Overview

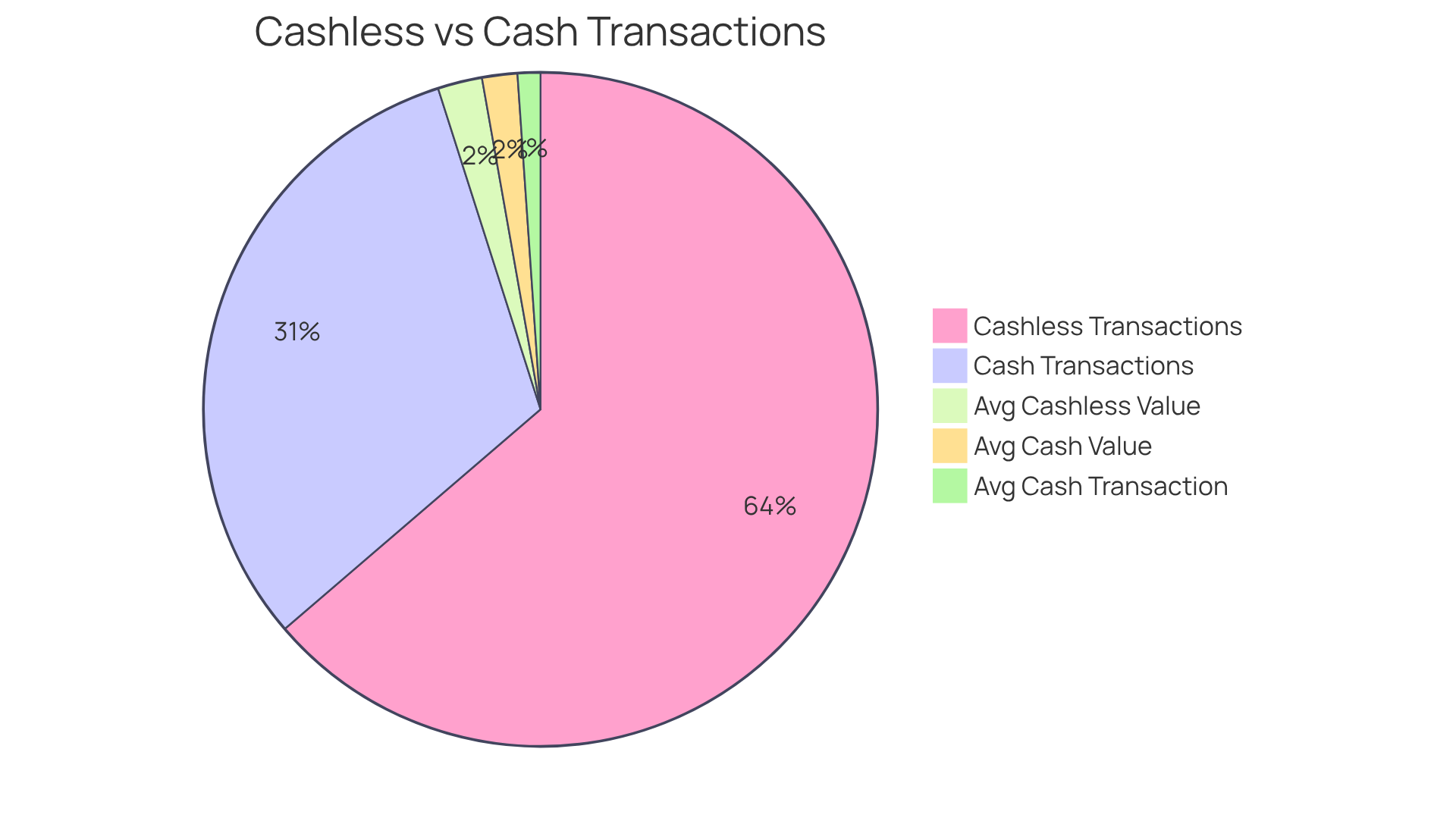

So, let’s talk about credit card vending machines. You know, those handy machines that let customers pay without cash? Setting them up can really make a difference for your business. They can boost your sales and keep your customers happy. Did you know that cashless transactions now account for over 71% of sales in automated dispensers? That’s a clear sign that folks are moving towards digital payments.

Here’s the thing: integrating these machines isn’t just smart; it’s a game-changer. Imagine your customers breezing through their purchases without fumbling for change. It makes the whole experience smoother and more enjoyable for everyone involved.

