewer service visits, which can really lower operating costs.

Real-Time Data Insights: Many cashless systems come with analytics tools that help property managers keep an eye on sales trends, inventory levels, and customer preferences. This info is gold for making smart decisions.

Improved Tenant Satisfaction: Offering modern payment options not only makes tenants happier but also attracts potential renters. In a market where digital transactions are becoming the norm, properties that provide cashless vending really stand out.

Overall, adding digital vending solutions can shake up property management for the better, boosting revenue and enhancing tenant experiences. As Don Apgar, Director of the Merchant Payments Practice at Javelin Strategy & Research, puts it, "Transitioning away from cash at these types of locations is the logical extension of card acceptance." It’s clear that the industry is moving towards cashless solutions, and that’s something worth considering.

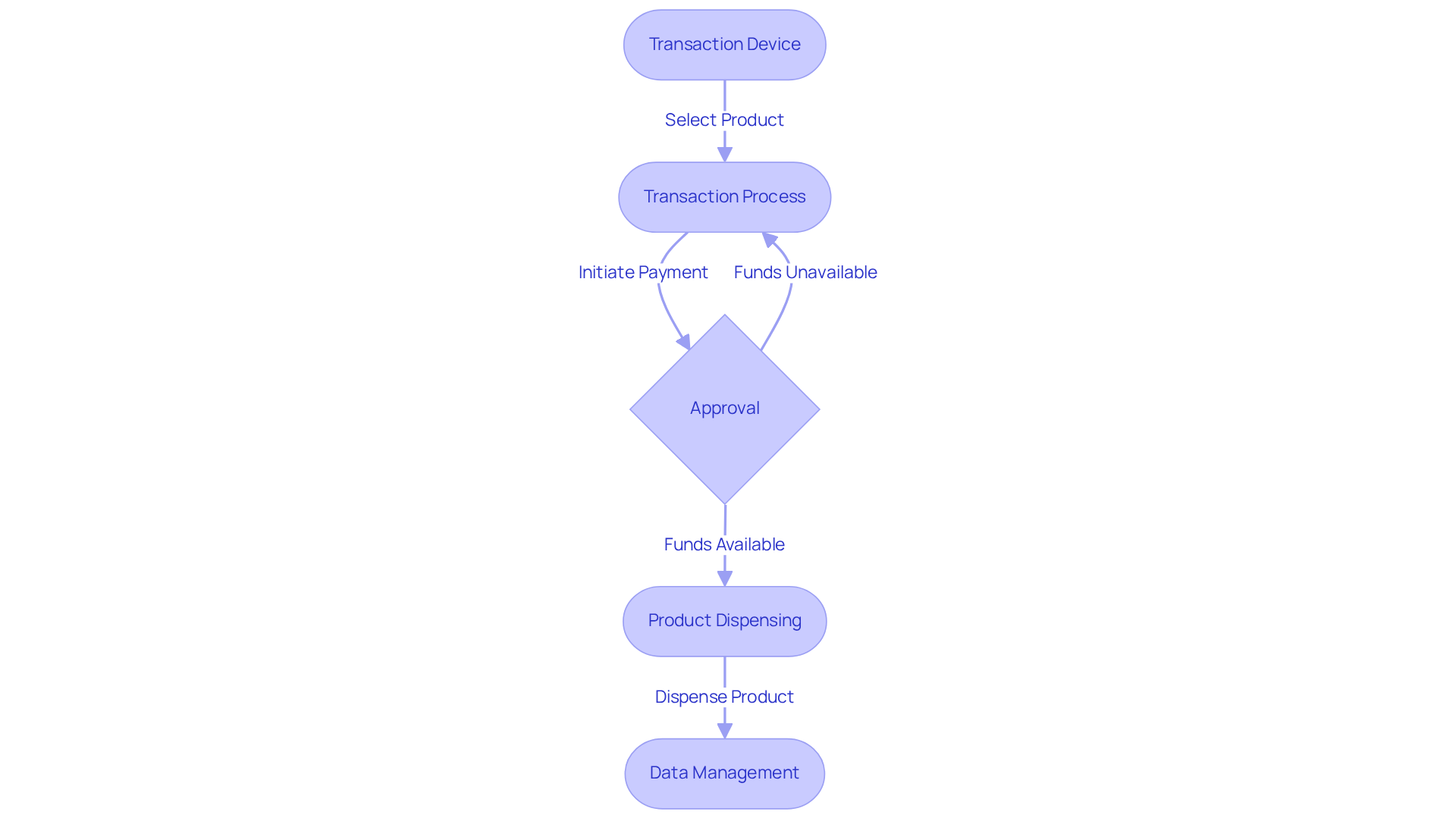

Understand How Cashless Payment Systems Operate in Vending Machines

Cashless vending systems in automated dispensers depend on a combination of hardware and software to facilitate smooth and easy exchanges. Let’s break it down:

