Introduction

Starting a vending machine business can be pretty exciting, right? But let’s be real — figuring out the legal and financial stuff can feel like a maze. That’s where forming a Limited Liability Company (LLC) comes in. Not only does it protect your personal assets, but it also offers some sweet tax benefits and boosts your credibility in a crowded market.

You might be asking yourself: what are the actual steps to set up an LLC, and how does it really help your vending operations? Here’s the thing: this guide is here to break it all down for you. We’ll walk through the process together, giving you a clear path to establishing an LLC that sets your business up for long-term success.

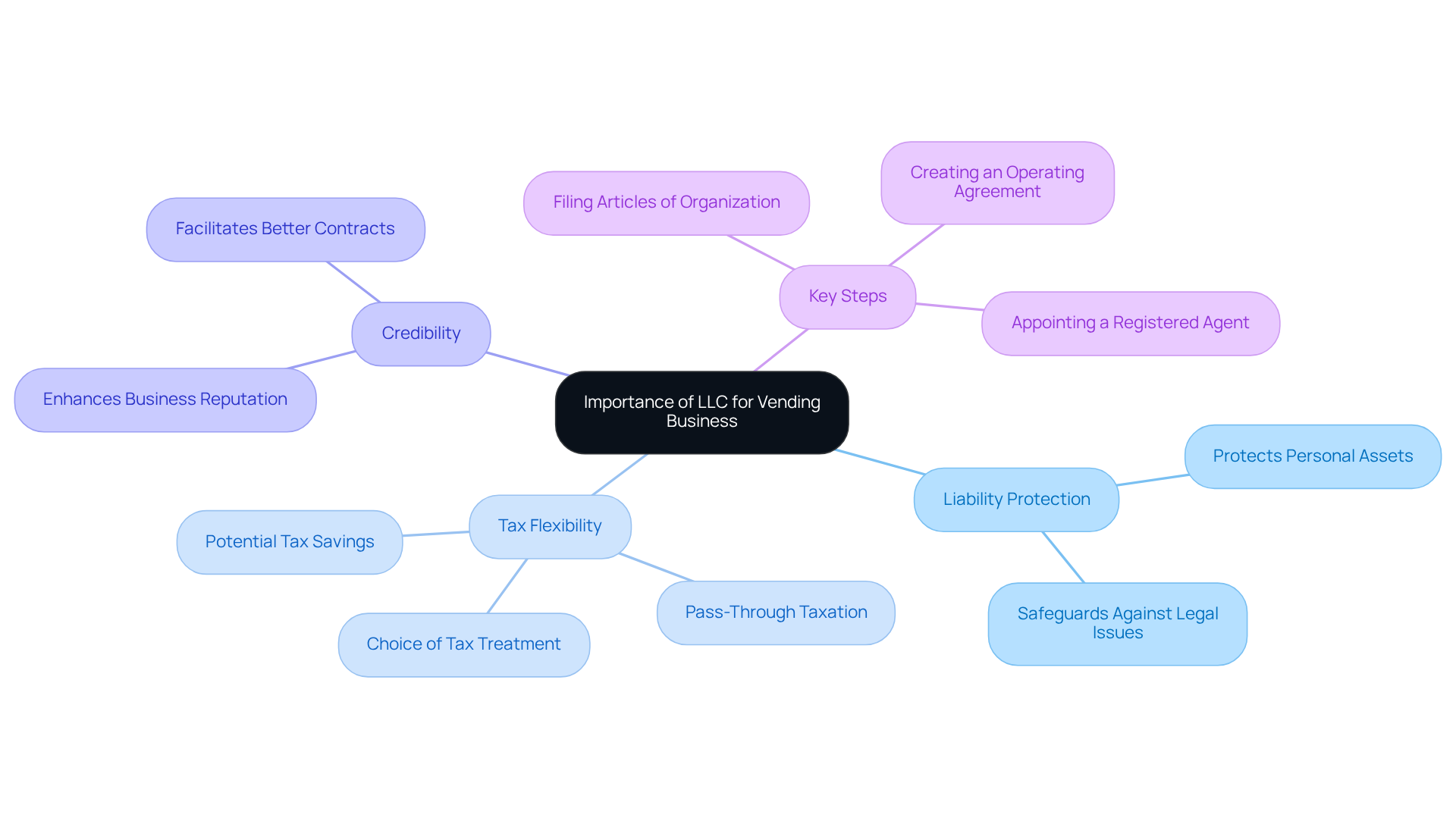

Understand the Importance of an LLC for Your Vending Business

[Starting an LLC](https://blog.vendingvillage.com/how-much-does-it-cost-to-buy-a-vending-machine-key-factors-explained) for vending machine business is a smart move if you're diving into that industry. Why? Well, an LLC gives you , keeping your personal assets safe from debts and legal issues. This is super important in an industry that can face contract disputes and challenges with machine placements. For example, if a vending operator gets sued over a faulty machine, they can feel secure knowing their finances are protected thanks to the LLC structure.

But there’s more! LLCs also offer tax flexibility. You get to choose how you want to be taxed—whether as a sole proprietor, partnership, or corporation. This can lead to some serious tax savings since LLC members enjoy pass-through taxation, which helps you dodge that pesky double taxation that often comes with corporations. According to the Small Business Administration, "LLCs enable owners to determine their tax status which simplifies financial management systems." Plus, did you know that over 73% of U.S. small businesses opt for an LLC? They love it for its cost-effectiveness, ease, and protection of personal assets.

Now, let’s talk credibility. Forming an LLC can boost your business’s reputation with potential clients and partners, making it easier to snag prime vending spots and negotiate better contracts. In a competitive market, having that professional credibility can really set you apart. Just keep in mind that starting an LLC means filing Articles of Organization and appointing a Registered Agent—these are key steps you can’t skip. Also, be aware that maintaining an LLC can cost between $100 to $800 each year, which is something to factor in if you’re thinking about starting your own venture.

Overall, understanding these benefits is essential for laying a solid foundation for your operation of an LLC for vending machine. It’s all about positioning yourself for long-term success. So, if you’re ready to take the plunge, forming an LLC could be your best bet!

