Overview

Have you ever thought about how those vending machines could boost your sales? Well, if you're considering adding card readers for cashless payments, it’s super important to understand the fees that come with them. Monthly service fees, transaction costs, and maintenance charges can really add up.

Here’s the thing: knowing these fees helps you figure out if going cashless is worth it for your business. It’s not just about convenience; it can actually enhance customer satisfaction and drive sales in today’s fast-paced market.

So, take a moment to evaluate these costs. You want to ensure that integrating these systems aligns with your goals. It’s all about making informed decisions that can lead to a happier customer base and a healthier bottom line.

Introduction

Have you ever noticed how vending machines have really changed over the years? They’ve evolved into these modern retail solutions that fit right into our cashless society. But here’s the catch: this shift comes with a tangled mess of fees tied to card readers.

For vending operators, figuring out these card reader fees isn’t just about keeping costs in check; it’s a chance to boost customer experience and ramp up sales. But with so many moving parts—like monthly service charges and transaction fees—how do you navigate this financial maze?

Let’s break it down. Understanding these costs can help you not only stay profitable but also embrace the future of vending. So, what’s your next move?

Explore the Basics of Vending Machine Card Readers

Vending machines have come a long way, right? Nowadays, they’re not just about cash; they also focus on cashless transactions with credit and debit options, which may involve vending machine card reader fees. This shift has opened up a world of payment methods, like contactless options and mobile wallets. For vending operators, this means a chance to really enhance what they offer. Understanding how these systems work, especially the , is key to boosting sales and keeping customers happy.

Key Features of Card Readers:

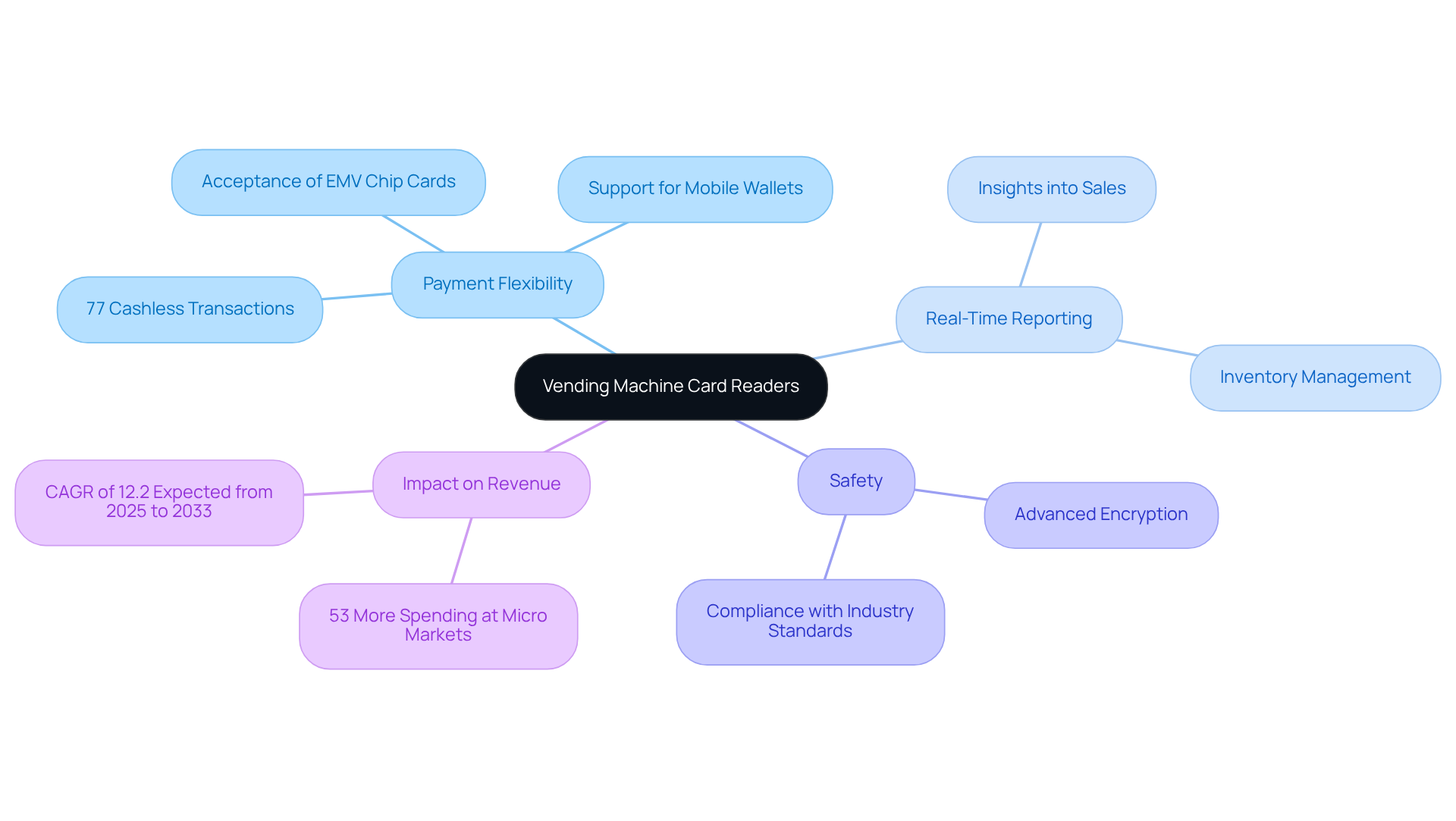

- Payment Flexibility: Modern card readers are pretty versatile. They accept various payment types, including EMV chip cards and mobile wallets, which is perfect for the growing number of folks who prefer cashless transactions.

- Real-Time Reporting: These devices don’t just take payments; they also give operators valuable insights into sales and inventory. This means better management of vending machines and smarter decision-making.

- Safety: Security is a big deal. Card readers ensure safe transactions and, despite vending machine card reader fees, provide advanced encryption and compliance with industry standards, protecting both operators and customers.

Now, here’s the thing: integrating cashless systems has significantly impacted vending operators, particularly in relation to vending machine card reader fees. In fact, by 2024, 77% of vending activities were cashless, showing a major shift in how consumers behave. And this trend isn’t slowing down; the cashless vending machine market is expected to grow at a CAGR of 12.2% from 2025 to 2033. By embracing these technologies, operators can not only make things easier for customers but also reach a wider audience, which means more sales.

Successful cashless systems that incorporate vending machine card reader fees have proven to boost revenue. Take micro markets, for example. They mainly use cashless transactions and reported that consumers spent 53% more per transaction compared to traditional vending machines. That’s a clear sign that adopting these advanced payment solutions can lead to bigger ticket sizes and better profits.

Industry leaders are all on board with the idea that advancing vending machine payment devices is crucial for the future of self-service retail. As the market continues to evolve, it’s a smart move for operators to invest in these technologies to stay competitive and meet modern consumer demands.

Analyze Common Fees for Vending Machine Card Readers

When you’re thinking about integrating card readers into your vending machines, it’s important to consider the vending machine card reader fees that you’ll need to keep in mind. These can really impact your bottom line.