So, if you’re considering adding credit card vending machines to your setup, go for it! It’s a straightforward way to tap into the growing trend of cashless transactions and keep your business thriving.

Introduction

As digital payment methods become more popular, vending machines are changing to keep up with what consumers want. Credit card vending machines aren't just a nice-to-have; they offer a real chance for business owners to improve customer experience and boost sales. But switching to cashless systems does bring up some important questions about costs, technology, and security.

So, how can operators tackle these challenges while enjoying the perks of this modern payment solution? Let's break it down together.

Define Credit Card Vending Machines and Their Importance

Credit facilities are like those handy systems that let you buy stuff without needing cash—just swipe your card. As more and more people lean towards digital payments, these setups have become essential for business owners. By adding credit options, you can tap into a wider audience, boost your sales, and keep your customers happy. In fact, studies show that cashless payments at automated kiosks have really taken off, with cashless sales making up over 67% of all transactions in 2022. And get this, cashless purchases account for about 25% to 27% of total sales in the workplace market. That just shows how much folks crave convenience these days.

But the perks of credit card dispensers go beyond just being convenient. Operators who embrace these systems often see their profits soar. Cashless payments usually lead to higher sales per transaction compared to cash. For instance, the average cashless transaction was around $2.24, while cash purchases were only about $1.78, and cash transactions averaged $1.15. This trend really emphasizes why investing in credit dispensers is key to staying competitive in today's market.

We’re seeing successful cashless retail solutions popping up in all sorts of shopping spaces, proving they really do enhance customer experiences. As more shoppers opt for the ease of card payments, it’s a smart move for operators to adapt by integrating a credit card vending machine. This not only streamlines operations—like cutting down on service costs and speeding things up during busy times—but also positions you to capitalize on the growing trend of cashless payments. This way, you can meet the . As Jeff Cramer points out, the stats show cashless sales are on the rise, and there are significant profits to be made when sellers use credit and debit readers on their devices.