- Transaction Device: At the core of a card-operated vending machine is the transaction device. It’s designed to accept various electronic payment methods. With card readers and Near Field Communication (NFC) technology, cashless vending allows for , which are becoming super popular—over 75% of sales in cashless vending now!

- Transaction Process: When you pick a product and start the payment, the terminal chats with a payment processor. This means sending encrypted data to confirm the transaction, keeping everything secure and efficient. Property managers should make sure all exchanges happen through secure platforms like Vending Village. This way, communication and financial transfers are protected, and keeping everything within the platform chat helps maintain records and resolve any disputes.

- Approval: The transaction processor checks if there are enough funds in the customer’s account and sends an authorization back to the vending machine. This quick verification is key—processing times for cashless vending are much faster than traditional methods. It’s also important for property managers to understand the refund policy in case payment issues pop up.

- Product Dispensing: Once the authorization is successful, the vending machine dispenses the selected item, wrapping up the process. This streamlined approach not only boosts customer satisfaction but also encourages higher spending. Did you know that the average digital transaction is $2.24 compared to $1.78 for cash purchases?

- Data Management: Many systems for cashless vending come with software that tracks sales data, inventory levels, and customer preferences. This info is gold for property managers, helping them optimize operations and enhance service. Plus, swapping out bill acceptors for card transactions cuts down on how often machines need servicing, which can lower operating costs.

Understanding this process gives property managers the know-how to tackle issues effectively and ensure smooth operations, ultimately enhancing the customer experience in retail spaces. As Judith McGuire, senior vice president of global products at payment services, pointed out, "The payments landscape is rapidly evolving, and shifts in how consumers pay are expected." By following best practices for secure transactions—like researching the seller—property managers can create positive buyer experiences and maintain the integrity of their sales operations.