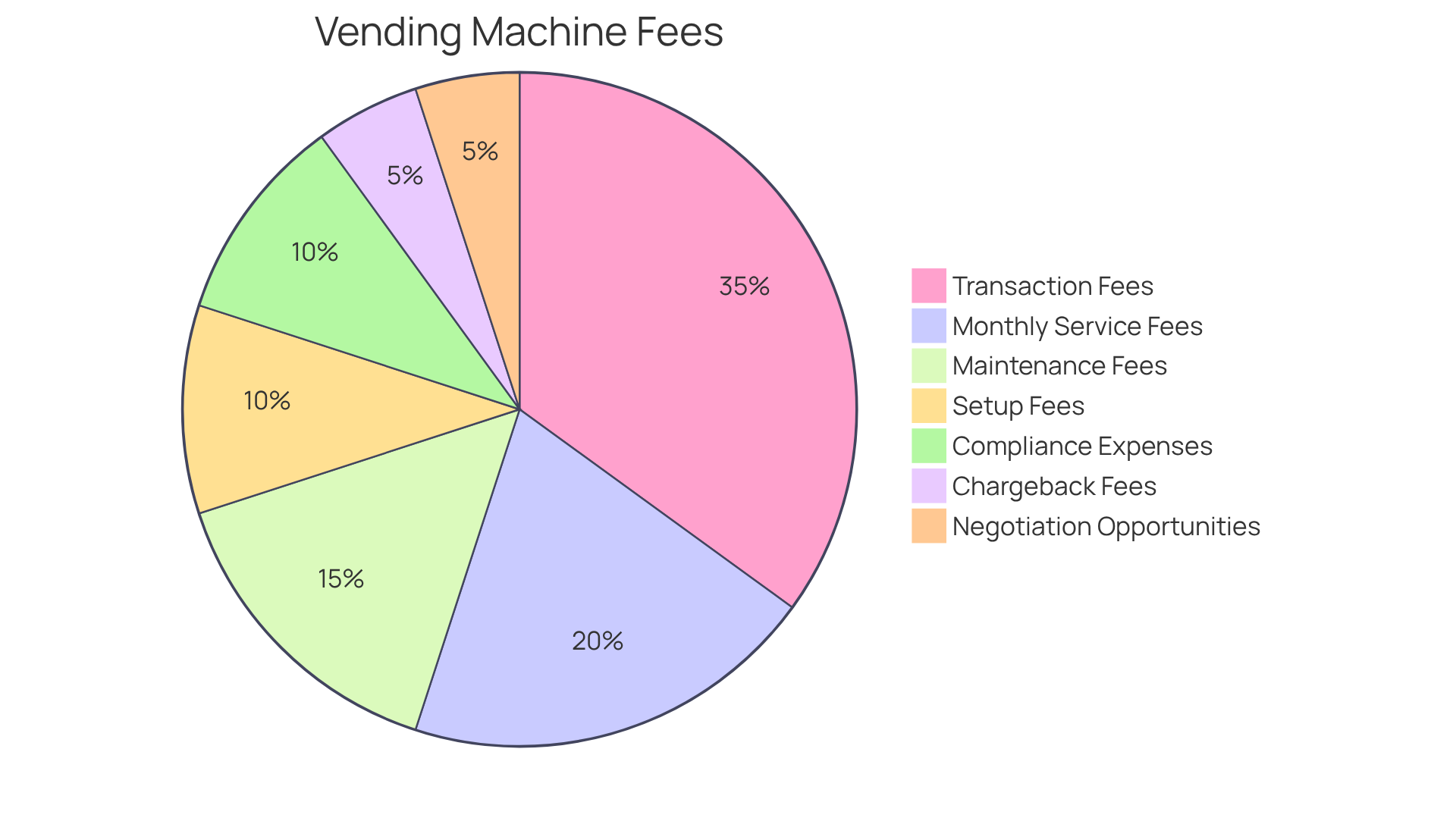

- Monthly Service Fees are a big one. Card processing providers usually charge a monthly fee for their services, which can run anywhere from $5 to $30 per device. For instance, USA Technologies hits you with an $8.99 monthly fee, plus processing charges.

- Then there are Transaction Fees. Every time a transaction goes through your payment device, it typically costs you a percentage of the sale—usually between 2.5% and 5%—plus a flat fee that’s generally between $0.10 and $0.30. On top of that, interchange charges from credit providers like Visa and Mastercard can vary from 1.10% + $0.10 to 3.15% + $0.10. This can really add up, especially if you’re moving a lot of product.

- Don’t forget about Setup Fees. Some providers might charge you a one-time installation fee to get everything up and running. This can vary based on how complicated the setup is.

- Maintenance Fees are another factor. You might face regular charges for maintenance or support, especially if your device needs updates or repairs. Keeping those card readers in tip-top shape is key to minimizing downtime and keeping sales flowing.

- Chargeback Fees can also sneak up on you. If there are any disputes, you could end up paying these fees, which can vary by provider. They can throw a wrench in your overall costs.

- Let’s not overlook Compliance Expenses. You’ll need to be aware of the to ensure secure operations when you’re implementing payment devices.

- But here’s the good part: there are Negotiation Opportunities. It’s worth looking into whether you can negotiate processing agreements to lower those fees, especially if you’re running a high-volume business.

Understanding the vending machine card reader fees is crucial for evaluating how cost-effective it is to integrate payment devices into your vending machines. As Jeff Cramer points out, cashless vending is on the rise, and if you manage these transaction costs wisely, you can really boost your profits.

Select the Right Card Reader for Your Vending Business

Choosing the right card reader for your vending business is a big deal, and it’s worth taking some time to think about a few key factors.