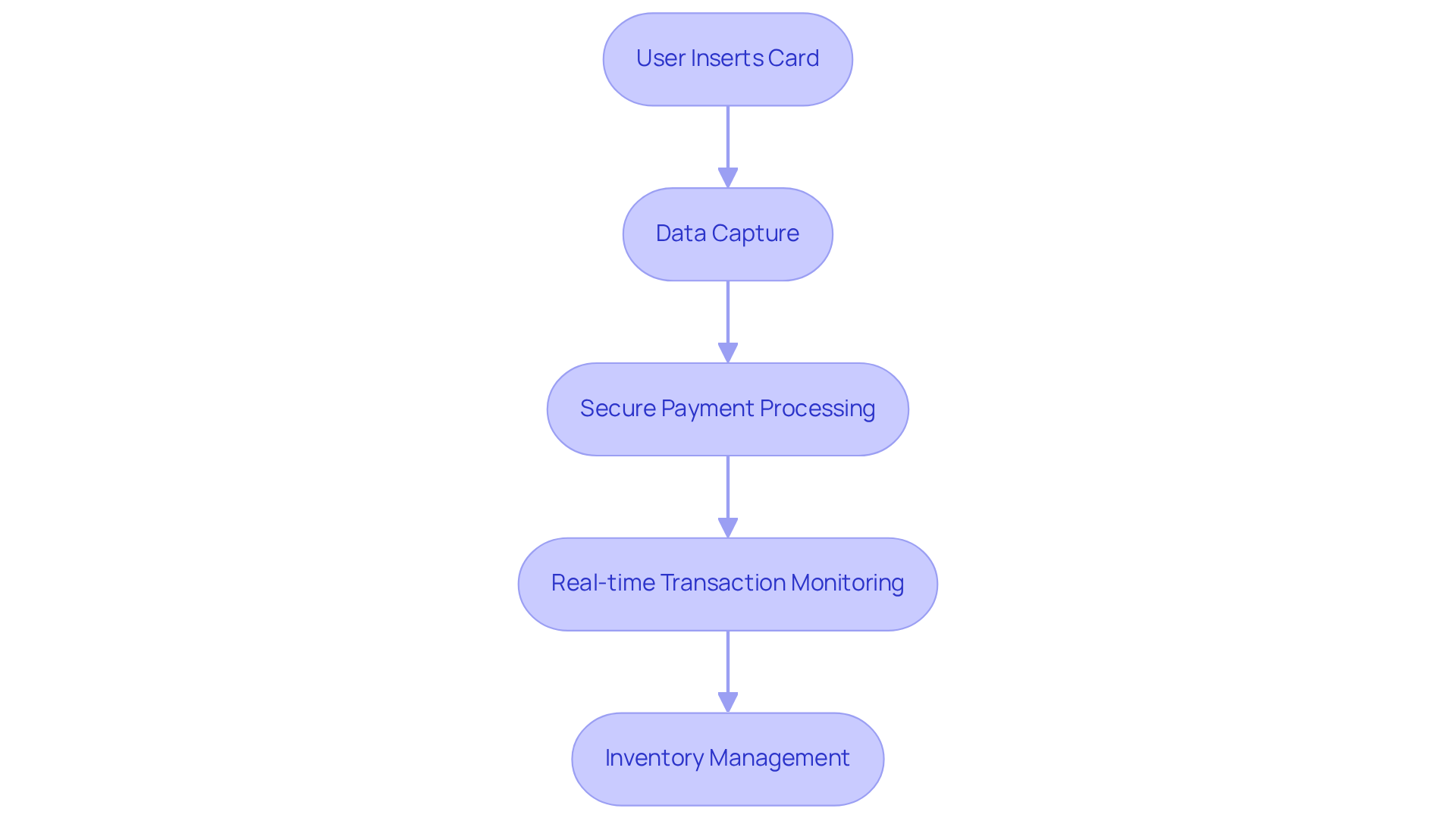

Explain the Technology Behind Credit Card Vending Machines

Have you ever noticed how credit card vending machines are changing the game? They’re using some pretty cool tech to make secure exchanges a breeze, blending hardware and software for top-notch performance. At the heart of it all is the credit card vending machine, which captures your card info when you make a purchase. That data zips over to a secure payment processing system—often linked to platforms like Stripe—to ensure your payments are safe and sound.

These days, many machines come with wireless connectivity, which means they can process transactions and keep an eye on inventory in real-time. This not only makes life easier for customers but also lets operators monitor sales and stock levels from afar, making everything run smoother.

Here’s a stat for you: cashless transactions made up over 75% of sales from machines in 2024. That really shows how much people are leaning towards digital payments. Plus, the use of EMV technology has taken off, with EMV payments at food and beverage kiosks soaring by over 350% as part of cashless sales in 2022. It’s clear that choosing a credit card vending machine with secure payment processing is key to meeting the changing needs of consumers.

Experts in payment processing are saying that the fast-paced evolution of machine technology is all about what consumers want—speed and security. Judith McGuire from Discover put it well: "It’s no secret the payments landscape is rapidly evolving, and shifts in how consumers pay are expected." This really highlights why operators should invest in modern automated solutions that focus on secure and .