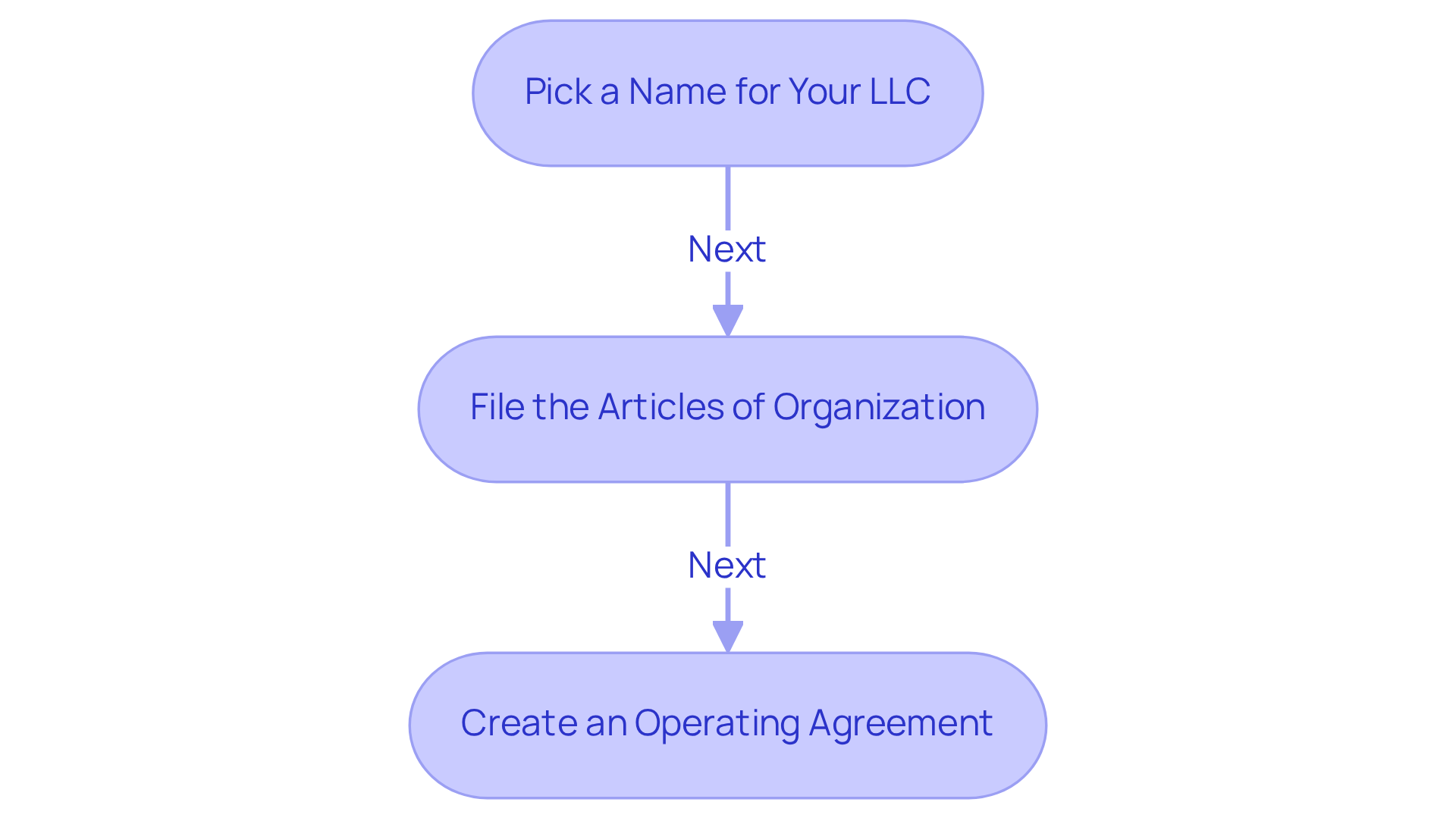

Follow the Steps to Form Your LLC

Starting your LLC? Let’s break it down into three simple steps that’ll make the process a breeze:

- First up, pick a name for your LLC. You want something unique that follows your local naming rules. A quick check on your region’s business registry will tell you if it’s available. And don’t forget to include 'LLC' in the name to show its legal standing.

- Next, you’ll need to . This is the official document that sets up your LLC. Most folks file online through their Secretary of State’s website. The filing fee varies quite a bit — for instance, it’s $150 in Illinois but only $40 in Kentucky. New York charges $205, while Mississippi is at $53. Just make sure to include all the necessary details like your LLC name, address, and member names. By the way, as of 2025, the average cost to form an LLC in the U.S. is $132, so keep that in mind for budgeting.

- Finally, consider creating an Operating Agreement. While it’s not always required, it’s super helpful for outlining how your LLC will be managed and how things will run. This document clarifies who does what, which can help avoid any future disputes. It’s a good idea to consult a legal pro to draft this, ensuring everything’s up to code. And if you’re thinking about operating in multiple states, remember that failing to register a Foreign LLC in Massachusetts can hit you with a $500 penalty each year.

So, ready to get started? You’ve got this!