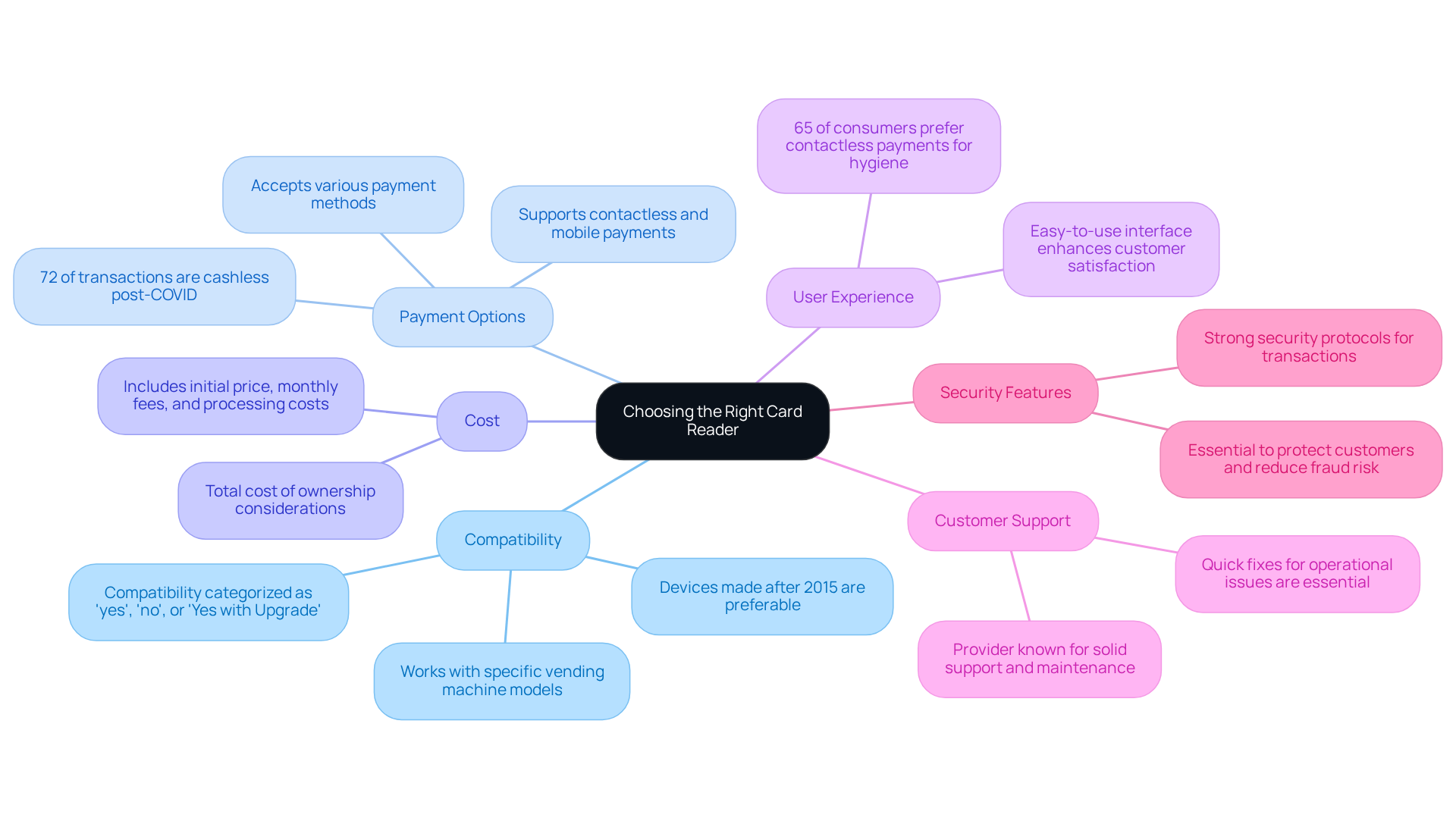

First off, compatibility is crucial. You want to make sure the card device works with your specific vending machine model and transaction system. Generally, devices made after 2015 are better equipped to handle today’s cashless systems, which can really boost your efficiency.

Next, let’s talk about payment options. It’s smart to pick a reader that accepts various payment methods, including contactless and mobile payments. With 72% of transactions being cashless after COVID, offering multiple options can really help you reach more customers.

Then there’s cost. It’s important to look at the total cost of ownership, which includes not just the initial price but also the monthly fees, processing costs, and vending machine card reader fees. This way, you can find a solution that fits your budget while still maximizing your profits.

Don’t forget about the user experience. A device with an easy-to-use interface can make transactions smoother for your customers. When it’s simple to use, it not only boosts satisfaction but also encourages people to come back. Plus, 65% of consumers believe contactless payments are cleaner than traditional swipes, which highlights how important it is to keep things hygienic.

Another thing to consider is customer support. You’ll want a provider known for and maintenance services. Quick fixes for any issues are key to keeping your operations running smoothly and maintaining customer trust.

Lastly, take a close look at the security features. Check out the security protocols for transactions and communications. Having strong security measures in place is essential to protect your customers and reduce the risk of fraud.

By carefully considering these factors, you can choose a card reader that meets your needs while enhancing customer satisfaction, boosting sales, and managing vending machine card reader fees. As cashless transactions continue to rise, investing in the right payment solution is more important than ever. Consider reliable models like Nayax VPOS Touch or Parlevel Payplus, which are known for their user-friendly interfaces.