Guide to Installing a Credit Card Reader on Your Vending Machine

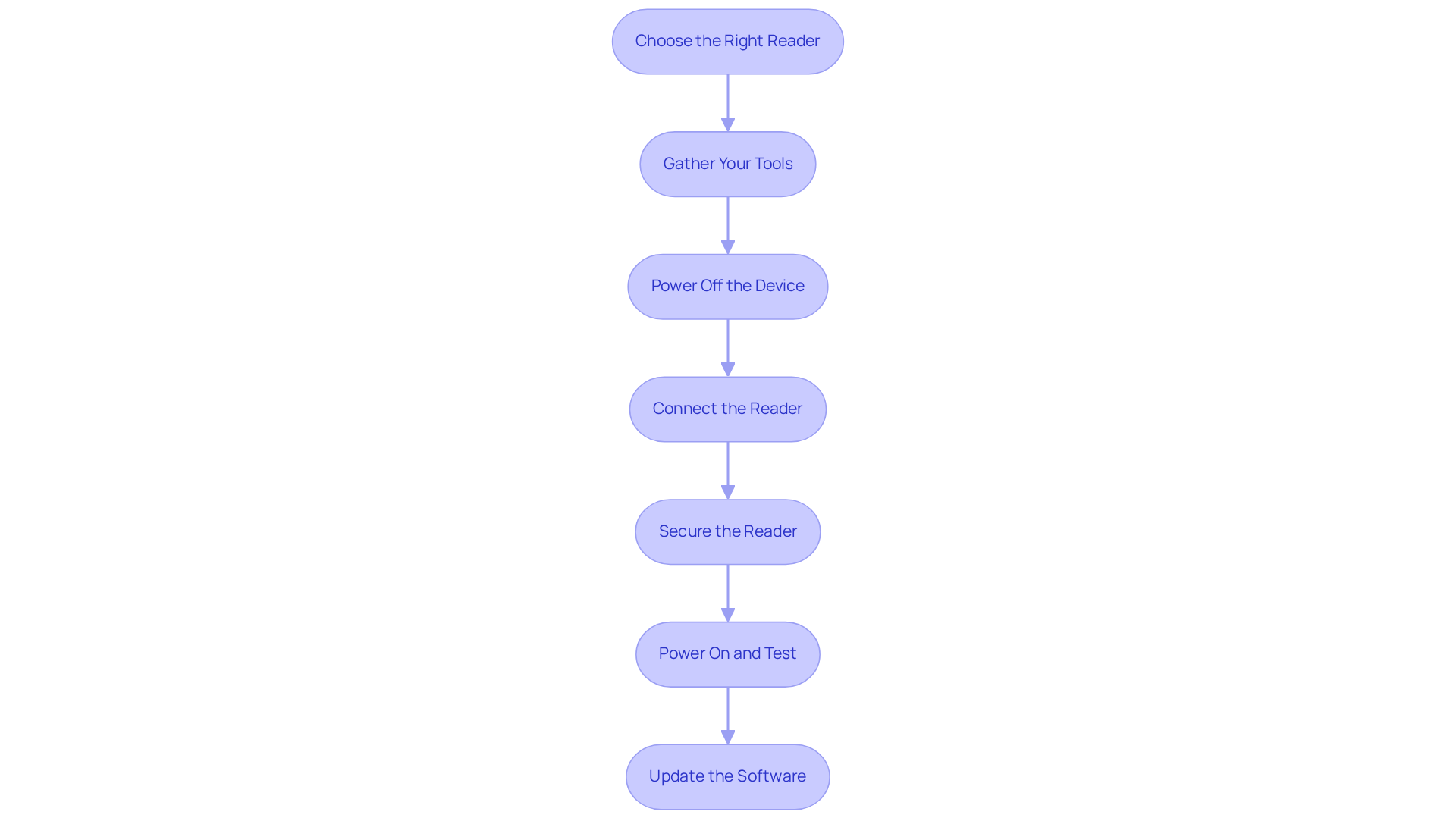

Setting up a credit reader on your automated retail unit is easier than you might think, and it can really boost your sales while making things smoother for your customers. Let’s walk through this step-by-step so you can get it done right.

- Choose the right reader. You’ll want a credit reader that works with your specific dispensing unit model. Some popular choices are the Canteloupe ePort G11 and Nayax VPOS Touch — both are reliable options.

- Gather your tools. Grab a screwdriver and any cables you might need to make the installation process a breeze.

- Power off the device. This is super important to avoid any electrical issues while you’re working.

- Connect the reader. Follow the manufacturer’s guidelines closely to link the credit reader to the mainboard of your dispenser. This step is key for making sure everything .

- Secure the reader. Use screws or adhesive to hold it firmly in place, ensuring it’s easy for customers to access.

- Power on and test. Turn the device back on and run a test operation to check that the reader works. This is crucial because credit payments can increase average sales from automated dispensers by 30% compared to cash sales, with cash sales averaging $1.15 and cashless payments averaging $1.49.

- Update the software if needed. Make sure the system’s software is compatible with the new reader — you might need to download updates from the manufacturer’s website.

By following these steps, you’ll be all set to improve your kiosk’s functionality and tap into the growing trend of cashless payments, which currently account for 25% to 27% of total sales in the workplace market. Just keep in mind some common issues like connectivity challenges or software compatibility, and think about which payment reader fits your machine goals best to ensure a smooth installation.