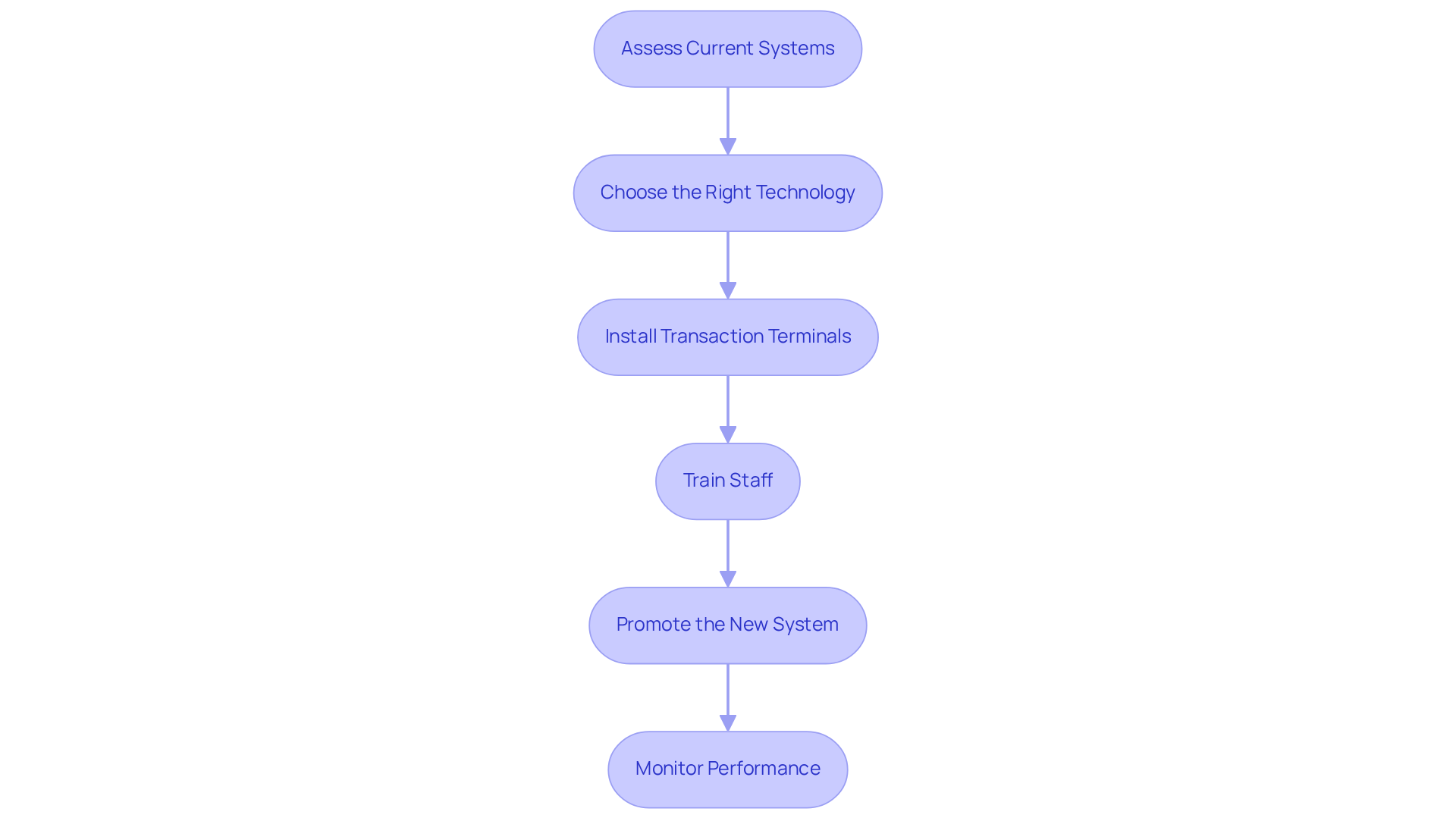

Navigate the Transition to Cashless Vending Solutions

Are you considering a transition to cashless vending solutions? It’s not as daunting as it sounds! Let’s break it down into some key steps that can make your life easier:

- Assess Current Systems: First things first, take a good look at your existing vending machines. Are they ready for electronic transactions? If you’ve got older models, they might need some upgrades or even replacements to keep up with today’s tech.

- Choose the Right Technology: Next, do a bit of research. Pick cashless transaction solutions that fit your property’s needs. Think about processing fees, customer support, and how well they integrate with your current setup. You want everything to .

- Install Transaction Terminals: Now, it’s time to get those transaction terminals set up. Team up with your vendors to ensure a seamless installation on your vending machines. A smooth process here means less downtime and happier customers.

- Train Staff: Don’t forget about your team! Provide them with solid training on how to operate the new systems, troubleshoot common issues, and help customers with digital transactions. This will make the transition easier and boost your customer service.

- Promote the New System: Spread the word about these new digital payment options! Use newsletters, signage, or community meetings to inform your tenants. Good communication is key to encouraging usage and helping everyone adapt.

- Monitor Performance: Once everything is up and running, keep an eye on how your electronic vending machines are performing. Use data analytics to track sales trends and gather customer feedback. This way, you can make any necessary tweaks to optimize operations.

By following these steps, you’ll be well on your way to successfully transitioning to cashless vending solutions. It’s a win-win: not only does this enhance operational efficiency, but it also boosts tenant satisfaction. Plus, let’s not forget about the numbers! Going digital can lead to an average increase of 40 cents per transaction compared to cash payments. Studies even show that average monthly sales can jump by 85% after adopting cashless vending systems. Sounds like a smart investment, right?

Conclusion

Embracing cashless vending solutions is a game changer for property management. It’s all about making things easier and aligning with what today’s consumers want. By adding electronic payment systems, property managers can boost efficiency, cut down on cash handling risks, and ultimately keep tenants happier. This shift isn’t just about convenience; it’s a smart strategy to future-proof property management services.

So, what’s in it for you? The article points out some key perks of cashless vending. You’ll see:

- Increased revenue from higher transaction values

- More convenience for tenants

- Less risk of theft and vandalism

Plus, the real-time data insights can help you make informed decisions, optimize your inventory, and focus on what really matters. Transitioning to cashless systems isn’t just an upgrade; it’s a chance to enhance the tenant experience and stand out in a crowded market.

As consumer behavior keeps leaning towards digital transactions, it’s time for property managers to get proactive about cashless vending solutions. Start by:

- Assessing your current systems

- Picking the right technologies

- Communicating these changes clearly to your tenants

This way, you can smoothly integrate cashless options into your operations. The potential for increased revenue and happier tenants makes this shift not just a good idea, but a must for modern property management.