Conclusion

Integrating card readers into vending machines is a big step forward in the vending industry. We're moving from cash-only transactions to a more flexible, cashless approach. This shift not only makes things easier for customers but also opens up new ways for operators to boost their revenue. By getting a handle on the different card reader fees, operators can make smart choices that lead to better profits.

Throughout this discussion, we've pointed out some key aspects, like the various fees tied to card readers—think monthly service fees, transaction fees, and maintenance costs. Plus, we’ve highlighted the importance of picking the right card reader. You need to consider things like compatibility, payment options, user experience, and security. These are crucial for managing vending machines effectively while keeping up with what today’s consumers expect.

As cashless transactions keep gaining momentum, it’s essential for vending operators to adapt and embrace these new technologies. By doing this, they’re not only improving the customer experience but also staying competitive in a fast-changing market. The future of vending is definitely cashless, and making smart investments in card reader solutions can lead to significant improvements in customer satisfaction and operational efficiency. So, let’s get on board with this trend and make the most of the opportunities it brings!

Frequently Asked Questions

What are the main payment options available for modern vending machines?

Modern vending machines accept various payment types, including cash, credit and debit cards, EMV chip cards, contactless options, and mobile wallets.

What are vending machine card reader fees?

Vending machine card reader fees are charges associated with the use of card readers for processing cashless transactions in vending machines.

How do card readers benefit vending machine operators?

Card readers provide operators with payment flexibility, real-time reporting for sales and inventory insights, and enhanced transaction safety through advanced encryption and compliance with industry standards.

What impact has the integration of cashless systems had on vending operators?

The integration of cashless systems has increased the percentage of cashless vending activities to 77% by 2024, which has led to higher sales and the ability to reach a wider audience.

How much more do consumers spend on cashless transactions compared to traditional vending machines?

Consumers using cashless transactions in micro markets have reported spending 53% more per transaction compared to those using traditional vending machines.

What is the projected growth rate of the cashless vending machine market?

The cashless vending machine market is expected to grow at a compound annual growth rate (CAGR) of 12.2% from 2025 to 2033.

Why is it important for vending operators to invest in advanced payment technologies?

Investing in advanced payment technologies is crucial for vending operators to stay competitive, meet modern consumer demands, and enhance their sales potential in the evolving self-service retail market.

List of Sources

- Explore the Basics of Vending Machine Card Readers

- cantaloupe.com (https://cantaloupe.com/resource-center/micropayment-trends-report-2025)

- Cashless - Retail vending machine market outlook (https://grandviewresearch.com/horizon/statistics/retail-vending-machine-market/payment-mode/cashless/global)

- Cashless payments dominate self-service retail, Cantaloupe report finds (https://vendingtimes.com/news/cashless-payments-dominate-self-service-retail-cantaloupe-report-finds)

- Self-Service Goes Cash-Free: Cantaloupe’s 2025 Micropayment Trends Report Reveals Cashless Payments Now Dominate Self-Service Retail | Cantaloupe, Inc. (https://cantaloupeinc.gcs-web.com/news-releases/news-release-details/self-service-goes-cash-free-cantaloupes-2025-micropayment-trends)

- Cashless Vending Machine Market Size, Growth, Scope & Forecast Report - 2033 (https://datahorizzonresearch.com/cashless-vending-machine-market-22211)

- Analyze Common Fees for Vending Machine Card Readers

- Average Credit Card Processing Fees and Costs in 2025 | The Motley Fool (https://fool.com/money/research/average-credit-card-processing-fees-costs-america)

- Vending Machines With Credit Card Readers And Mobile Payments (https://bottomsupvend.com/vending-machines-with-credit-card-readers-and-mobile-payments)

- 7+ Vending Machine Card Reader Fees: A Guide (https://video.my1styears.com/vending-machine-card-reader-fees)

- Should I Consider a Credit Card Reader Vending Machine? | Vending How (https://vendinghow.com/article/should-i-consider-a-credit-card-reader-vending-machine)

- vending machines with credit card reader (https://harrisons.platform81.com/post/vending-machines-with-credit-card-reader)

- Select the Right Card Reader for Your Vending Business

- Comparing Credit Card Readers for Your Vending Machine (https://quickfreshvending.com/comparing-credit-card-readers-for-your-vending-machine)

- The Best Card Reader for Vending Machines | Nayax (https://nayax.com/pl/blog/best-vending-machine-card-reader)

- Vending Machine Cashless Compatibility (https://parlevelsystems.com/cashless-compatibility-list)

- Why a Vending Machine Card Reader Will Attract More Customers (https://ecspayments.com/vending-machine-card-reader)