Discuss the Benefits of Cashless Transactions for Vending Operators

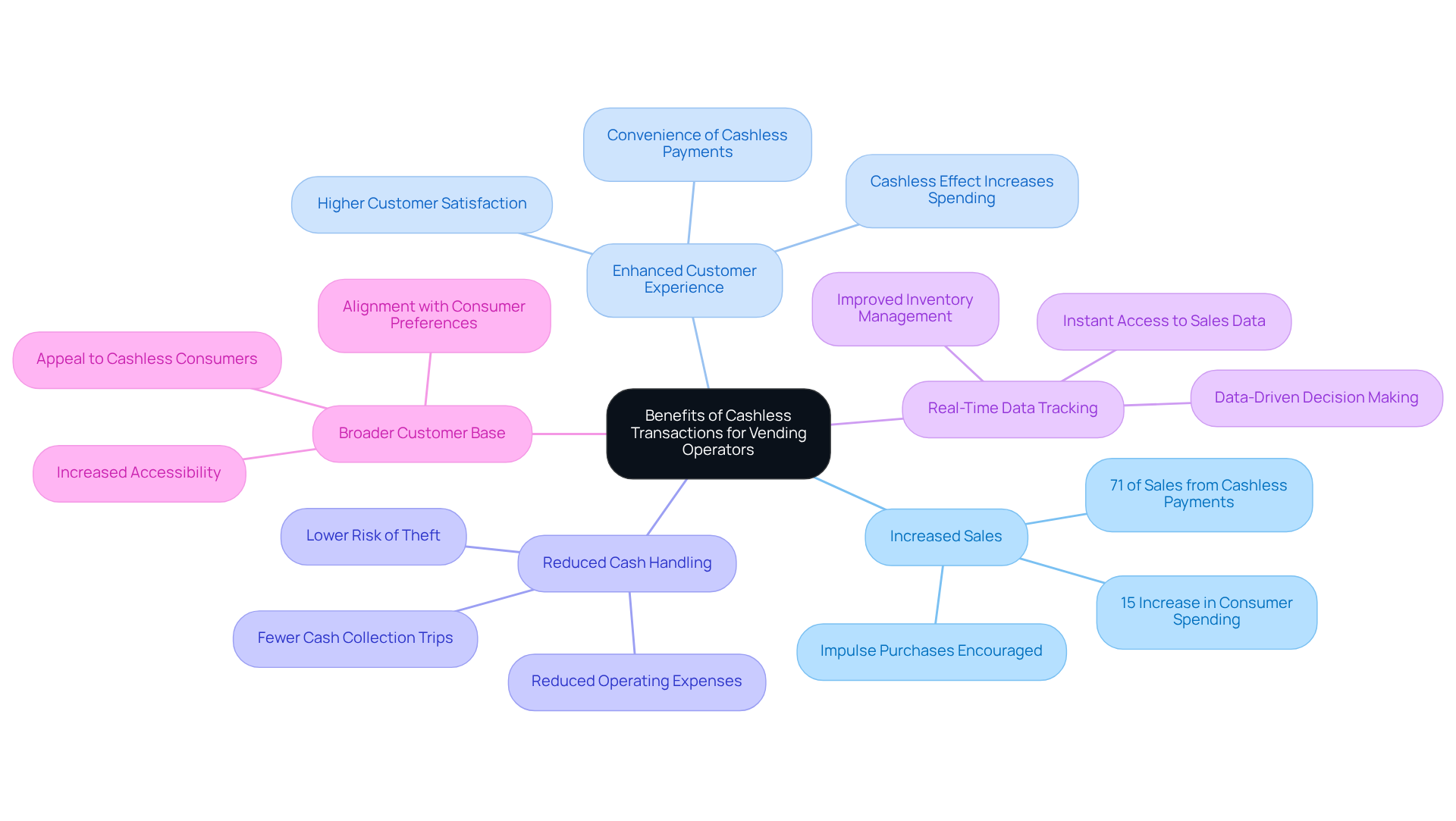

Transitioning to cashless transactions can really transform the game for vending operators.

First off, let’s talk about increased sales. Research shows that sales see a big boost in machines like the credit card vending machine. Last year, cashless payments made up 71% of all sales from automated dispensers—up 17% from 2023! When cash isn’t a barrier, customers are more likely to make those , which means more revenue for you.

Now, think about the enhanced customer experience. Cashless payment options make things super convenient, and that leads to happier customers. There’s this thing called the 'cashless effect' where people tend to spend more when they’re not using cash. Happier customers mean loyalty and repeat business, which is what we all want, right?

And let’s not forget about reduced cash handling. By going cashless, you can cut down on the risks and costs tied to managing cash. This means less worry about theft and fewer trips for cash collection, saving you time and money.

Another perk? Real-time data tracking. Many cashless systems come with cool analytics tools that let you keep an eye on sales trends and inventory levels right away. Having instant access to this data helps you make smart decisions and run your operations more efficiently.