Frequently Asked Questions

What is cashless vending?

Cashless vending refers to the use of automated machines that allow purchases without cash, accepting electronic payment methods such as credit and debit cards, mobile wallets like Apple Pay and Google Pay, and QR codes.

How do cashless vending machines work?

Cashless vending machines are equipped with technology that connects to financial processors, utilizing secure processing terminals and often relying on Near Field Communication (NFC) for quick, contactless transactions.

What is the expected trend for cashless vending by 2025?

By 2025, it is expected that about 75% of automated dispensers will be equipped for cashless vending, reflecting a shift in consumer habits towards digital transactions.

What factors are driving the shift from cash to digital transactions?

The shift is driven by changing consumer preferences and the need for efficiency in property management.

What is the projected market growth for cashless vending machines?

The market for cashless vending machines is projected to grow at a compound annual growth rate (CAGR) of 12.2% from 2025 to 2033.

What are the benefits of cashless vending in property management?

Cashless vending boosts customer satisfaction, cuts operational costs, and allows property managers to capitalize on the trend towards digital transactions.

How does the average transaction value compare between cash and digital transactions?

The average digital transaction value is $2.24, while cash transactions average $1.78, indicating a financial advantage for digital systems.

What strategies can enhance the profitability of cashless vending?

To maximize profitability, it is important to position automated retail machines in high-traffic areas and offer a variety of products.

List of Sources

- Define Cashless Vending and Its Mechanisms

- Cashless Vending Machine Market Size, Growth, Scope & Forecast Report - 2033 (https://datahorizzonresearch.com/cashless-vending-machine-market-22211)

- Beyond Chips: Unlocking the Future of Vending Machines in 2025 (https://amsvendors.com/beyond-chips-unlocking-the-future-of-vending-machines-in-2025)

- Cashless Payments Are a Boon for Vending Machines (https://paymentsjournal.com/cashless-payments-are-a-boon-for-vending-machines)

- U.S. Retail Vending Machine Market | Industry Report, 2033 (https://grandviewresearch.com/industry-analysis/us-retail-vending-machine-market-report)

- Vending is Dead: Why Digital Payments Just Made Machines More Profitable Than Ever (https://dfyvending.com/digital-payments-vending-profitability)

- Explore the Benefits of Cashless Vending Machines

- cantaloupe.com (https://cantaloupe.com/resource-center/micropayment-trends-report-2025)

- Cashless Payments Are a Boon for Vending Machines (https://paymentsjournal.com/cashless-payments-are-a-boon-for-vending-machines)

- Vending is Dead: Why Digital Payments Just Made Machines More Profitable Than Ever (https://dfyvending.com/digital-payments-vending-profitability)

- Cashless - Retail vending machine market outlook (https://grandviewresearch.com/horizon/statistics/retail-vending-machine-market/payment-mode/cashless/global)

- Cashless Tech Boosting Vending Machine Revenue, Study Finds (https://cutimes.com/2019/05/20/cashless-tech-boosting-vending-maching-revenue-study-finds)

- Understand How Cashless Payment Systems Operate in Vending Machines

- Cashless Payments Are a Boon for Vending Machines (https://paymentsjournal.com/cashless-payments-are-a-boon-for-vending-machines)

- Cashless Economy Statistics 2025: Digital Payment Surge • CoinLaw (https://coinlaw.io/cashless-economy-statistics)

- EMV Payments at Vending Machines Are on the Rise (https://convenience.org/Media/Daily/2023/June/19/EMV-Payments-Vending-Machines-Rise_Payments)

- Cashless in 65% of vending machines - Vending International (https://vendinginternational-online.com/cashless-in-65-of-vending-machines)

- Navigate the Transition to Cashless Vending Solutions

- Cashless Payments Are a Boon for Vending Machines (https://paymentsjournal.com/cashless-payments-are-a-boon-for-vending-machines)

- Getting Into Cashless Vending: A Guide No Matter Your Size (https://vendingmarketwatch.com/technology/article/12300516/getting-into-cashless-vending-a-guide-no-matter-your-size)

- Are Cashless Vending Machines Worth the Investment? (https://dfyvending.com/cashless-vending-machines-investment)

- The Future of Cashless, Electronic Payments in Vending (https://vending.com/blog/go-cashless-go-smart-a-peak-into-the-future-of-cashless-vending)

- The future is cashless: what’s in it for vending machine owners? | VendSoft (https://vendsoft.com/the-future-is-cashless)