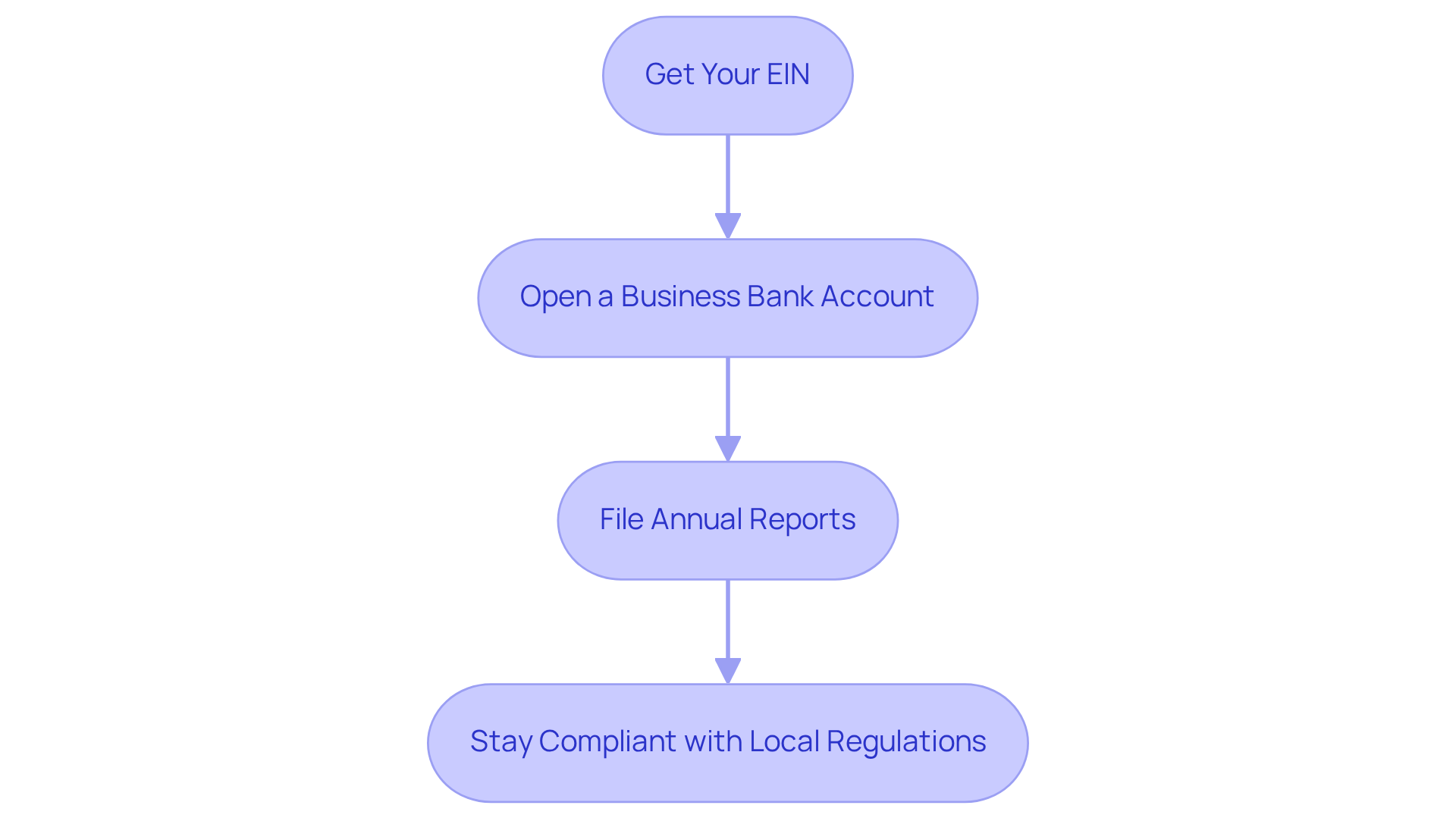

Complete Post-Formation Requirements for Your LLC

Once you’ve got your LLC set up, there are a few important things you need to tackle:

- Get Your EIN: First off, you’ll want to grab an Employer Identification Number (EIN). It’s a must for tax purposes and you’ll need it if you plan on hiring employees or buying another business. You can on the IRS website, and guess what? It’s totally free! It’s best to do this sooner rather than later because it makes tax reporting easier and helps keep you compliant as your business grows. Most businesses need an EIN once they’re incorporated.

- Open a Business Bank Account: To keep your LLC’s liability protection intact, you’ve got to separate your personal and business finances. Did you know that about 96% of small business owners have a bank account? And over half of them stick to just one bank! Keeping your finances separate is key for managing your LLC for vending machine operations. Use your EIN and LLC formation documents to set up a dedicated business bank account. This way, your business transactions won’t mix with your personal expenses.

- File Annual Reports: Many states require LLCs to file annual reports to stay in good standing. Make sure to check what your state needs regarding deadlines and fees. If you miss the deadline, you could face penalties or even risk losing your LLC.

- Stay Compliant with Local Regulations: Depending on where your vending machines are located, you might need specific permits or licenses. Take some time to research local regulations to ensure you’re following all the necessary legal requirements for establishing an LLC for vending machine operations. This diligence not only protects your investment but also boosts your credibility in the market.

So, what’s the next step? Dive into these tasks and set your LLC up for success!