Finally, think about reaching a broader customer base. Accepting payment through a credit card vending machine opens the door to more customers, especially those who prefer cashless transactions for safety, convenience, and hygiene. This shift not only brings in new faces but also aligns with what today’s consumers are looking for.

These benefits make a strong case for operators to invest in credit transaction devices. It’s all about positioning yourself for growth in a world that’s moving towards cashless solutions.

Identify Challenges and Considerations in Transitioning to Credit Card Vending

Transitioning to credit card vending machines can be very beneficial, although operators need to navigate a few bumps in the road.

First up, let’s talk about initial costs. You’re looking at an that typically runs between $300 and $450, plus monthly service fees averaging around $8.99. That’s a decent chunk of change right out of the gate, so careful budgeting is key to keeping your finances in check.

Now, onto technical issues. Installation or operational hiccups can happen, and they can throw a wrench in your service. It’s super important to have ongoing support and maintenance lined up to tackle these challenges. You want to resolve any issues quickly to keep downtime to a minimum.

Then there's customer adaptation. Some folks might be a bit hesitant to ditch cash for cards. It’s a good idea to keep your clients in the loop about the benefits and safety of cashless payments. Research shows that cashless options can boost average transaction values by 30%—we’re talking about $1.49 on average compared to $1.15 for cash payments.

Next, let’s consider processing fees. Credit card transactions often come with processing charges, which can be a mix of a fixed cost and a percentage of sales. If these aren’t managed well, they can eat into your profit margins. So, it’s crucial to factor these fees into your pricing strategy. Vending Village partners with Stripe to ensure secure transactions, which helps ease concerns about fees and builds user confidence.

Finally, there are security concerns. Protecting customer data and preventing fraud should be a top priority. Vending Village uses advanced security measures, like SSL technology for data encryption and regular security audits, to keep every transaction safe. Operators need to invest in secure payment solutions to build trust with users. Plus, Vending Village’s ID verification process through Stripe helps confirm user identities, which further reduces fraud risk.

By recognizing these challenges and tapping into Vending Village’s strong security measures, operators can come up with smart strategies to mitigate risks. This way, you can smoothly transition to credit card vending, boost your operational efficiency, and keep your customers happy.

Conclusion

You know, embracing credit card vending machines is a big deal in the vending industry. It really aligns with what consumers want these days—cashless transactions. These machines not only make things easier for customers but also ramp up sales potential for operators. By adding credit card readers, businesses can reach a wider audience, streamline their operations, and ultimately boost profitability.

So, throughout the article, we’ve talked about some key insights. We explored the tech behind these machines, how easy they are to install, and all the benefits that come with going cashless. The data shows that cashless payments can lead to higher average transaction values and even improve customer satisfaction and loyalty. But hey, I get it—there are challenges too, like initial costs and security concerns. The good news is that with the right planning and support, these challenges can be managed effectively.

Here’s the thing: switching to credit card vending machines isn’t just an upgrade; it’s a smart move for future-proofing your business in a cashless world. Operators should seriously consider investing in this technology to enhance customer experiences, boost sales, and stay competitive in the ever-evolving marketplace. By doing this, you’re not just meeting today’s consumer demands; you’re setting yourself up for sustained growth and success in the vending industry.

Frequently Asked Questions

What are credit card vending machines and why are they important?

Credit card vending machines are systems that allow customers to make purchases using credit or debit cards instead of cash. They are important because they cater to the growing trend of digital payments, helping business owners reach a wider audience, increase sales, and enhance customer satisfaction. In 2022, cashless payments accounted for over 67% of all transactions at automated kiosks.

How do cashless transactions compare to cash transactions in terms of sales?

Cashless transactions generally result in higher sales per transaction compared to cash. The average cashless transaction was about $2.24, while cash purchases averaged $1.78, and cash transactions were around $1.15. This trend indicates the financial benefits of investing in credit dispensers.

What benefits do credit card vending machines provide to operators?

Credit card vending machines streamline operations by reducing service costs and speeding up transactions, especially during busy times. They also allow operators to capitalize on the growing trend of cashless payments, ultimately enhancing the customer experience and increasing profitability.

What technology is used in credit card vending machines?

Credit card vending machines utilize a combination of hardware and software to facilitate secure transactions. They capture card information during purchases, which is processed through secure payment systems, often linked to platforms like Stripe. Many machines also feature wireless connectivity for real-time transaction processing and inventory monitoring.