Conclusion

Starting an LLC for your vending machine business isn’t just a smart move; it’s a crucial step for making sure your venture lasts and stays secure. When you set up an LLC, you get important protections against personal liability, enjoy tax benefits, and boost your credibility. These are key elements for navigating the vending industry, where legal issues and financial management can really throw you off your game.

So, let’s break it down. There are three essential steps to forming your LLC:

- Pick a unique name

- File the Articles of Organization

- Create an Operating Agreement

And don’t forget about the post-formation tasks! You’ll want to get an EIN, open a dedicated business bank account, and stay compliant with local regulations. Each of these steps helps solidify your business structure and streamline your operations, setting your vending machine business up for success.

In short, forming an LLC is a game-changer if you want to thrive in the vending machine industry. By following the necessary steps and sticking to compliance requirements, you can protect your personal assets and boost your business’s credibility and efficiency. So, embrace this opportunity to lay a solid foundation for your venture. Take that first step toward a successful and secure future in the vending business!

Frequently Asked Questions

Why is starting an LLC important for a vending machine business?

Starting an LLC is important for a vending machine business because it provides liability protection, safeguarding personal assets from debts and legal issues that may arise in the industry.

How does an LLC protect personal assets?

An LLC protects personal assets by ensuring that, in case of legal disputes or debts related to the business, the owner's personal finances are shielded from being affected.

What tax advantages do LLCs offer?

LLCs offer tax flexibility, allowing owners to choose their tax status as a sole proprietor, partnership, or corporation. This can lead to tax savings through pass-through taxation, avoiding the double taxation often associated with corporations.

What percentage of U.S. small businesses opt for an LLC?

Over 73% of U.S. small businesses opt for an LLC due to its cost-effectiveness, ease of formation, and protection of personal assets.

How can forming an LLC enhance a vending business's credibility?

Forming an LLC can enhance a vending business's credibility with potential clients and partners, making it easier to secure prime vending locations and negotiate better contracts in a competitive market.

What are the key steps to starting an LLC?

The key steps to starting an LLC include filing Articles of Organization and appointing a Registered Agent.

What are the ongoing costs associated with maintaining an LLC?

Maintaining an LLC can cost between $100 to $800 each year, which is an important factor to consider when starting your own venture.

How does forming an LLC contribute to long-term success in a vending business?

Forming an LLC contributes to long-term success by providing legal protection, tax benefits, and enhanced credibility, all of which position the business favorably in the market.

List of Sources

- Understand the Importance of an LLC for Your Vending Business

- Pros and Cons of LLC for Small Business in 2025 - BusinessRocket (https://businessrocket.com/business-corner/start/llc/small-business-benefits)

- bizreport.com (https://bizreport.com/llc-for-vending-machine)

- dfyvending.com (https://dfyvending.com/llc-vending-machine-benefits)

- Vending Machine Statistics in 2023 - Vending Locator (https://vendinglocator.com/blog/vending-machine-statistics)

- How to start a profitable vending machine business | VendSoft (https://vendsoft.com/vending-machine-business-guide)

- Follow the Steps to Form Your LLC

- LLC Annual Fees by State - All 50 States (2025 Costs) (https://llcuniversity.com/llc-annual-fees-by-state)

- stripe.com (https://stripe.com/resources/more/business-formation-fees-in-the-us-a-guide-costs-in-each-state)

- zenbusiness.com (https://zenbusiness.com/state-fees)

- LLC cost by state - How much does an LLC cost? 2025 | LLCU® (https://llcuniversity.com/llc-filing-fees-by-state)

- commenda.io (https://commenda.io/blog/llc-filing-fees-by-state)

- Complete Post-Formation Requirements for Your LLC

- Small Business Statistics In 2025 | Bankrate (https://bankrate.com/loans/small-business/small-business-statistics)

- taxjar.com (https://taxjar.com/blog/3-benefits-of-having-an-ein)

- nerdwallet.com (https://nerdwallet.com/article/small-business/benefits-of-getting-an-ein)

- nerdwallet.com (https://nerdwallet.com/article/small-business/small-business-statistics)

- stripe.com (https://stripe.com/resources/more/the-benefits-of-having-an-ein-for-your-business)