What is the current trend in cashless transactions?

Cashless transactions have become increasingly popular, making up over 75% of sales from vending machines in 2024. The use of EMV technology, which enhances payment security, has also surged, with EMV payments at food and beverage kiosks increasing by over 350% in 2022.

Why is investing in modern credit card vending machines important for operators?

Investing in modern credit card vending machines is crucial for operators to meet the evolving demands of consumers for speed and security in payment methods. As the payments landscape continues to change, operators who embrace these advancements can enhance their service and profitability.

List of Sources

- Define Credit Card Vending Machines and Their Importance

- Cashless Payments Are a Boon for Vending Machines (https://paymentsjournal.com/cashless-payments-are-a-boon-for-vending-machines)

- Should I Consider a Credit Card Reader Vending Machine? | Vending How (https://vendinghow.com/article/should-i-consider-a-credit-card-reader-vending-machine)

- Vending Machine Statistics in 2023 - Vending Locator (https://vendinglocator.com/blog/vending-machine-statistics)

- EMV Payments at Vending Machines Are on the Rise (https://convenience.org/Media/Daily/2023/June/19/EMV-Payments-Vending-Machines-Rise_Payments)

- The Future of Cashless, Electronic Payments in Vending (https://vending.com/blog/go-cashless-go-smart-a-peak-into-the-future-of-cashless-vending)

- Explain the Technology Behind Credit Card Vending Machines

- The Future of Cashless, Electronic Payments in Vending (https://vending.com/blog/go-cashless-go-smart-a-peak-into-the-future-of-cashless-vending)

- Top Vending Machine Trends for 2025: What’s Next for Retail (https://widermatrix.com/vending-machine-trends-for-2025)

- EMV Payments at Vending Machines Are on the Rise (https://convenience.org/Media/Daily/2023/June/19/EMV-Payments-Vending-Machines-Rise_Payments)

- What Payment Trends Are Shaping the Vending Industry in 2025? (https://vending-machines.ie/what-payment-trends-are-shaping-the-vending-industry-in-2025)

- How the Card Vending Machine Is Powering Smart Retail Automation - Restaurant Marketing & Tech (https://primidigital.com/card-vending-machine-and-smart-retail-automation)

- Guide to Installing a Credit Card Reader on Your Vending Machine

- customvending.com (https://customvending.com/comparing-credit-card-readers-for-your-vending-machine)

- The Complete Guide to Vending Machine with Card Reader (https://linkitsoft.com/vending-machine-with-a-card-reader)

- Should I Consider a Credit Card Reader Vending Machine? | Vending How (https://vendinghow.com/article/should-i-consider-a-credit-card-reader-vending-machine)

- Cashless Tech Boosting Vending Machine Revenue, Study Finds (https://cutimes.com/2019/05/20/cashless-tech-boosting-vending-maching-revenue-study-finds)

- Discuss the Benefits of Cashless Transactions for Vending Operators

- The Cashless Vending Data Report: How Payment Methods Impact Purchase Behavior (https://dfyvending.com/cashless-vending-payments)

- The Future of Cashless, Electronic Payments in Vending (https://vending.com/blog/go-cashless-go-smart-a-peak-into-the-future-of-cashless-vending)

- Cashless Payments Are a Boon for Vending Machines (https://paymentsjournal.com/cashless-payments-are-a-boon-for-vending-machines)

- Five Reasons Your Vending Business Should Accept Cashless Payments | Cantaloupe (https://cantaloupe.com/articles/five-reasons-your-vending-business-should-accept-cashless-payments)

- Identify Challenges and Considerations in Transitioning to Credit Card Vending

- Vending Machine Cost Breakdown: Features, Models, and ROI Analysis (https://blog.cloudpick.ai/vending-machine-cost-breakdown-roi-analysis)

- Vending Machine Statistics in 2023 - Vending Locator (https://vendinglocator.com/blog/vending-machine-statistics)

- dfyvending.com (https://dfyvending.com/vending-machine-industry-challenges)

- Credit Card Options Increase for Vending Operators (https://vendingmarketwatch.com/technology/article/10273240/credit-card-options-increase-for-vending-operators)

- Should I Consider a Credit Card Reader Vending Machine? | Vending How (https://vendinghow.com/article/should-i-consider-a-credit-card-reader-vending-machine)